Alphabet and Nvidia are value choosing up after their latest slides.

A sell-off has taken maintain of the inventory market in July, primarily aimed on the tech business. The Nasdaq-100 Know-how Sector index is down by 9% since July 10, when the majority of the declines started.

The downturn began amid growing tensions between the U.S. and China. Earlier this month, a Bloomberg article revealed that the U.S. was contemplating additional tightening restrictions on China’s entry to superior expertise. Implementing the proposed measure, the Overseas Direct Product Rule, would permit the U.S. to limit overseas firms from exporting merchandise to China that use even small quantities of American expertise. Such a coverage might negatively have an effect on the gross sales of huge numbers of tech firms.

The earnings season that kicked off in late July solely exacerbated issues as Wall Avenue was unimpressed by a number of the first experiences. Nevertheless, tech stays a superb place to search out dependable long-term investments. Budding applied sciences like synthetic intelligence (AI) and cloud computing have loads of development forward.

So, run, do not stroll to take benefit after tech market sell-offs. Listed below are two shares to purchase earlier than it is too late.

1. Nvidia is at its lowest valuation in months

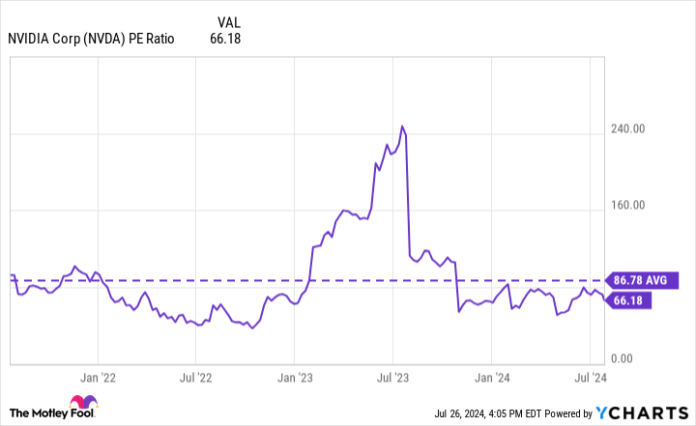

Nvidia (NVDA 12.81%) has fallen by 17% since early July. Whereas that hasn’t felt nice for established shareholders, it has made the inventory a bit extra enticing for these contemplating opening new positions. Nvidia’s price-to-earnings ratio is now effectively under its three-year common and considerably decrease than it was a yr in the past.

Information by YCharts.

The inventory has risen by 478% within the final three years whereas sustaining a median P/E of about 87. So whereas a P/E of 66 would usually be considered as excessive relatively than a cut price, Nvidia’s important development potential and its dominant place in a key tech area make {that a} compelling degree at which to take a position.

Nvidia has delivered huge income and earnings development lately by cornering the market on AI graphics processing items (GPUs) — chips able to dealing with the heavy workloads concerned in coaching AI fashions. As lots of its rivals scrambled to launch new chips that would reap the benefits of rising demand, Nvidia was completely positioned to produce builders and cloud infrastructure suppliers worldwide, reaching an estimated 85% market share within the AI chip business.

Rivals like AMD and Intel have launched competing merchandise. Nevertheless, Nvidia has retained its majority share thanks partially to its Compute Unified Machine Structure, the software program platform that accompanies its GPUs. Massive numbers of builders have acclimated to this platform, making them much less prone to swap to a competing product that might include a studying curve.

In the meantime, Nvidia is staying forward of the competitors with common updates to its chip lineup. The corporate launched its Blackwell GPU structure earlier this yr, and its Rubin structure is due out in 2025.

Nvidia is crushing it in AI, and likewise holds strong positions in gaming, shopper merchandise, self-driving expertise, and extra. After its latest sell-off, the corporate’s inventory is simply too good to cross up.

2. Alphabet’s booming cloud enterprise is vital

Alphabet‘s (GOOG 0.75%) (GOOGL 0.73%) shares have declined by 13% since July 10. Past the headwind of a sectorwide downturn, that pull-back was pushed by its earnings launch on July 23 and a brand new announcement from OpenAI simply two days later.

On July 25, OpenAI unveiled SearchGPT, a prototype search engine that can ultimately be built-in into the ChatGPT chatbot. That device might reduce into Google’s market share in search. Nevertheless, Google controls greater than 90% of the search engine market, and has dominated it for not less than the final decade. With market dominance and huge monetary sources, it will not be simple to dethrone Google.

Furthermore, Alphabet’s second-quarter outcomes final week beat estimates on a number of fronts. Income jumped by 14% yr over yr, exceeding the consensus estimate by $450 million. In the meantime, earnings per share got here in at $1.89 when analysts had anticipated $1.85. But Alphabet’s inventory slid, which market watchers attributed to the slower-than-expected development of YouTube advert gross sales, which elevated by 13%.

Nevertheless, there was lots to be bullish about within the Q2 report. Working earnings soared by 26%, powered by important development in its AI-focused Google Cloud section. Google Cloud income elevated by 29%, with working earnings practically tripling to high $1 billion for the primary time.

Alphabet’s bread-and-butter enterprise has lengthy been advert gross sales. Nevertheless, latest developments counsel cloud computing is probably going its future. The corporate has ramped up its AI growth, making Google Cloud its fastest-growing enterprise.

Buying and selling at a lovely price-to-earnings ratio of 24, Alphabet is a no brainer tech inventory to purchase in 2024.

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Dani Prepare dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Alphabet, and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and brief August 2024 $35 calls on Intel. The Motley Idiot has a disclosure coverage.