No one mentioned investing in equities was straightforward, and that remark definitely holds when analyzing the funding proposition at Caterpillar (CAT -1.25%) proper now. There’s a sturdy case for purchasing shares of the heavy equipment maker in the present day, however there’s one key factor buyers will need to see earlier than shopping for the inventory.

The case for purchasing Caterpillar inventory

Regardless of a ten% year-over-year lower in gross sales within the first quarter and a whopping 27% decline in working revenue, there’s nonetheless a sturdy case for purchasing Caterpillar. It is based mostly on three interconnected components.

- The corporate’s retail gross sales information was higher than anticipated within the first quarter and signifies an upturn is coming.

- Its sellers’ stock place within the first quarter suggests a good setup for Caterpillar gross sales for the remainder of 2025.

- Administration estimates for earnings and money move indicate the inventory is an effective worth for an organization within the trough 12 months of its earnings cycle.

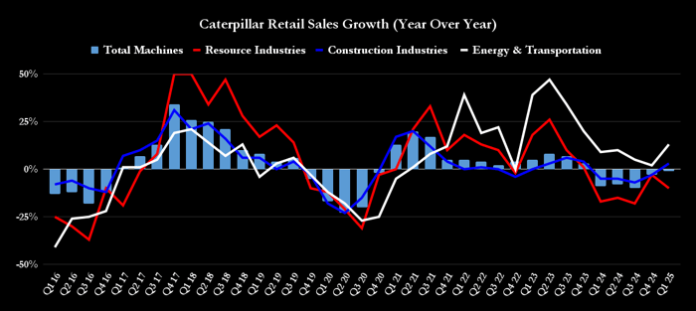

Earlier than supporting these factors intimately, it is price noting that Caterpillar generates the overwhelming majority of its gross sales by impartial sellers to finish customers. The sellers handle their stock of kit, and the gross sales information within the chart beneath displays their gross sales to finish customers.

A greater-than-expected first quarter

In the course of the first-quarter earnings name in late April, outgoing CEO Jim Umpleby famous, “Machine gross sales to customers have been stronger than we anticipated within the first quarter, leading to flat machine supplier stock, versus our expectation for development in supplier stock throughout the quarter.”

Caterpillar’s retail gross sales to finish customers within the development and vitality and transportation segments have been in optimistic development territory within the first quarter, with solely a ten% decline in useful resource industries (mining and aggregates) flattening complete machine gross sales (which embrace development and useful resource industries gross sales) into adverse territory.

Knowledge supply: Caterpillar displays, chart by creator.

The higher-than-expected finish person gross sales (keep in mind, they signify sellers’ gross sales) led to sellers solely growing stock by $100 million within the first quarter. By the use of comparability, sellers elevated stock by $1.4 billion within the first quarter of 2024.

Given present gross sales patterns, “sellers are ordering to replenish” in line with CEO Joe Creed, giving credence to administration’s forecast for flat gross sales in 2025.

Total, administration’s full-year steering, excluding the influence of tariffs, is for flat gross sales, an adjusted working revenue margin within the high half of its cyclical vary (which is roughly 16% to twenty%), and free money move (FCF) towards the highest half of the $5 billion to $10 billion vary.

For reference, Wall Avenue analysts have penciled in $8.4 billion in FCF for 2025, a determine that may put Caterpillar inventory at 19.6 occasions FCF in 2025 — a superb valuation for a cyclical firm in a trough 12 months. That is the purchase case, and it is fairly compelling.

Picture supply: Getty Photos.

The important thing metric to regulate

That being mentioned, there are a few issues to bear in mind. First, there’s the nice unknown of the tariff panorama. Administration’s commentary on the matter contains altering steering from “high half” of the ranges mentioned above to “inside,” assuming the tariffs in place on the finish of April. Since then, there was a de-escalation, giving buyers cause to really feel extra optimistic.

The second consideration is extra problematic and pertains to “value realization.” This refers back to the influence of pricing on gross sales and working revenue, impartial of the impact on gross sales volumes. Constructive value realization implies Caterpillar was capable of obtain higher pricing on equipment, and may also mirror comparatively higher gross sales of higher-priced equipment or in additional profitable geographies. Damaging value realization means that Caterpillar could also be providing reductions or incentives in response to competitors.

The change in working revenue is sort of fully attributable to adjustments in gross sales quantity (Caterpillar’s gross sales quantity, not sellers’ gross sales, as outlined above) and value realization. Because the chart beneath demonstrates, optimistic value realization was capable of offset declining gross sales volumes till the second quarter of 2024, after which each tendencies turned downward within the third quarter.

Knowledge supply: Caterpillar displays, chart by creator.

What it means for Caterpillar buyers

Damaging value realization is more likely to proceed within the second quarter because it comes up in opposition to a tough comparability with the second quarter of 2024. Nonetheless, suppose Caterpillar’s gross sales are set to enhance within the second half, in step with the optimistic development in person gross sales and sellers’ stock positions. In that case, it is cheap to count on some enchancment in value realization within the third quarter, and probably within the second quarter as nicely.

It is a key metric to observe, indicating a strengthening of market situations and Caterpillar’s skill to develop earnings and meet its full-year targets.