Traders trying to capitalize on the booming demand for AI servers ought to contemplate taking a better take a look at these two shares which can be set to ship spectacular progress.

Shipments of synthetic intelligence (AI) servers have shot up remarkably prior to now couple of years as cloud service suppliers have been investing large quantities of cash in infrastructure that is able to coaching AI fashions, in addition to for AI inferencing functions to deploy these fashions in real-world functions.

Market analysis agency TrendForce estimates that the worldwide AI server market may hit a whopping $187 billion in income this 12 months, up by 69% from 2023. A number of corporations are already benefiting massive time from this large end-market alternative. From chip producers similar to Nvidia to customized chip producers similar to Broadcom and server options suppliers similar to Dell Applied sciences, there are a number of methods to spend money on the booming AI server market.

On this article, nevertheless, we are going to take a better take a look at the prospects of Micron Expertise (MU 1.16%) and Marvell Expertise (MRVL 2.11%), two corporations that make crucial parts that go into AI servers.

Micron Expertise’s high-bandwidth reminiscence chips are in terrific demand

Excessive-bandwidth reminiscence (HBM) is utilized in AI server chips similar to graphics processing models (GPUs) due to its capacity to allow quicker switch of information to scale back processing occasions and increase efficiency, in addition to scale back energy consumption. The demand for HBM is so robust that Micron says that it has bought out its total capability for this 12 months and the subsequent.

Even higher, Micron administration factors out that it “can have a extra diversified HBM income profile” for 2026 because of the brand new enterprise that it has landed for its newest HBM3E chip. The chipmaker factors out that it has already begun shipments of this new chip to its prospects for approval.

Micron claims that HBM3E consumes 20% much less energy and supplies 50% extra capability as in comparison with rival choices. The corporate expects to start out the manufacturing ramp of HBM3E in early 2025 and improve its output because the 12 months progresses. Even higher, Micron is assured that it’s going to proceed to realize extra share within the HBM market.

Singapore-based information channel CNA factors out that Micron is reportedly aiming to seize 20% to 25% of the HBM market by subsequent 12 months. That’s doubtless to provide Micron’s progress an enormous increase subsequent 12 months because it expects the HBM market’s income to leap to a formidable $25 billion in 2025 from simply $4 billion in 2023.

An growth of the top market together with Micron’s concentrate on grabbing a much bigger share of the HBM area are the explanations the corporate’s income is anticipated to leap by a surprising 52% to $38 billion within the present fiscal 12 months (which began on Aug. 30). In the meantime, analysts are forecasting Micron’s earnings to extend to $8.94 per share from $1.30 per share within the earlier 12 months.

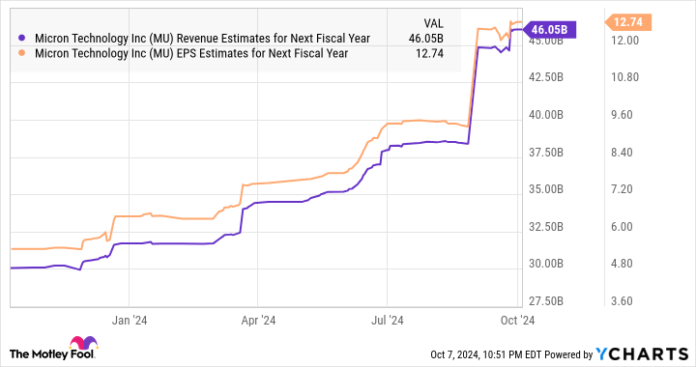

Micron is anticipated to continue to grow at a terrific tempo within the subsequent fiscal 12 months as properly.

MU Income Estimates for Subsequent Fiscal 12 months information by YCharts

Shopping for shares of Micron Expertise proper now may transform a wise transfer for traders trying to profit from the rising deployment of AI servers. The inventory has a ahead earnings a number of of simply 11, whereas its value/earnings-to-growth ratio (PEG ratio) of simply 0.16 additional reinforces the truth that it’s extremely undervalued with respect to the expansion that it’s forecast to ship.

Marvell Expertise is getting a pleasant increase due to its customized AI chips

Marvell Expertise is understood for manufacturing application-specific built-in circuits (ASICs), that are customized chips designed to carry out particular duties. It’s price noting that the demand for these customized chips deployed in AI servers is growing since main cloud service suppliers similar to Meta Platforms, Alphabet‘s Google, and Amazon wish to scale back their prices by growing in-house processors.

In consequence, ASICs are anticipated to account for 26% of the general marketplace for AI server chips in 2024. Even higher, the deployment of ASICs in AI servers is anticipated to extend at a pleasant clip sooner or later and open a possible income alternative price a formidable $150 billion. Marvell is already capitalizing on this profitable alternative.

The corporate’s total income was down 5% 12 months over 12 months within the second quarter of fiscal 2025 (for the three months ended Aug. 3) to $1.27 billion because of the weak point within the service infrastructure, client, automotive, and enterprise networking finish markets. Nonetheless, it delivered an amazing year-over-year improve of 92% in information heart income to $881 million.

There’s a good probability that Marvell’s information heart enterprise will proceed to develop at a wholesome clip as the corporate’s AI chip manufacturing is ready to ramp up, as identified by CEO Matt Murphy on the most recent earnings convention name:

Our AI customized silicon packages are progressing very properly with our first two chips now ramping into quantity manufacturing. Growth for brand new customized packages we now have already received, together with tasks with the brand new Tier 1 AI buyer we introduced earlier this 12 months, are additionally monitoring properly to key milestones.

In consequence, Marvell is anticipating its information heart enterprise’s progress to “speed up into the excessive teenagers sequentially on a proportion foundation” within the present quarter, which might be an enchancment over the 8% sequential progress it reported within the earlier quarter. This explains why Marvell’s steering for the present quarter factors towards an enchancment in its monetary efficiency.

The corporate is anticipating income of $1.45 billion in fiscal Q3, up from $1.42 billion in the identical quarter final 12 months. So, Marvell is ready to return to progress from the present quarter, and analysts expect it to ship strong progress over the subsequent couple of fiscal years.

MRVL Income Estimates for Present Fiscal 12 months information by YCharts

Moreover, analysts expect Marvell’s earnings to extend at a compound annual progress fee of 21% for the subsequent 5 years. So, traders trying to get their palms on a semiconductor inventory to learn from the rising demand for customized AI chips can contemplate including Marvell Expertise to their portfolios. Its progress is ready to speed up because of the great alternative within the AI server market.

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, and Nvidia. The Motley Idiot recommends Broadcom and Marvell Expertise. The Motley Idiot has a disclosure coverage.