Bitcoin Journal

The Nakamoto Technique: Seeding Bitcoin Treasury Corporations in Each Capital Market

NOTE: This text presents the creator’s perspective on the seemingly construction and future implications of Nakamoto’s technique. It’s a forward-looking evaluation, not an announcement from Nakamoto or its workers. Till the proposed merger closes, Nakamoto’s strategic execution stays topic to vary. The evaluation displays public supplies, early actions, and directional alerts noticed so far.

Introduction: From Treasury Technique to World Bitcoin Refinery

The Nakamoto technique gives a brand new framework for capital formation within the age of Bitcoin. Somewhat than viewing Bitcoin solely as a reserve asset, Nakamoto is pursuing an strategy that makes use of Bitcoin as a basis for developing a extra dynamic and globally built-in capital construction.

The technique includes greater than merely accumulating BTC on a steadiness sheet. Nakamoto treats Bitcoin as a base layer of worth and pairs it with public fairness as a leverage layer—strategically deploying capital into smaller, high-potential public corporations. The aim is to compound publicity, enhance market entry, and help the expansion of a decentralized, Bitcoin-native monetary ecosystem.

Already, UTXO Administration has supplied examples by seeding and supporting a number of high-profile Bitcoin treasury corporations:

- Metaplanet (TSE: 3350) – Japan’s fastest-growing public Bitcoin firm with 13,350 BTC, and #1 performing public firm of 2024 out of 55,000 globally.

- The Smarter Internet Firm (AQUIS: SWC) – A UK-based net companies agency that IPO’d with a BTC treasury technique and has returned greater than 100x since itemizing.

- The Blockchain Group (Euronext: ALTBG) – Europe’s first Bitcoin treasury firm, with over 1000% BTC yield YTD 2025.

Backed by over $750+ million in capital, Nakamoto can scale this technique globally—market by market, trade by trade, one Bitcoin treasury firm at a time.

As Bitcoin more and more capabilities because the emergent international hurdle fee for capital—methods that generate returns in extra of Bitcoin itself change into particularly priceless. Nakamoto’s mannequin is designed not simply to protect worth in BTC phrases, however to compound it. In that context, companies able to persistently outperforming Bitcoin by disciplined BTC-denominated methods are prone to earn outsized consideration—and will more and more appeal to capital as buyers search returns above the Bitcoin benchmark.

The Nakamoto Technique Defined

The technique rests on a simple perception: market entry constraints are as essential as Bitcoin itself. In lots of jurisdictions, institutional capital can’t purchase or custody Bitcoin straight. However that very same capital should buy public equities that maintain Bitcoin as a treasury reserve.

This creates a particular alternative:

- Seed new Bitcoin treasury corporations: These are established in jurisdictions the place entry to BTC is structurally constrained, or the place no such corporations but exist.

- Deploy Bitcoin strategically: BTC could also be contributed straight or not directly by fairness financing mechanisms like PIPEs, warrants, or structured investments.

- Allow public market revaluation: These corporations could start to commerce at a premium to the worth of their BTC holdings (an mNAV enlargement).

- Recycle capital by appreciation: Nakamoto can take part on this cycle and will reinvest in extra corporations or accumulate additional BTC.

