The monetary market made a fast restoration this week with a few of the extra risky names within the trade main the best way. Wenesday’s information that tariffs (exterior of China) could be delayed by 90 days led to some optimism and even weak financial information late within the week did not put a damper in the marketplace.

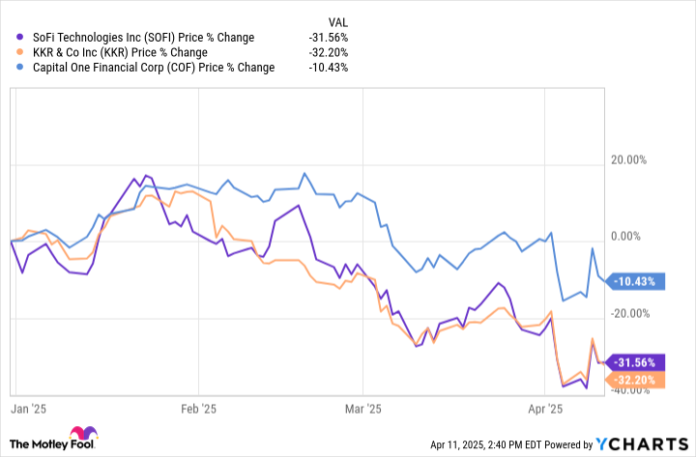

In keeping with information supplied by S&P International Market Intelligence, shares of SoFi Applied sciences (SOFI 1.66%) jumped as a lot as 11.3% this week, KKR (KKR -0.46%) was up 9.2% at its peak, and Capital One Monetary (COF -0.74%) rose 7.4%. The shares are up 10.6%, 7.5%, and 6%, respectively, as of two:30 p.m. ET.

Bouncing off a low

To be honest, the strikes this week are in comparison with final week’s market collapse. Shares are nonetheless down from the start of April, solely 11 days in the past, and have all fallen thus far in 2025.

With that perspective, it is onerous to name this a sturdy rally. However traders had been betting this week {that a} delay in some tariffs and potential offers on others would scale back the danger of a recession and due to this fact defaults on the debt firms like SoFi and Capital One have on their stability sheets. KKR’s rise was clearly as a result of asset values are up, and that is an enormous a part of their price construction.

Whereas the short-term danger could also be seen as decrease than a number of days in the past, there are nonetheless extra dangers right this moment than early this 12 months as economists ramp up their expectations for a recession. And making issues worse is the rise in rates of interest this week that might make it extra expensive for firms, customers, and even the federal government to refinance debt. Oh, and the greenback is dropping, too.

Taking a step again

Lengthy-term traders will wish to take this chance to take a look at the long-term tendencies out there and financial system. Up to now in 2025 shopper confidence is down, tariffs and expectations for inflation are up, and rates of interest are rising.

These components do not bode properly for the financial system or monetary corporations, so it will be a matter of who will survive and thrive by upcoming market turbulence. I do not assume we’re in for main losses on loans at this level, however the dangers for monetary firms are leveraged in comparison with most shares based mostly on their enterprise fashions, so earnings and steerage will probably be value watching carefully.

Ignore the volatility

As these shares rise and fall quickly, it is essential for traders to remember the long-term aim, which is to purchase opportunistically when the market is pondering short-term. I believe these firms will have the ability to handle dangers higher than what the market noticed in the course of the monetary disaster and whereas the restoration might not be clean I am beginning to dollar-cost common at decrease costs. Lengthy-term, any massive dips are alternatives for traders.