The charging enterprise hasn’t been all it was cracked as much as be, however is a change so as?

Three years in the past, ChargePoint (CHPT 4.41%) was price over $8 billion and was seen as one of many huge winners within the electrical automobile (EV) revolution. Now the corporate is price slightly below $600 million, and the inventory is dropping so quick that choices are operating out for financing the long run.

The place will the corporate be 5 years from now? The choices are getting skinny for ChargePoint.

ChargePoint’s operations are a multitude

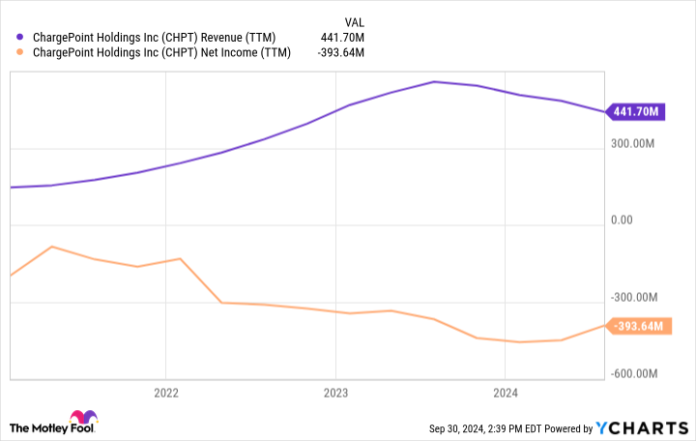

It isn’t onerous to see the operational challenges ChargePoint is going through. The corporate makes most of its cash promoting EV chargers, not electrical energy or companies, and the demand for chargers is down. You possibly can see the income decline over the previous 12 months, and the losses are piling up.

CHPT Income (TTM) information by YCharts

What’s going to change this dynamic? Administration cannot lean on pricing energy as a result of EV chargers are primarily a commodity, and the trade is transferring to the North American Charging Commonplace (NACS), which can additional commoditize chargers.

Gross margins are already down over the previous three years, and I do not see the dynamic bettering. In the meantime, working bills are unsustainably excessive.

CHPT Gross Revenue Margin information by YCharts

The steadiness sheet can also be in actual bother. If you happen to take a look at the money on the steadiness sheet and the present price of money burn, the corporate has a couple of 12 months’s price of money left. However elevating capital might be a problem with $286 million in debt already on the steadiness sheet and a inventory worth approaching $1 per share.

CHPT Money and Equivalents (Quarterly) information by YCharts

ChargePoint wants to seek out options quickly

Given the state of the steadiness sheet and money flows, I believe ChargePoint is operating out of time to show its enterprise round. The corporate wants to seek out an alternate, like a strategic purchaser or an organization that desires to construct an enormous EV charging community by itself.

An automaker like Basic Motors or Ford that is increasing EV gross sales could possibly be a purchaser, though they’ll the usual NACS plug, and having a proprietary community might not make sense.

An organization like Blink Charging (NASDAQ: BLNK) might additionally purchase ChargePoint to consolidate the availability of EV chargers. However do not forget that Blink and ChargePoint make most of their cash promoting chargers, not electrical energy, so the community impact from these chargers might not be as sturdy as hoped.

ChargePoint might additionally deal with operational effectivity, because it did with its lately introduced layoff of 15% of workers and its partnership with LG Electronics that may offload manufacturing to LG and permit ChargePoint to deal with {hardware}. However these strikes could also be too little, too late.

The place will ChargePoint be in 5 years?

I do not see any path to ChargePoint being a stand-alone firm in 5 years. The corporate is burning an excessive amount of money and would not have a path to a worthwhile enterprise mannequin.

The query for buyers is whether or not the enterprise gives any worth to a possible purchaser or associate. I do not assume there may be, and that is why I am staying away from this inventory.

Travis Hoium has positions in Basic Motors. The Motley Idiot recommends Basic Motors and recommends the next choices: lengthy January 2025 $25 calls on Basic Motors. The Motley Idiot has a disclosure coverage.