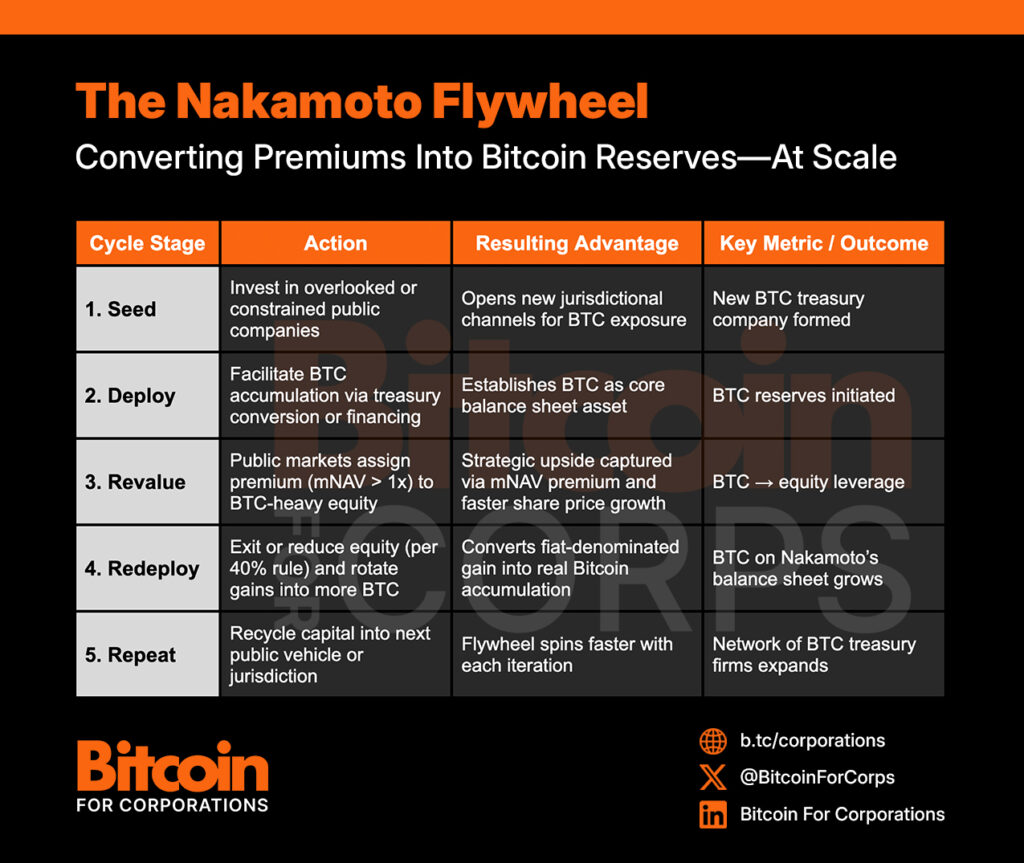

The Nakamoto Flywheel beneath illustrates how fairness premiums from public markets are strategically transformed into long-term Bitcoin reserves. This repeatable mannequin compounds Bitcoin-denominated worth with every cycle—constructing steadiness sheet power at international scale.

Key Mechanics: How the Technique Multiplies Worth

mNAV Arbitrage and Strategic Premium Seize

The Nakamoto technique generates worth by leveraging the structural dynamics of public markets and the constrained nature of Bitcoin entry in lots of jurisdictions. One of many foundational mechanisms of the Nakamoto technique is mNAV (a number of of Internet Asset Worth) arbitrage. When Nakamoto allocates capital to a Bitcoin treasury firm in a jurisdiction the place no different compliant BTC publicity automobiles exist, that firm typically begins buying and selling at a a number of of its web Bitcoin holdings. This final result assigns a strategic premium to Nakamoto’s deployed capital and successfully will increase the market worth of Bitcoin initially acquired at or close to spot.

BTC Yield because the Core Efficiency Metric

Somewhat than specializing in conventional accounting metrics, Nakamoto evaluates efficiency in Bitcoin-denominated phrases—particularly by monitoring Bitcoin per diluted share. This measure, known as BTC Yield, captures the compounding profit when a treasury firm will increase its Bitcoin holdings at a fee quicker than its fairness issuance. This reinforces long-term alignment with Bitcoin-native worth creation.

Nakamoto additionally tracks look-through BTC possession—its proportional declare on Bitcoin held throughout portfolio corporations—as a secondary KPI, guaranteeing each fairness transfer is benchmarked in Bitcoin phrases.

Whereas most Bitcoin treasury corporations rely closely on repeated fairness issuance—diluting present shareholders with a purpose to develop BTC-per-share, Nakamoto can compound holdings with out dilution by operating what’s known as the mNAV² technique. In observe, this implies:

- Seed at Intrinsic Worth: Nakamoto launches or invests in a Bitcoin treasury firm at or close to 1× mNAV—which means the fairness is priced roughly in keeping with the corporate’s web Bitcoin holdings.

