On-chain information signifies that Tesla Inc. has retained its complete Bitcoin holdings, dispelling current hypothesis a couple of potential sale. Final week, blockchain analytics agency Arkham Intelligence reported that Tesla had transferred its complete stash of 11,509 BTC—presently valued at over $776 million—to new, unidentified wallets.

This substantial motion led to widespread conjecture that Elon Musk’s Tesla may be divesting its Bitcoin property as soon as once more. Nonetheless, Arkham Intelligence has up to date its findings, suggesting that the transfers had been inside and that Tesla nonetheless owns the Bitcoin.

Tesla Retains All 11,509 Bitcoin

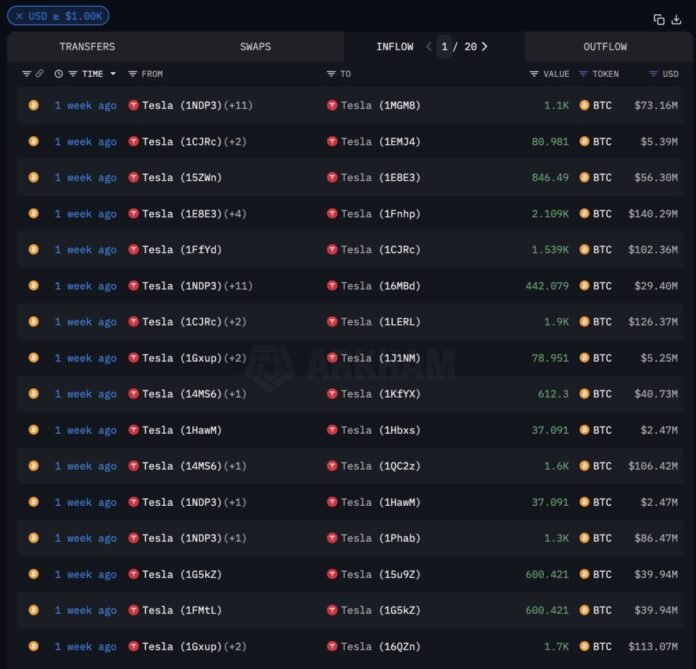

In a assertion on X, Arkham clarified: “We consider that the Tesla pockets actions that we reported on final week had been pockets rotations with the Bitcoin nonetheless owned by Tesla. Tesla moved their complete stability of 11,509 BTC ($776.9M) to new wallets.”

The agency discovered that the cash had been redistributed throughout seven wallets. Every pockets obtained check transactions, and all however one maintain a spherical variety of BTC, suggesting a strategic repositioning reasonably than liquidation. “The Bitcoin has been break up between 7 wallets holding 1,100 and a pair of,200 BTC. All holding wallets obtained check transactions and all however one maintain a spherical variety of BTC,” Arkham writes through X.

Tesla’s BTC is presently held on the following pockets addresses: 1Fnhp – 2,109.3 BTC ($142.2 million), 1LERL – 1,900 BTC ($128.1 million), 1D6Vh – 1,800 BTC ($121.3 million), 16QZn – 1,700 BTC ($114.6 million), 1QC2z – 1,600 BTC ($107.8 million), 1Phab – 1,300 BTC ($87.6million) and 1MGM8 – 1,100 BTC ($74.1 million).

Arkham added: “Some have speculated that that is motion to a custodian, for instance to safe a mortgage in opposition to the BTC.” The hypothesis that Tesla may be transferring its BTC to a custodian to safe a mortgage aligns with practices of companies leveraging crypto property for liquidity with out promoting them outright.

The timing of those developments is especially noteworthy. Tesla is scheduled to report its subsequent earnings at present, October 23, 2024, after market shut (23:30 CEST). The upcoming earnings name might present additional insights into Tesla’s BTC technique and the rationale behind the current pockets actions.

Including a layer of historic context, yesterday, October 22, marked the sixth anniversary of Elon Musk’s first public endorsement of Bitcoin on X. Six years in the past, the BTC worth was as little as $6,400. On that day in 2018, Musk playfully engaged with followers by sharing a picture and commenting, “Wanna purchase some Bitcoin?” Since then, BTC has surged by over 1,000%.

✨ Elon Musk telling you to purchase #Bitcoin at $6,000, precisely 6 years in the past.

Up 1,000% ever since 💫 pic.twitter.com/1UqsyODZqv

— The Bitcoin Historian (@pete_rizzo_) October 22, 2024

Tesla’s relationship with Bitcoin has been dynamic. In February 2021, the corporate made headlines by buying $1.5 billion price of BTC, as disclosed in a submitting with the Securities and Trade Fee (SEC). This transfer positioned Tesla as one of many largest company holders of BTC.

Nonetheless, within the second quarter of 2022, Tesla transformed 75% of its BTC holdings into fiat forex. The choice was attributed to liquidity issues stemming from COVID-19 lockdowns in China. The sale amounted to roughly $936 million, as reported in Tesla’s quarterly earnings.

At press time, BTC traded at $67,083.

Featured picture from Shutterstock, chart from TradingView.com