This dominant shopper model checks the fitting bins for the best long-term funding.

For those who’re on the lookout for a progress inventory that will help you construct wealth for retirement, it isn’t sufficient to only choose a inventory of any rising firm that’s commonly hitting new highs. There are different vital qualities you need to search for.

Clearly, you need an organization with excellent progress prospects, however it’s additionally helpful to put money into a enterprise that has a loyal base of consumers that commonly spend cash with the corporate. This provides resiliency to the enterprise, particularly throughout recessions and bear markets.

One firm that instantly involves thoughts is Amazon (AMZN -0.27%). Listed here are three explanation why.

1. Repeat income from hundreds of thousands of consumers

Amazon has hundreds of thousands of retail prospects that commonly use their Prime membership to order a number of gadgets each month. Statista estimates the U.S. Prime member depend at 167 million, and over 200 million worldwide, with an estimated 42% of U.S. Prime members making between two and 4 purchases each month. That is a giant motive why Amazon has grown into an enormous enterprise with $604 billion in trailing-12-month income as of June 30, 2024.

Over the past 4 quarters, Amazon generated $42 billion from subscriptions and $237 billion from its on-line retailer. The corporate has continued to increase its same-day supply and grocery supply to Prime members, which reveals the potential to seek out extra methods to extend buy frequency and develop income.

Amazon additionally generates repeat income from its enterprise cloud service. Amazon Internet Providers (AWS) is the highest cloud computing supplier on the earth, with hundreds of thousands of consumers in over 190 international locations. AWS contributes lower than 20% of Amazon’s whole income, however importantly, it is essentially the most worthwhile enterprise, contributing round two-thirds of the corporate’s working revenue.

2. Amazon has great progress alternatives

Amazon’s on-line retailer and cloud enterprise have an enormous market to increase into that may hold the corporate rising for many years.

The worldwide e-commerce market is ready to achieve $6 trillion this yr, in line with eMarketer. It is anticipated to achieve $8 trillion by 2028, so Amazon has the advantage of chasing a rising market.

As for AWS, the chance is much more profitable for shareholders. Income from AWS grew 19% yr over yr final quarter, reaching $98 billion in trailing-12-month income. Nonetheless, it is estimated that not less than 80% of enterprise information has but to maneuver from on-premises servers to the cloud.

With that a lot alternative, AWS might develop into a really giant enterprise at some point — probably Amazon’s largest income supply. The excessive margins from cloud providers would considerably enhance Amazon’s profitability and ship the inventory increased.

3. The inventory has nice upside potential

Amazon at all times appears to be like costly on the idea of price-to-earnings. That is as a result of administration would not handle the enterprise to maximise earnings per share however to maximise long-term money flows from operations.

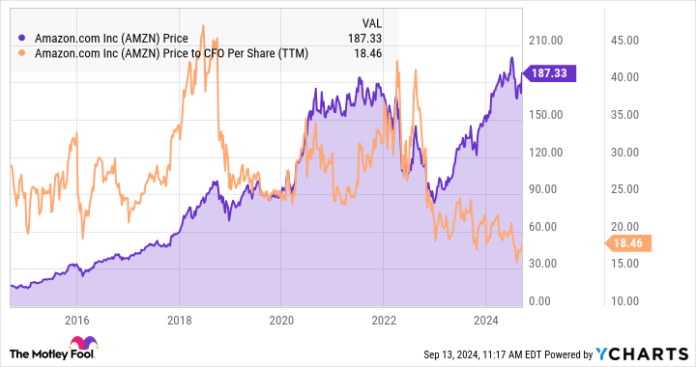

Utilizing Amazon’s money from operations (CFO) per share, the inventory trades at a price-to-CFO a number of of 18.4. Regardless of the inventory doubling in worth within the final 5 years, it’s buying and selling on the lowest P/CFO valuation in over 10 years.

Amazon’s money from operations has tripled within the final 5 years to $107 billion. Within the chart, discover how the inventory has soared in worth because it adopted the expansion within the firm’s money from operations, however the shares proceed to commerce throughout the identical vary on a P/CFO foundation. With the alternatives Amazon has in e-commerce and cloud providers, its money from operations will proceed to develop over time, and that seemingly means extra new highs for the share value.

The inventory is presently buying and selling barely off its latest excessive of $201, so for an investor that solely has a number of hundred {dollars}, now is a good alternative to purchase it.

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. John Ballard has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon. The Motley Idiot has a disclosure coverage.