Shares are up 300% within the final 12 months.

Cava Group (CAVA 1.34%) shareholders are sitting fats and comfortable after the final yr. As of this writing the inventory within the Mediterranean restaurant chain is up a whopping 300% within the final 12 months, making it one of many best-performing shares on this planet over the past yr.

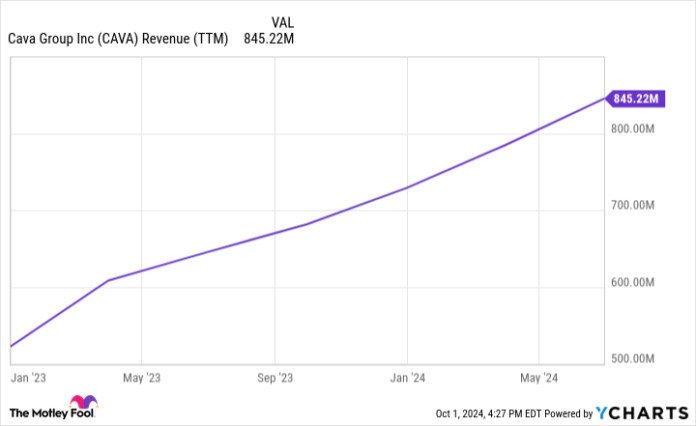

The current IPO has change into an investor favourite with its sturdy visitors development and room to develop its restaurant areas across the nation. Nevertheless, the inventory now has a demanding valuation with a market cap of $14 billion and fewer than $1 billion in gross sales. The place will Cava Group inventory be in 5 years, and do you have to purchase or promote shares as we speak? Time to take a better look and analyze this 2024 investor favourite.

Chipotle however for Mediterranean delicacies

The founders of Cava had a improbable concept: take the success of Chipotle and apply it to a different worldwide delicacies. They selected Mediterranean-style meals, and it has change into a success. Cava now has 341 areas unfold round america, with unit rely rising by over 20% yr over yr final quarter. In 2024, it expects to open round 55 new areas.

Even higher is Cava’s visitors and same-store gross sales development. When a Cava opens in a brand new location, it constantly sees upticks in visitors when folks check out the idea and change into followers of the meals. I imply, who is not a fan of a steak and feta pita wrap?

Final quarter, visitors to Cava eating places — on a per-restaurant foundation — grew 9.5% yr over yr. Similar-store gross sales development was 14.4%. Similar-store gross sales measure the gross sales from present restaurant areas. Sometimes, a restaurant will generate low single-digit share development for same-store gross sales. Cava’s close to 15% development blows most eating places out of the water.

Profitability is powerful. Cava’s restaurant-level revenue margins are 26.5%, which ought to translate to at the very least 10% to fifteen% consolidated revenue margins when together with overhead prices as soon as the corporate stops pushing for development so aggressively. As we speak, it has an working margin of barely above 5%.

Development projections are clear

Restaurant manufacturers could be nice development investments due to the simple path to increasing unit rely throughout america (and ultimately internationally). Cava seems to be to be on the same path as Chipotle and believes it may possibly attain at the very least 1,000 areas in america, if no more.

As we speak, the corporate has 341 areas and plans so as to add 55 areas to its arsenal this yr. If the corporate can add a mean of 75 models per yr for the subsequent 5 years, it is going to have 716 areas in 5 years, or greater than double what it has as we speak. That may be a clear development prospect that has the funding group excited.

On a per-unit foundation, Cava areas are producing $2.7 million in annual gross sales. Assuming these sturdy same-store gross sales persist, common unit quantity can hit $3.5 million in 5 years. Multiply this by 716 areas and you’ll get $2.5 billion in income 5 years from now. Lastly, we must always apply a revenue margin to this income, which might probably develop to 10% by the top of this time interval. That equals $250 million in earnings 5 years from now for Cava Group.

CAVA Income (TTM) knowledge by YCharts

The place will Cava inventory be in 5 years?

After rising 300%, Cava now trades at a market cap of $14 billion. That is round 17 occasions its trailing gross sales and an enormous a number of of its trailing earnings.

However what about in 5 years? Above, we illustrated that there’s a clear path for Cava to develop its gross sales and earnings over the subsequent 5 years. Making use of that $250 million earnings estimate to a $14 billion market cap, you get a price-to-earnings ratio (P/E) of 56 in 5 years. A P/E of 56 can be costly on a trailing foundation. However based mostly on five-year ahead estimates? That’s downright absurd.

Cava is a good enterprise. Nevertheless, the inventory is grossly overvalued. I feel shares are probably decrease — or at the very least flat — 5 years from now. Keep away from shopping for Cava inventory until the inventory worth will get cheaper.

Brett Schafer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Chipotle Mexican Grill. The Motley Idiot recommends Cava Group and recommends the next choices: brief September 2024 $52 places on Chipotle Mexican Grill. The Motley Idiot has a disclosure coverage.