Will an already stretched shopper preserve paying up for high-quality trainers?

Sneakers made by Switzerland’s On Holding (ONON 3.19%) are among the many most in-demand on the planet. However not content material with its spectacular current market-share positive factors, On’s administration is setting two objectives for the rest of 2024 that appear fairly formidable.

Concerning its market share positive factors, On’s progress has been nothing wanting spectacular because it went public. The corporate has loved web gross sales progress of 69%, 47%, and 24% in 2022, 2023, and the primary half of 2024, respectively. That progress far outpaces progress for the business and is best than lots of On’s friends.

On says it is successful due to its differentiated cushioning. The corporate calls it CloudTec — there are particular person cushioning pockets that extra simply adapt to a runner’s stride. The corporate claims this makes it really feel such as you’re “operating on clouds.”

No matter it’s about this shoe model, it is working. Not solely is On rising its gross sales, however the progress is fueled by direct-to-consumer gross sales. That is noteworthy. With common gross sales, a shopper may purchase On’s sneakers after stumbling upon them in a retailer. However with direct gross sales, shoppers are deliberately looking for the sneakers out, suggesting a deep model consciousness.

Issues are going nice for On. Besides, the corporate has a few objectives that I discover maybe too formidable.

On’s bullish outlook

For 2024, On’s administration says it ought to develop its web gross sales by 30% in comparison with 2023 (adjusted for forex fluctuations). Furthermore, it expects a full-year gross revenue margin of 60%. This steerage assumes that progress accelerates within the second half of the yr and that its gross margin additionally improves.

As talked about, On’s web gross sales grew by 24% within the first half of 2024 (earlier than adjusting for forex fluctuations). Administration says it expects to generate gross sales of two.26 billion Swiss francs for the yr, which is about $2.6 billion. Contemplating it had simply lower than 1.1 billion Swiss francs within the first half of the yr, it assumes gross sales of almost 1.2 billion within the again half of the yr.

For perspective, if it hits this objective, On’s web gross sales would wish to leap 28% yr over yr within the second half of the yr (earlier than adjusting for forex fluctuations). That may signify an acceleration in gross sales progress.

Furthermore, On had a gross margin of rather less than 60% within the first half of 2024. With its steerage of a 60% margin for the complete yr, this means a slight margin enchancment within the again half of the yr.

Why this sounds formidable

Not solely is On’s administration saying that it expects its sneakers to be in increased demand from right here, however it additionally expects shoppers to pay full value. If the corporate achieves this, it would have really pulled away from its competitors.

E-commerce large Amazon has its finger on shoppers’ pulse maybe higher than some other firm. In its second quarter, CEO Andy Jassy talked about that its clients had been being “cautious” and buying and selling all the way down to cheaper merchandise. With On positioning itself as a extra premium athletic model, it is formidable to count on gross sales progress acceleration when shoppers are behaving this fashion.

Additionally think about that On’s prime competitor within the operating shoe class is probably going Nike. For its half, Nike is dissatisfied with its current monetary outcomes and is working onerous to reestablish itself because the chief. It is launching new trainers within the again half of the yr whereas concurrently upping its investments in advertising and marketing.

Customers are stretched skinny and On’s opponents could also be determined to win gross sales wherever they’ll. Briefly, it will not be simple for On’s progress to speed up on this atmosphere.

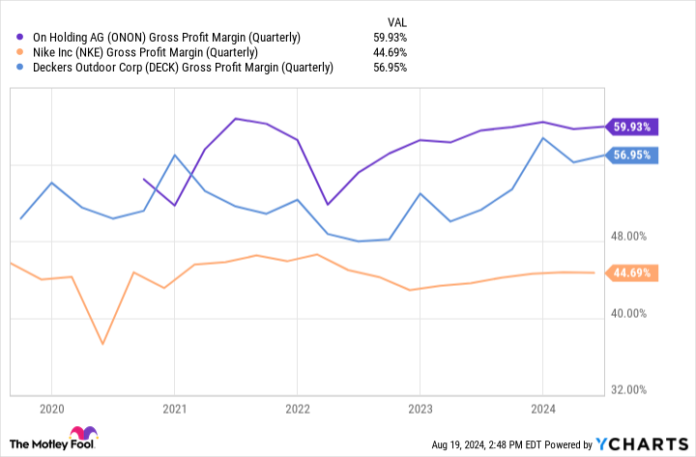

Turning to gross margin, On is already a prime canine. Not solely is it higher than Nike by a mile, it is even higher than one other key rival, Deckers Out of doors, which is commendable.

ONON Gross Revenue Margin (Quarterly) information by YCharts

Can On’s margins widen in a difficult macroeconomic atmosphere when it is already one of many perfect? I am not saying it is unimaginable. But it surely’s actually formidable.

What it means for buyers

On has a terrific enterprise and sure has years of worthwhile progress forward. That mentioned, buying and selling at a price-to-sales (P/S) ratio of 9, the inventory is not low cost. An costly valuation implies that buyers have excessive expectations for the corporate. And administration clearly has excessive expectations as effectively, given its bullish steerage. However in my opinion, will probably be onerous to hit these numbers within the again half of 2024.

If On comes up quick, it might disappoint buyers and sure result in a decrease inventory value, a minimum of within the close to time period. I do consider On may rebound over the long run. However I might wait earlier than shopping for On inventory. And if I had been a shareholder with a long-term outlook, I might brace myself for the potential of near-term volatility.

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon and Nike. The Motley Idiot recommends On Holding and recommends the next choices: lengthy January 2025 $47.50 calls on Nike. The Motley Idiot has a disclosure coverage.