The inventory’s upside potential is much larger than its steep decline would have you ever suppose.

Streaming firm Roku (ROKU 0.09%) has been a brutal maintain for buyers for the reason that inventory peaked in 2021. Shares have fallen 89% from their excessive mark, which means the inventory must climb 9 occasions in worth for many who purchased shares close to the highest to interrupt even.

To say Roku is overwhelmed down could possibly be an understatement.

The corporate should progress in key areas to win again buyers, however the inventory’s decline dramatically overstates the negatives and provides little to no credit score for what the enterprise has achieved up to now few years.

At the moment, Roku is a mid-cap inventory that, imagine it or not, has the potential to extend tenfold from right here. It will not occur in a single day, however here is the case for Roku as a future multibagger value shopping for at present.

Roku has continued to develop its ecosystem

The corporate is finest identified for its streaming sticks and Roku-branded sensible TVs, which permit folks to entry their content material in a single place. Streaming is a aggressive subject with content material giants like Disney and Netflix and massive know-how firms like Amazon and Alphabet all providing competing platforms. Roku, wit its $7.8 billion market capitalization, could appear outclassed amongst this group.

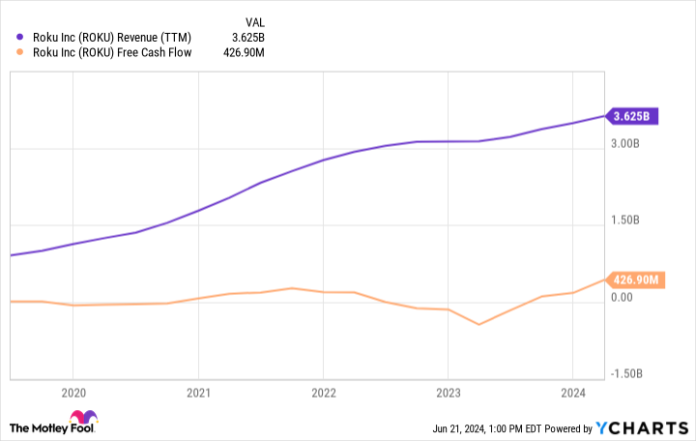

Nonetheless, the corporate has steadily thrived as a result of it provides an excellent product. As of the primary quarter, the corporate had 81.6 million streaming households, up 14% 12 months over 12 months, and these accounts elevated their engagement 23% with 30.8 billion hours of content material streamed. Trailing-12-month income now tops $3.6 billion, and roughly 85% of the highest line comes from the platform (promoting and royalties) somewhat than {hardware} gross sales.

Knowledge by YCharts.

Audiences proceed to gravitate to the Roku platform, and the corporate’s aggressive footing strengthens as extra folks use it. It could be a special dialog if Roku’s person base was stagnant or declining, however the firm continues to develop regardless of being considerably smaller than its friends.

Some imperfections however nothing deadly

If there’s one thing to level the finger at to clarify the inventory’s decline, it might most likely be Roku’s lack of income. The corporate might have $3.6 billion in trailing-12-month income, but it surely’s nonetheless not worthwhile on a usually accepted accounting ideas (GAAP) foundation. A part of the difficulty is Roku has frequently invested in rising the enterprise, particularly overseas the place it is change into the main TV working system model in Mexico. The corporate is engaged on taking market share in Canada, Europe, Latin America, and Australia as properly.

Roku has additionally invested in rising the Roku Channel, its in-house ad-supported streaming service. The Roku Channel has change into a notable a part of the enterprise and is the platform’s third-largest app by attain and engagement. Progressive engagement instruments like shoppable adverts have been featured on the platform too.

It is not all roses, nonetheless. Promoting is significant to Roku’s enterprise mannequin. The corporate initially tried to construct an in-house promoting platform much like Meta and Alphabet. Nonetheless, administration hinted at altering course final quarter when it highlighted its intent to develop relationships with third-party advert platforms like The Commerce Desk.

Proudly owning all the promoting ecosystem would have been perfect, but it surely’s necessary for administration to acknowledge when there is a have to adapt. Moreover, Roku is financially wholesome with roughly $2.1 billion in money in opposition to zero debt. The enterprise is producing robust free money circulation too.

Certain, being worthwhile at present would assist investor sentiment, however there’s undoubtedly long-term upside for this trade chief.

Can Roku rise 10x from right here?

You’ll seemingly see investor sentiment towards Roku enhance as a path to GAAP income turns into extra obvious within the coming quarters. Its internet lack of $51 million within the first quarter was a large enchancment from the year-ago interval’s $194 million loss. And as soon as that tide turns, issues might get actually fascinating for Roku inventory.

Recall it is a firm value $7.8 billion with $2.1 billion of money on its steadiness sheet, giving it an enterprise worth of $5.8 billion. Roku’s enterprise worth should method $60 billion to 10x the inventory. Whereas that might take years to occur, it is a degree Roku has seen earlier than.

Knowledge by YCharts.

Over its lifetime as public firm, Roku has loved a mean enterprise-value-to-revenue a number of of almost 10 occasions. If it reverts to that historic common, Roku would want roughly $6 billion of annual income to provide shareholders a 10x return. Some analysts see income hitting that degree by 2028.

Whereas that flip of occasions would possibly require a very bullish outlook, consider it this fashion: Roku might fall quick and nonetheless outperform the market given its robust trade place and enhancing profitability. That favorable risk-reward dynamic is what makes Roku inventory so compelling.

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Justin Pope has positions in Roku. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, Netflix, Roku, The Commerce Desk, and Walt Disney. The Motley Idiot has a disclosure coverage.