09 Feb Privateness Layers: From Privateness Cash to Privateness Infrastructure

Whereas the late-2025 rally in privateness cash like Zcash (ZEC) and Monero (XMR) has since cooled, demand for nameless, permissionless digital cash — the cypherpunk imaginative and prescient that motivated early Bitcoiners — is unlikely to vary.

What has modified is the place privateness innovation is being directed.

Fairly than present primarily as standalone cash and separate networks, privateness is more and more being explored as infrastructure: confidentiality embedded instantly into high-liquidity public blockchains, paired with selective disclosure mechanisms supposed to face up to regulatory scrutiny.

The current launch of Arcium’s Mainnet Alpha on Solana, with Umbra deploying as its first software, is one sign of that broader shift — not as a result of both of them essentially “solves” privateness however as a result of they mirror the place consideration is transferring.

For many of crypto’s first decade, privateness largely meant privateness cash: purpose-built networks designed to make base-layer exercise more durable to surveil. That mannequin nonetheless issues, significantly for customers who need privateness by default and outdoors of institutional frameworks.

Market construction, nonetheless, has modified. Liquidity, functions and day-to-day workflows have turn into more and more targeting a small variety of main L1s. Because of this, privateness innovation is being pulled towards the place capital, customers and integrations exist already.

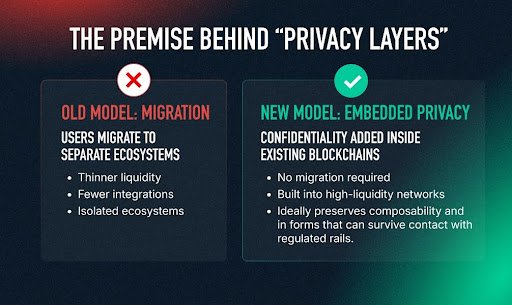

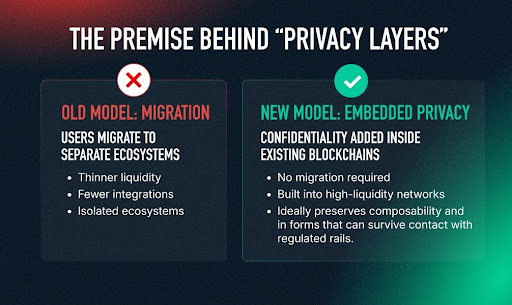

That is the premise behind so-called “privateness layers”: as an alternative of asking customers emigrate to separate ecosystems with thinner liquidity and fewer integrations, the aim turns into including confidentiality inside present networks — ideally with out breaking composability and in types that may survive contact with regulated rails.

Arcium and Umbra are well timed examples of this method on Solana. Arcium positions itself as a confidential computation community — an “encrypted supercomputer” — supposed to let functions course of delicate knowledge with out putting that knowledge instantly onto the general public ledger, whereas nonetheless returning verifiable outcomes to the principle chain. Umbra, positioned as a “shielded monetary layer,” is an early software constructing on high of that infrastructure, with an preliminary deal with shielded transfers and encrypted swaps.

Umbra’s key business framing is selective disclosure: privateness by default, with a mechanism to disclose related particulars to an auditor, counterparty, or authority the place legally required.

The purpose will not be that these launches characterize an endpoint for privateness. It’s that they illustrate how the class is being redefined — away from remoted privateness venues and towards confidentiality expressed as infrastructure inside main ecosystems.

As soon as privateness strikes into the principle venues, precision issues. Not all “privateness layers” try the identical factor.

Confidential transactions are a slender method targeted on hiding values (and generally asset particulars) whereas nonetheless permitting the community to validate that guidelines had been adopted. They map cleanly to settlement: transferring worth with out broadcasting quantities to the market. As a result of the scope is constrained, there may be sometimes much less that may go improper — and it’s simpler to be exact about what’s and isn’t protected.

The Liquid Community’s Confidential Transactions are a main instance on Bitcoin: settlement-first privateness with a intentionally bounded design that has operated for years with out attracting regulatory scrutiny.

Confidential computation, as employed by Arcium, targets a broader downside. Fairly than simply hiding quantities, it goals to maintain delicate inputs and intermediate software state non-public whereas nonetheless producing right, verifiable outcomes. In apply, that is non-public smart-contract-style execution — logic that runs with out revealing commercially delicate knowledge.

