16 Jan The Liquid Community & The Inevitable Rise of Bitcoin-Native Tokenisation

BlackRock CEO Larry Fink has known as tokenisation the “subsequent era of markets.” No matter whether or not trillion-dollar projections materialise on schedule, the course of journey is obvious. Regulators are now not ignoring the development and capital is swiftly shifting on-chain.

The query now isn’t whether or not monetary belongings might be tokenised, however on what sort of infrastructure.

For monetary establishments, the more and more apparent reply is the Liquid Community, a Bitcoin sidechain developed by Blockstream and the popular asset issuance expertise for Bitfinex Securities.

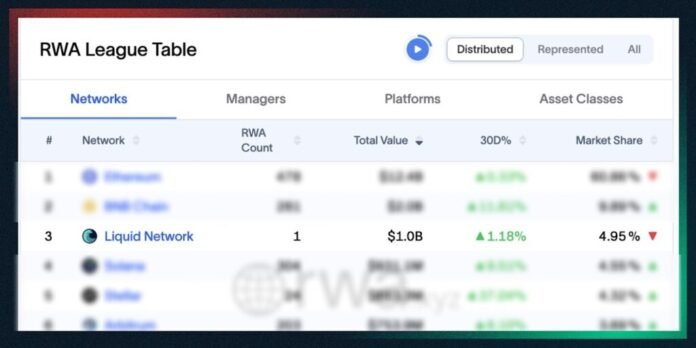

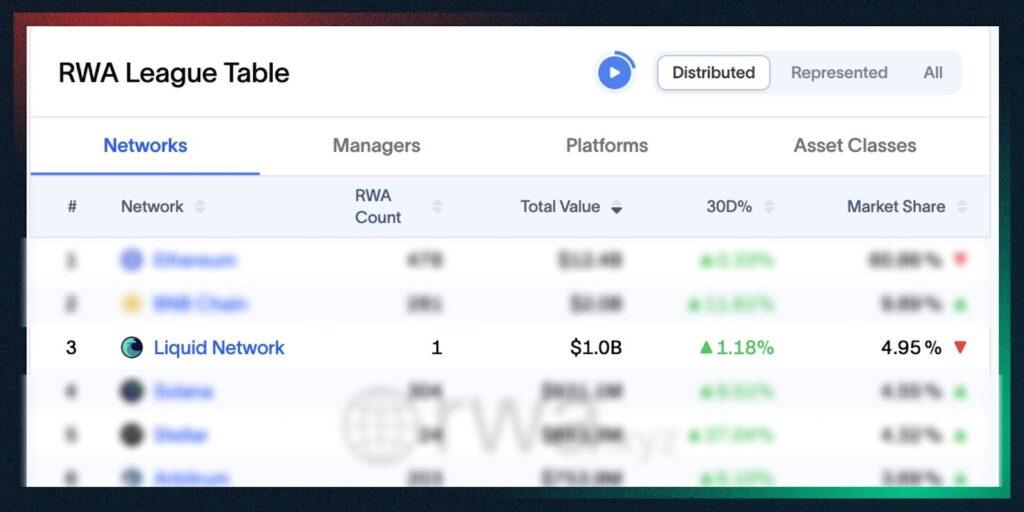

In response to RWA.xyz, the industry-standard analytics platform for tokenised belongings, Liquid is already the world’s third-largest blockchain for distributed real-world belongings (RWAs), behind solely Ethereum and BNB Chain.

Even that rating probably understates Liquid’s footprint, failing to seize all tokenised belongings on the community together with quite a few choices from Bitfinex Securities, in addition to over $1 billion in promissory notes issued through Mifiel in Latin America.

With complete worth locked (TVL) right now exceeding $5 billion, Liquid’s institutional standing continues to develop.

The Significance of Bitcoin-Native Infrastructure

Liquid’s development displays an easy actuality: monetary establishments are more and more realising they want Bitcoin’s battle-tested safety mannequin with out its inherent layer-1 limitations.

Bitcoin presents unmatched decentralisation and immutability. Its design, nonetheless, prioritises safety over velocity; on-chain transactions can take 10 minutes or extra to verify, and charges can spike during times of excessive demand. That is lower than best for high-frequency monetary functions the place settlement effectivity is paramount.

In distinction, the Liquid Community is a purpose-built sidechain that extends Bitcoin’s core strengths whereas addressing these ache factors.

Launched in 2018, Liquid is constructed on Parts, an open-source sidechain framework developed by Blockstream that shares roughly 80 p.c of its codebase with Bitcoin Core.

The community itself operates as a federated sidechain, which means it’s ruled by a rising consortium of trusted entities (functionaries) often called the Liquid Federation. This federation consists of main gamers within the Bitcoin ecosystem, akin to exchanges and monetary establishments, making certain strong safety with out the reliance on proof-of-work. Clients can peg Bitcoin into Liquid as L-BTC (Liquid Bitcoin), enabling seamless transfers between the 2 networks through a two-way peg mechanism.