- Unlock the Premium: Public markets re-rate the corporate, assigning a valuation a number of above its Bitcoin holdings attributable to shortage, strategic positioning, or narrative momentum—creating an mNAV premium.

- Recycle With out Dilution: Nakamoto harvests a portion of the appreciated fairness, redeploying the proceeds into extra BTC or new ventures—with out issuing new Nakamoto shares, enabling BTC-per-share development by capital effectivity.

As competitors amongst listed treasury automobiles intensifies, markets are prone to reward the companies that may increase BTC-per-share by non-dilutive mechanisms. mNAV² makes that final result native to Nakamoto’s playbook, turning balance-sheet effectivity itself right into a aggressive moat.

Closing the Institutional Entry Hole

Jurisdictional limitations forestall many institutional buyers from straight holding Bitcoin. Nevertheless, they’re typically permitted to put money into public equities that maintain BTC as a treasury asset. Nakamoto addresses this asymmetry by seeding and supporting regionally compliant public automobiles that function authorized and sensible conduits for institutional Bitcoin publicity.

Benefits of Working By Public Markets

By utilizing public markets as its operational area, Nakamoto advantages from transparency, ongoing liquidity, and environment friendly worth discovery. These attributes enable it to recycle capital effectively and increase into new geographies rapidly. In contrast to conventional personal market buildings, this strategy helps scale, visibility, and regulatory alignment in real-time.

The 40% Rule: Redeploying Good points Into Bitcoin

A key structural requirement of the Nakamoto technique is compliance with the Funding Firm Act of 1940, which mandates that not more than 40% of Nakamoto’s steadiness sheet can include securities akin to public equities. Bitcoin, categorized as a commodity, doesn’t rely towards this restrict.

This regulatory boundary shapes how Nakamoto should function:

- As fairness positions in Bitcoin treasury corporations respect, Nakamoto is compelled to promote down these stakes to remain throughout the 40% threshold.

- This naturally reinforces the technique’s deal with biking features from fairness again into Bitcoin—accelerating BTC accumulation.

- To handle this constraint, Nakamoto has begun utilizing modern buildings akin to Bitcoin-denominated convertible notes. These devices assist repair asset publicity, enabling gradual conversion and avoiding sudden threshold breaches.

The cap just isn’t a limitation on ambition—it’s a forcing operate for capital self-discipline and strategic BTC reinvestment. As Nakamoto’s steadiness sheet grows, so does its capability to carry bigger fairness positions—at all times with Bitcoin because the core reserve asset.

Strategic Devices: Bitcoin-Denominated Convertible Notes

To handle compliance with the 40% securities threshold and mitigate volatility publicity, Nakamoto is prone to depend on Bitcoin-denominated convertible observe buildings in future deployments. These devices provide a versatile strategy to construction publicity—permitting Nakamoto to repair the worth of an funding on its steadiness sheet whereas retaining the choice to transform into fairness over time.

This construction presents a number of strategic benefits:

- Regulatory Buffer: As a result of conversion is optionally available and could be staged, these notes assist delay classification as securities—preserving steadiness sheet headroom beneath the 40 Act.

- Gradual Entry and Exit: Nakamoto can incrementally convert notes as wanted, smoothing market affect and aligning publicity with evolving steadiness sheet capability.

This strategy has already proven promise in fashions pursued by The Blockchain Group and H100, the place related buildings have enabled Bitcoin-native capital deployment with out triggering regulatory friction. If scaled appropriately, Bitcoin-denominated convertibles may change into a defining instrument in Nakamoto’s toolkit—one which aligns capital technique with each efficiency and compliance.

Addressing Criticism of the Nakamoto Technique

Navigating Tax Complexity

A recurring concern facilities across the tax penalties of transferring Bitcoin between entities. In lots of jurisdictions, such transfers can set off taxable occasions, lowering capital effectivity. Nakamoto mitigates this danger by avoiding direct BTC transfers and as an alternative using equity-based buildings—akin to PIPEs, warrants, and joint ventures—that present publicity with out incurring fast tax obligations.

