Carnival (CCL 1.83%) (CUK 1.88%) is the most important cruise operator on this planet, however this business chief has had a tough few years. Its enterprise has rebounded, however there are some leftover results which can be nonetheless weighing on its monetary statements.

It is in a significantly better place than it was final yr at the moment, with increased income, optimistic internet earnings, and decrease debt. It is also benefiting from decrease rates of interest. Let’s examine the place it may very well be in a yr from now.

Setting sail

Carnival continues to report document quarter after document quarter. A number of the data cannot go on eternally, like worth and occupancy, however it ought to have the ability to continue to grow gross sales and internet earnings, even when demand moderates.

The fiscal 2024 fourth quarter (ended Nov. 30) was the latest instance. Here is a rundown of a number of the highlights:

- Report income of $5.9 billion, up 10% yr over yr

- Report fourth-quarter adjusted earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) of $1.2 billion, up 29% yr over yr

- Report internet yields, up 6.7% yr over yr

- Cumulative superior booked place was at a document for the 2025 full yr

- Booked place for 2026 broke earlier data within the fourth quarter

Internet earnings wasn’t a document, however it was optimistic, and that had been escaping Carnival for a number of years. It reported optimistic internet earnings of $303 million within the fourth quarter, up from a $48 million loss the yr earlier than, and $1.9 billion for the total yr. Carnival is in its best-ever booked place for each worth and occupancy, coming from increased ticket costs and better on-board spending, and that is exceeding unit value and resulting in increased earnings. For 2025, administration is guiding for internet yields to enhance by 4.2% and adjusted internet earnings of $2.3 billion.

Carnival is setting itself as much as meet demand and generate extra. It acquired three new ships final yr, and it is opening up two new unique locations within the Caribbean. Its promoting campaigns resulted in a 60% enhance in paid search clicks and a 40% enhance in net visits, which is a technique that ought to gasoline additional demand.

In a yr from now, I’d envision increased income, growing internet earnings, and powerful demand. It is solely potential that the excessive demand streak continues into 2026, with bookings out by 2027. It may rely upon rate of interest strikes and different financial developments. If rates of interest maintain declining, shopper spending may enhance. If issues keep the identical manner they’re in the present day, demand may start to stabilize.

Coping with debt

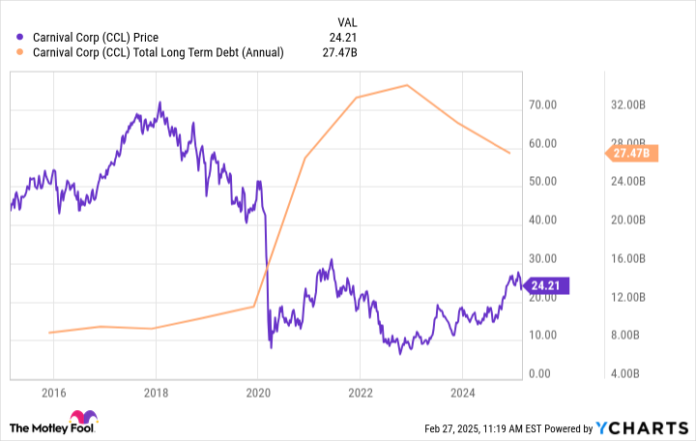

The principle adverse issue that continues to plague Carnival is its debt. The debt stays effectively above its traditionally regular ranges, ending 2024 at $27.5 billion. That creates danger, as a result of demand may wane earlier than the debt is paid off, limiting the corporate’s capability to pay it again responsibly.

With this debt stage, Carnival inventory might not proceed its climb, however it’s prone to rise because the debt is decreased. That is how the inventory has moved over the previous 5 years, since Carnival assumed the excessive debt. Discover how the inventory has moved conversely with the debt stage over the previous two years.

The debt is coming down because the enterprise improves, and the web debt-to-EBITDA ratio improved from 6.7 in 2023 to 4.3 in 2024. Administration is anticipating it to additional decline to three.8 this yr.

One yr from now, the debt is prone to be diminished however not gone. The inventory worth ought to replicate that. If rates of interest go decrease, the inventory is prone to rise increased. Affected person buyers can purchase in the present day and profit from the inventory’s probably sluggish however possible eventual rise again to earlier highs and even increased.