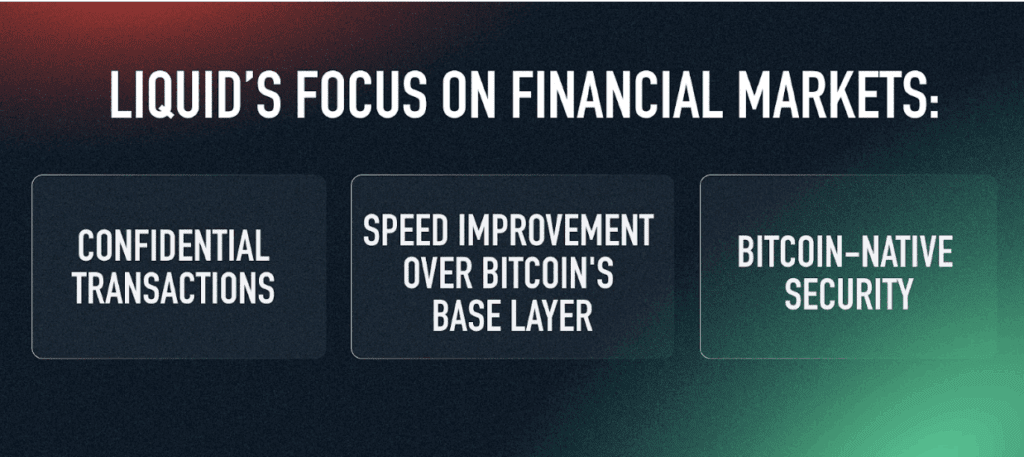

What units Liquid aside is its deal with monetary markets: it helps confidential transactions, the place asset quantities and kinds are hidden from public view, enhancing privateness for institutional clients. It additionally delivers one-minute block occasions and two-minute settlement finality, a dramatic enchancment over Bitcoin’s base layer. For banks shifting tokenised bonds or asset managers rebalancing portfolios, for instance, this mix of privateness, velocity and Bitcoin-native safety is vital.

Bitfinex Securities: Main on Liquid

At Bitfinex Securities, a fully-regulated digital securities platform working in Kazakhstan’s Astana Worldwide Monetary Centre and El Salvador, we’ve constructed our complete issuance infrastructure on Liquid. The selection to take action wasn’t arbitrary however rooted in each Bitfinex’s Bitcoin-first ethos and, most significantly, the clear technical requirements of regulated monetary markets.

Bitfinex Securities has facilitated the issuance of a number of tokenised securities on Liquid thus far, together with microfinance bonds issued with Mikro Kapital, in addition to the issuance of the first-ever regulated public providing of tokenised US Treasury payments. The platform additionally lists and distributes the Blockstream Mining Observe (BMN), offering regulated investor entry to Bitcoin mining publicity.

Throughout these choices, Bitfinex Securities has surpassed $250 million in belongings issued on Liquid, all of it representing actual capital deployed in regulated buildings, not speculative tokens.

What makes Liquid notably appropriate for Bitfinex Securities is its mixture of compliance capabilities and Bitcoin alignment. Liquid’s Confidential Transactions meet regulatory necessities for investor privateness with out compromising auditability for authorised events. The community’s Asset Administration Protocol (AMP) permits issuers to implement switch restrictions, KYC necessities, whitelists and different compliance controls on the protocol degree.

For a securities platform working throughout a number of jurisdictions these qualities are important.

Why Liquid’s Development is Inevitable

A number of converging developments level to continued development for Bitcoin-native tokenisation infrastructure and Liquid specifically.

First, institutional urge for food for Bitcoin publicity continues to broaden past easy holdings. Nation-states are persevering with to discover Bitcoin reserves, an increasing number of company treasuries are allocating meaningfully and conventional finance is constructing complete product traces round it. A tokenisation layer that brings regulated securities to Bitcoin’s ecosystem lets establishments take part with out abandoning the bottom layer to which they’re already dedicated.

Second, regulatory readability round digital securities is bettering. Frameworks in the USA, Singapore, the European Union and jurisdictions like El Salvador are creating viable paths for compliant issuance. Liquid’s federated mannequin and built-in compliance tooling have been designed for this atmosphere from the beginning. As regulation matures, infrastructure that anticipated these necessities has a transparent benefit.

Third, the tokenisation market itself is maturing past pilot tasks. With the broader RWA tokenisation market reaching $24 billion in 2025 and projected to hit wherever from $2 trillion to $16 trillion by 2030, the infrastructure selections made right now will form the {industry} for years. Liquid isn’t making an attempt to be every little thing to everybody — it’s centered on a particular, high-value use case: regulated securities on Bitcoin rails.

Lastly, community results are constructing. As extra issuers launch on Liquid, extra wallets, exchanges, and custody suppliers add help. Extra liquidity follows extra belongings, which is able to inevitably entice extra issuers. Bitfinex Securities’ success offers a template that different platforms can comply with. The combination work will get simpler with every new participant.

Constructing for the Lengthy Time period

Liquid isn’t but the default settlement layer for international capital markets, and it doesn’t faux to be. Its deal with Bitcoin-native safety, regulatory-grade confidentiality and protocol-level compliance, nonetheless, makes it effectively suited to establishments which might be severe about issuing and managing digital securities.

As tokenisation strikes from experimentation towards repeatable issuance, the query is not going to be which blockchain is probably the most modern or feature-packed. It will likely be which infrastructure can help regulated capital markets reliably, over very long time horizons and with out altering its guidelines each cycle.

The reply to that query is Liquid.