Deciphering mNAV Premiums and Narrative Danger

Critics typically query the sturdiness of mNAV premiums, suggesting they might be pushed extra by market hype than fundamentals. Nakamoto responds to this concern by specializing in Bitcoin-per-share development slightly than valuation multiples alone. The agency emphasizes BTC Yield as a extra dependable metric and prioritizes tangible BTC accumulation by recapitalizations and disciplined capital deployment.

Governance and Operational Affect

Some observers have expressed concern about Nakamoto’s diploma of affect over the businesses it helps. Nakamoto doesn’t goal to regulate day by day operations however ensures strategic alignment by governance rights, board illustration, and fairness stakes. This construction permits Nakamoto to affect treasury coverage and keep Bitcoin-centric self-discipline with out compromising the autonomy of every firm.

Managing Market Volatility and Compression Danger

The potential for mNAV compression—notably in risk-off environments—is a identified problem. Nakamoto mitigates this danger by specializing in jurisdictions with low preliminary valuations and unmet demand for Bitcoin publicity. Even when valuation multiples contract, the businesses Nakamoto helps proceed to carry BTC on their steadiness sheets, preserving intrinsic worth no matter market sentiment.

Capturing Worth in a Bitcoin-Denominated Mannequin

A associated concern includes how Nakamoto captures tangible worth from the businesses it helps set up or help. In contrast to fashions that depend on dividend funds or near-term liquidity occasions, Nakamoto advantages by long-term strategic fairness stakes, pre-IPO warrant buildings, and fairness appreciation tied on to BTC-per-share development. This strategy permits worth seize that aligns with its thesis of Bitcoin-denominated efficiency, with out compromising the capital construction or autonomy of the underlying corporations.

Differentiation from Conventional Personal Fairness Fashions

Comparisons are sometimes drawn between Nakamoto’s technique and personal fairness investing. Whereas there are structural similarities, Nakamoto distinguishes itself by its liquidity profile, public market transparency, and alignment with Bitcoin-native accounting. Somewhat than working as a fund, Nakamoto capabilities as a public infrastructure builder—figuring out underserved markets, developing regulatory frameworks, and absorbing early-stage danger with a purpose to unlock institutional Bitcoin entry at scale.

The Position of Nakamoto vs. Direct Funding

Some critics query whether or not Nakamoto is solely a center layer between buyers and the businesses themselves—arguing that refined capital may bypass Nakamoto and make investments straight. In observe, nevertheless, Nakamoto delivers differentiated worth by sourcing offers in missed markets, architecting compliant itemizing buildings, and catalyzing early demand. It acts as a bridge between Bitcoin-native capital and conventional monetary methods, taking over the narrative and structural carry that many establishments are unwilling or unable to provoke alone.

The irreplaceable edge for Nakamoto is deal circulate. Nakamoto can supply, construction, and worth transactions in the intervening time of inception—entry that merely isn’t obtainable to most exterior capital till valuations have already moved.

Conclusion: Nakamoto and the Formation of Bitcoin-Native Capital Markets

The Nakamoto technique represents an rising capital structure centered round Bitcoin. By enabling market entry, accelerating public-market velocity, and aligning incentives round BTC-per-share accumulation, Nakamoto helps construct a brand new era of treasury-first public corporations.

With over $750 million raised, working examples throughout Tokyo, London, and Paris, and a rising community of potential listings, Nakamoto is executing on a method designed to bridge the hole between capital markets and Bitcoin adoption.

As conventional monetary establishments proceed to face structural and regulatory boundaries to holding BTC straight, the mannequin Nakamoto is growing could provide a scalable, compliant path ahead. It’s not only a capital technique. It’s a structural response to Bitcoin’s rising function in international finance.

Disclaimer: This content material was written on behalf of Bitcoin For Companies, and isn’t an announcement from Nakamoto or Kindly MD, Inc. This text is meant solely for informational functions.

This put up The Nakamoto Technique: Seeding Bitcoin Treasury Corporations in Each Capital Market first appeared on Bitcoin Journal and is written by Nick Ward.