The drugmaker will undergo key adjustments by the top of the last decade.

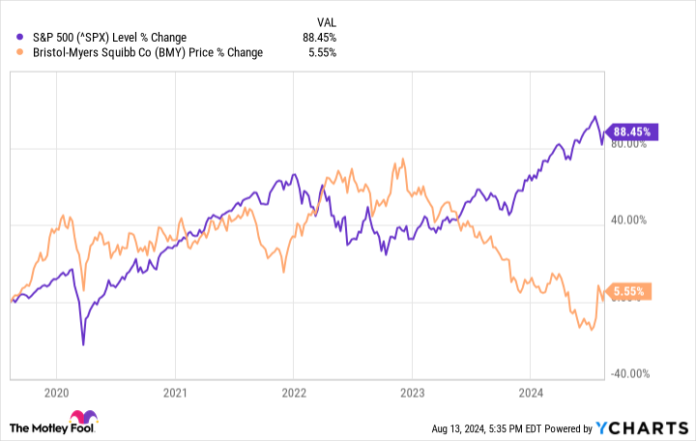

Bristol Myers Squibb (BMY 0.51%) has had a tough previous 5 years. Its shares are barely within the inexperienced, its monetary outcomes have been unimpressive, and it has confronted necessary patent cliffs. Most notably, its most cancers drug Revlimid, its top-selling product at one level, is now out of patent exclusivity.

Regardless of that poor displaying lately, issues is perhaps very completely different for BMS within the subsequent half-decade, however provided that it may higher deal with the headwinds it has skilled. Let’s learn how issues would possibly develop for the corporate by 2029.

Extra patent cliffs on the horizon

Within the second quarter, income elevated by virtually 9% 12 months over 12 months to $12.2 billion — the most effective top-line development price BMS has recorded in about three years:

BMY Income (Quarterly YoY Development) information by YCharts.

The drugmaker’s best-selling merchandise within the interval had been anticoagulant Eliquis and most cancers drugs Opdivo; BMS shares the rights to the previous drugs with Pfizer. Eliquis’ income elevated by 7% 12 months over 12 months to $3.4 billion. Opdivo’s gross sales of $2.4 billion had been up 11% in comparison with the year-ago interval. These two medicines made up 47.6% of the corporate’s whole income.

Sadly, each medicines will lose patent safety by the top of 2029. As soon as these patent cliffs arrive, income will decline. However BMS is already getting ready for that eventuality.

Bristol Myers Squibb’s plan to bounce again

BMS has earned a number of brand-new approvals since 2019. Let’s contemplate three of them. Reblozyl treats anemia in sufferers with beta-thalassemia; it was accepted in 2019. Opdualag, a remedy for melanoma, was launched in 2022. Camzyos, additionally accepted in 2022, treats a coronary heart illness. Although none of those offers a major share of income, they’re rising their gross sales quickly:

|

Drug |

Q2 Income |

Q2 Development (YoY) |

|---|---|---|

|

Reblozyl |

$425 million |

82% |

|

Opdualag |

$235 million |

53% |

|

Camzyos |

$139 million |

202% |

YoY= 12 months over 12 months. Information supply: Firm monetary statements.

These merchandise and different comparatively new additions to the corporate’s lineup ought to proceed rising their gross sales for the following 5 years. BMS expects greater than $25 billion in income from its new product portfolio by 2030. It will not cease incomes brand-new approvals or label expansions both: BMS boasts 55 compounds throughout dozens of scientific trials in its pipeline.

One of many drugmaker’s promising new merchandise is not precisely new: It is a subcutaneous model of its crown jewel, Opdivo. BMS expects that this model might goal between 65% and 75% of Opdivo’s indications within the U.S. It will not attain the identical peak, nevertheless it ought to assist clean out the losses the corporate will incur from Opdivo’s patent cliff.

Past that, BMS has many different merchandise, a few of which can be a part of the corporate’s rising portfolio of latest merchandise within the subsequent 5 years. The healthcare big has additionally made a number of acquisitions to spice up its pipeline lately.

Extra causes to purchase the inventory

The corporate’s efficiency ought to enhance in comparison with the previous 5 years, a minimum of till it hits necessary patent cliffs towards the top of the last decade. And it has the instruments to bounce again and carry out nicely after that.

Moreover, the inventory can be an important choose for dividend traders: BMS has elevated its payouts yearly for 15 years straight. The corporate is dedicated to persevering with these will increase, so anticipate it to take care of this streak by 2029. The ahead dividend yield at the moment stands at a formidable 5.1%.

The money payout ratio seems to be conservative at just below 37%. Bristol Myers Squibb seems to be like a strong, blue chip dividend inventory to purchase and maintain for the following half-decade, and sure nicely past that.

Prosper Junior Bakiny has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Bristol Myers Squibb and Pfizer. The Motley Idiot has a disclosure coverage.