Pinterest disappoints buyers for the second quarter in a row.

It’a been a tricky few months for shares of Pinterest (PINS -0.10%). The inventory was crushed throughout the summer time after the corporate warned of slower income progress when it reported its second-quarter outcomes. Then, the inventory took one other hit following its third-quarter outcomes as buyers disliked the corporate’s fourth-quarter steerage.

Let’s look at Pinterest’s most up-to-date outcomes and steerage to see if it is a golden alternative to purchase the inventory on the dip.

One other disappointing forecast

Pinterest turned in one other strong quarter of income progress, with its high line rising 18% to $898.4 million. Nevertheless, it marked a continued deceleration of progress from 23% in Q1 and 21% in Q2. U.S. and Canada income grew 16% to $719 million, whereas European income climbed 20% to $137 million. Income from the remainder of world (ROW) phase jumped 38% to $42 million.

Month-to-month energetic customers (MAUs) grew by 11% to 537 million, led by a 16% bounce in ROW customers to 300 million. U.S. and Canada MAUs elevated by 3% to 99 million, whereas European customers rose by 8% to 139 million.

One of the essential metrics to take a look at for Pinterest is common income per person (ARPU), as closing the hole with opponents and higher monetizing its customers is the corporate’s greatest alternative transferring ahead.

Total ARPU rose 5% to $1.70, though it tends to be finest to take a look at tendencies on a regional degree since ARPU ranges range vastly from area to area. Within the U.S. and Canada, ARPU climbed 13% to $7.31, whereas European ARPU rose by 11% to $1. For the remainder of the world, ARPU jumped 18% to $0.14.

Taking a look at profitability, Pinterest reported a 31% bounce in adjusted earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) to $242 million. Adjusted earnings per share (EPS), in the meantime, soared 43% to $0.40.

Pinterest forecast This autumn income of between $1.125 billion and $1.145 billion, representing 15% to 17% progress yr over yr. This could be a continued deceleration in income progress. The corporate mentioned it has been seeing weak point within the meals and beverage vertical, which is able to persist into This autumn. Nevertheless, it’s seeing energy in decrease funnel income.

Is that this a golden alternative to purchase the dip?

For the second straight quarter, Pinterest inventory sank on steerage. Whereas the meals and beverage trade vertical is dealing with headwinds and spending a bit much less on promoting, general there are nonetheless loads of good issues occurring at Pinterest.

Regional ARPU continues to develop solidly, and the corporate will develop its Amazon partnership into Canada and Mexico. In the meantime, it continues to check and develop its partnership with Alphabet to assist higher monetize customers from rising markets. It is also turning to resellers to assist in these markets.

In the meantime, it simply made its Efficiency+ automation platform (which helps enhance advert marketing campaign creation) usually obtainable to advertisers at the beginning of October — and can introduce Efficiency+ with ROAS (return on advert spending) in Q1. This could assist be a driver in 2025.

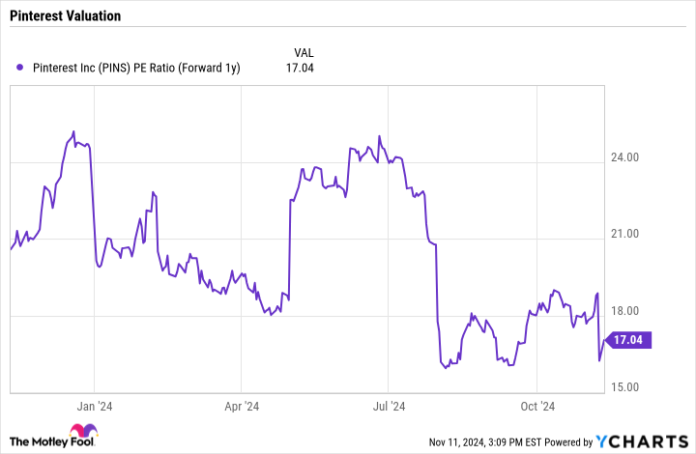

Buying and selling at a ahead price-to-earnings (P/E) ratio of about 17 primarily based on 2025 analyst estimates, Pinterest inventory appears to be like enticing given the alternatives in entrance of it.

PINS PE Ratio (Ahead 1y) knowledge by YCharts

Whereas buyers had been disillusioned with Pinterest’s decelerating progress, the inventory is attractively valued primarily based on its present progress. In the meantime, it nonetheless has loads of alternatives to proceed to raised monetize customers each in the usand overseas. This, along with Efficiency+ might assist reaccelerate income progress subsequent yr.

As such, I feel the dip in inventory worth is a golden alternative to purchase this progress inventory.

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Geoffrey Seiler has positions in Alphabet and Pinterest. The Motley Idiot has positions in and recommends Alphabet, Amazon, and Pinterest. The Motley Idiot has a disclosure coverage.