The scramble to construct compute capability for synthetic intelligence (AI) fashions and coaching has enriched longtime Nvidia (NVDA 1.30%) shareholders. Massive tech firms have been sharply growing capital spending to construct information facilities and fill them with highly effective servers, largely utilizing Nvidia’s merchandise.

Retail buyers and hedge fund managers alike piled into Nvidia shares over the previous few years. The inventory rocketed greater than 400% during the last three years, even with it hovering about 25% off its record-high stage.

I imagine the AI chief will proceed to beat the market going ahead. Listed here are some explanation why.

AI use will increase

Early use circumstances for AI have ranged from chatbots for web searches and customer support to AI brokers offering specialised companies. More and more, companies might be utilizing the highly effective expertise to enhance effectivity, goal profitable markets, and develop gross sales.

Producers can scale back faulty merchandise, improve productiveness, and save upkeep prices utilizing AI. Nvidia and Alphabet‘s Google Cloud simply introduced a collaboration to carry agentic AI to enterprises which might be aiming to have AI make selections and carry out duties autonomously. It would use Nvidia’s newest Blackwell platform on Google Distributed Cloud to successfully create on-site information facilities.

Educators are additionally more and more counting on AI to assist in educating in addition to analysis. Nvidia was concentrating on that section with the discharge of its first desktop AI supercomputer final 12 months. The corporate introduced growth of a compact desktop pc geared towards builders, researchers, and college students. Nvidia has additionally launched desktop AI machines “to assist entrepreneurs and different professionals leverage AI of their every day duties,” the corporate says.

The following period of AI

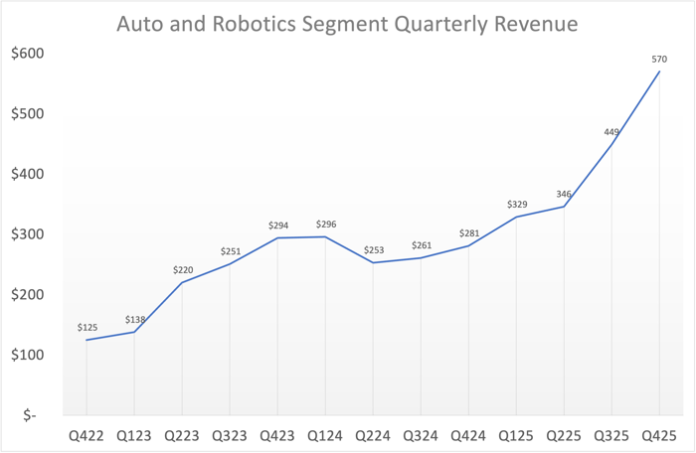

Robots powered by AI together with driver help and self-driving software program may effectively drive one other main progress spurt for Nvidia. The corporate is already realizing sharply rising gross sales in its automotive and robotics section.

Automotive and robotics fiscal quarterly income. Knowledge supply: Nvidia. Chart by creator.

Fourth-quarter income greater than doubled 12 months over 12 months, and the section contributed $1.7 billion to Nvidia’s gross sales final fiscal 12 months. Nvidia has enterprise partnerships with a number of international automakers. Toyota plans to construct its next-generation automobiles utilizing Nvidia’s software-defined platform for autonomous automobiles, for instance.

Car makers are together with superior driving help capabilities, and Nvidia might be one huge beneficiary. Equally, firms will make the most of clever machines and robots more and more throughout industries, together with manufacturing, healthcare and logistics.

A key to beating the market

There’s one other necessary issue that may assist Nvidia beat the market from right here: The inventory’s valuation has turn out to be very compelling, as shares have dropped 17.4% this 12 months, as of this writing.

The as soon as high-flying inventory now sports activities a price-to-earnings (P/E) ratio beneath 25 primarily based on the present fiscal 12 months’s earnings estimates. Nvidia’s enterprise can be considerably insulated from potential price will increase that would come from Trump administration tariff insurance policies and the U.S. commerce conflict with China.

Nvidia’s gross revenue margin elevated 230 foundation factors final 12 months to 75%. Whereas buyers could keep away from the inventory within the quick time period if revenue margins deteriorate, the corporate is ranging from a really robust place in that space.

No investor can know what’s going to come within the at the moment turbulent geopolitical surroundings. A common flight to security may push shares down farther from current ranges if buyers shun shares usually. In the long run, although, a rising enterprise with robust profitability like Nvidia’s will finally be a horny place to take a position for the long run.

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Howard Smith has positions in Alphabet and Nvidia. The Motley Idiot has positions in and recommends Alphabet and Nvidia. The Motley Idiot has a disclosure coverage.