Framed by Arcium as a step towards “encrypted capital markets,” the institutional angle is pretty simple: not merely hiding balances, however enabling commercially-sensitive methods and execution to run with out broadcasting intent to your complete market, whereas outcomes nonetheless decide on a public chain.

That ambition additionally introduces extra complexity — and extra trade-offs.

The Belief Commerce-Offs Behind Confidential Computation

As soon as methods transfer from hiding values to hiding execution, the central design query turns into easy: what are you prepared to belief, and the place does failure focus?

Arcium’s method is MPC-based. Multi-party computation splits delicate knowledge into cryptographic “shares” throughout operators so no single social gathering sees the total enter. Privateness breaks provided that sufficient operators collude (or are compromised) to reconstruct the underlying knowledge.

TEE-based designs, comparable to these related to Secret Community, a privateness layer on Cosmos, push the belief boundary into {hardware} enclaves: operators might not see plaintext, however confidentiality now relies on enclave safety and the {hardware} provide chain.

Totally different designs commerce off efficiency, belief assumptions, decentralisation and integration — and people trade-offs turn into central when you begin speaking about confidential execution somewhat than simply confidential settlement.

That is additionally the place the “regulator-tolerable” guess turns into actual.

Selective disclosure is among the most intriguing parts of the brand new privateness narrative. The pitch is easy: privateness by default, with the flexibility to disclose particular particulars at any time when there’s a lawful want. However selective disclosure doesn’t take away compliance stress; it relocates it. If view rights exist, somebody controls them. The onerous questions are operational and authorized — who can grant disclosure, who could be compelled to grant it, and the place legal responsibility sits when disclosure is demanded or refused.

Totally different designs push duty onto completely different actors — the consumer, builders, infrastructure operators, or intermediaries — and every alternative creates a distinct enforcement floor.

That’s why “regulator-tolerable” is finest handled as an open speculation somewhat than a settled end result. The market will not be solely testing cryptography; it’s testing governance and incentives beneath actual stress.

No dialogue of privateness infrastructure is full with out acknowledging Twister Money, as a result of it illustrates how privateness instruments can turn into enforcement flashpoints with penalties that outlast any single authorized occasion. The mechanism will not be solely deterrence. It’s ecosystem constriction: entrance ends, integrators, custodians and repair suppliers disengage, participation shrinks, and the sensible properties privateness methods rely upon weaken.

One thing can stay technically practical whereas turning into commercially unusable as soon as the encompassing ecosystem turns into risk-averse.

In Europe, the Anti-Cash Laundering Regulation (AMLR), set to come back into pressure in 2027, provides a concrete timeline round nameless wallets and “anonymity-enhancing” devices for regulated suppliers. The unresolved situation is how broadly these ideas will probably be utilized, and whether or not app-layer confidentiality infrastructure will probably be handled as distinct from mixer-style instruments or privateness cash as soon as regulators deal with outcomes somewhat than architectural nuance.

The implicit guess behind privateness infrastructure is that confidentiality framed as market construction, paired with workable auditability pathways, will probably be handled in a different way from instruments perceived primarily as obfuscation. Whether or not that distinction holds will rely much less on technical sophistication and extra on real-world outcomes: how methods are used, the place enforcement leverage could be utilized and whether or not disclosure mechanisms perform beneath stress.

If privateness is transferring from an asset class to an embedded functionality, the following part will come down to some sensible exams.

Adoption issues as a result of privateness is partly statistical. If solely a skinny slice of exercise makes use of confidential rails, utilization stands out and safety weakens. Composability issues as a result of DeFi assumes clear state; confidential execution has to coexist with pricing, analytics, liquidations and threat monitoring, or it stays a distinct segment facet pocket. And selective disclosure issues as a result of it will likely be judged beneath actual audits and enforcement stress: too weak and controlled rails step again; too sturdy or too centralised and it recreates the choke factors privateness methods had been meant to keep away from.

Arcium and Umbra are simply two components of an evolving story through which privateness is being pulled towards the chains the place liquidity already exists, and more and more framed as an try to make confidentiality suitable with compliance.

Whether or not that compromise holds — technically, economically and legally — is the final word check.