Bitcoin’s 46% decline from its October peak close to $126,100 to roughly $67,000 has triggered debate over what’s driving the pullback. Some market members have pointed to quantum computing as a looming menace to the community’s cryptographic safety. Others argue the reason lies elsewhere, in shifting capital flows, tightening liquidity and altering miner economics.

On a current episode of the Unchained podcast hosted by Laura Shin, Bitcoin developer Matt Corallo rejected the concept quantum fears are behind the downturn. If buyers have been pricing in imminent quantum threat to Bitcoin’s cryptography, he stated, Ether would probably be outperforming slightly than falling in tandem.

Bitcoin is down roughly 46% from its all-time excessive, whereas Ether has fallen roughly 58% since an early-October market break. Corallo argued that this parallel weak point undercuts the declare that quantum computing is uniquely weighing on Bitcoin. He added that some holders could also be in search of a scapegoat to clarify weak value motion.

The quantum debate has gained visibility as researchers discover post-quantum cryptography and as asset managers replace disclosures. Final yr, BlackRock amended the registration assertion for its iShares Bitcoin ETF to flag quantum computing as a possible threat to the community’s integrity.

Corallo countered that market pricing doesn’t sign urgency. He framed the present surroundings as one during which Bitcoin is competing for capital in opposition to different sectors, particularly synthetic intelligence.

Bitcoin mining and AI infrastructure

AI infrastructure requires massive information facilities, specialised chips and vital power capability. That capital depth, he prompt, has drawn investor consideration and funding which may in any other case have flowed into digital property.

Mining information displays these crosscurrents. Bitcoin mining problem lately climbed to 144.4 trillion, a 15% improve and the most important share soar since 2021, when China’s mining ban disrupted the community earlier than operations stabilized.

Problem adjusts each 2,016 blocks, about each two weeks, to maintain block manufacturing close to a 10-minute common no matter hashrate adjustments.

The most recent improve follows a 12% decline in problem after a drop in whole computational energy. In October, when bitcoin traded close to $126,500, hashrate peaked round 1.1 zettahash per second. As costs slid towards $60,000 in February, hashrate fell to 826 exahash per second. It has since recovered to about 1 zettahash per second as bitcoin rebounded to the high-$60,000 vary.

Even with that restoration, miner economics stay tight. Hashprice, a measure of each day income per unit of hashrate, sits close to multi-year lows round $23.9 per petahash per second. Decrease revenues have pressured margins, significantly for operators with greater power prices. Giant-scale miners with entry to cheap energy have continued to broaden. The United Arab Emirates, for instance, is estimated to carry roughly $344 million in unrealized revenue from mining operations.

On the similar time, a number of publicly listed mining corporations are reallocating power and computing assets towards AI and high-performance computing information facilities. Bitfarms lately rebranded to take away specific bitcoin references because it will increase its give attention to AI infrastructure.

Activist investor Starboard Worth has urged Riot Platforms to broaden additional into AI information heart operations. The shift underscores Corallo’s level that bitcoin now competes immediately with different capital-intensive applied sciences.

Bitcoin is consolidating in ‘excessive concern’

Onchain information suggests the market stays in a compression part. Analytics agency Glassnode reviews that BTC has damaged under its “True Market Imply,” a mannequin that tracks the combination price foundation of lively provide and presently sits close to $79,000.

The agency identifies the Realized Worth, round $54,900, as a decrease structural boundary. Bitcoin has traded between roughly $60,000 and $70,000 in current periods, inside that hall.

Sentiment stays fragile. The Crypto Worry and Greed Index has registered “excessive concern” for weeks. But some analysts see valuation help.

Bitwise’s head of European analysis, André Dragosch, stated bitcoin seems undervalued relative to world cash provide development, gold and exchange-traded product flows. He expects consolidation slightly than a fast restoration, noting that sharp capitulations not often produce fast V-shaped rebounds outdoors disaster occasions.

Macro information could form the subsequent transfer. Merchants are watching U.S. core PCE inflation figures for indicators on Federal Reserve coverage. Greater inflation might help scarce property in concept, however a hawkish response might strengthen the greenback and strain threat markets.

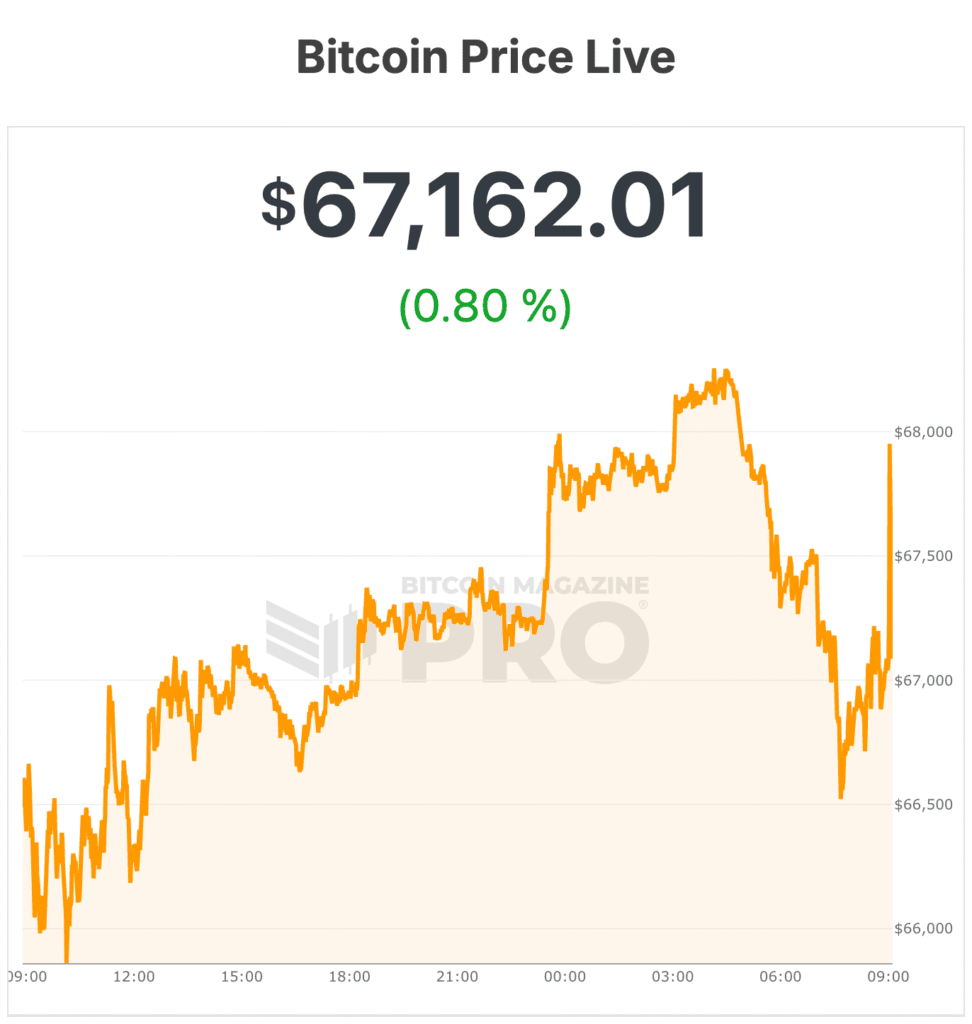

On the time of writing, Bitcoin is buying and selling close to $67,000.