These main tech corporations provide superior progress prospects at decrease price-to-earnings ratios.

Shares of Costco (COST 0.48%) are up 54% during the last 12 months, however most of that return was pushed by a rise within the price-to-earnings (P/E) a number of that Wall Road is keen to pay for the shares — not precise progress within the firm’s earnings per share.

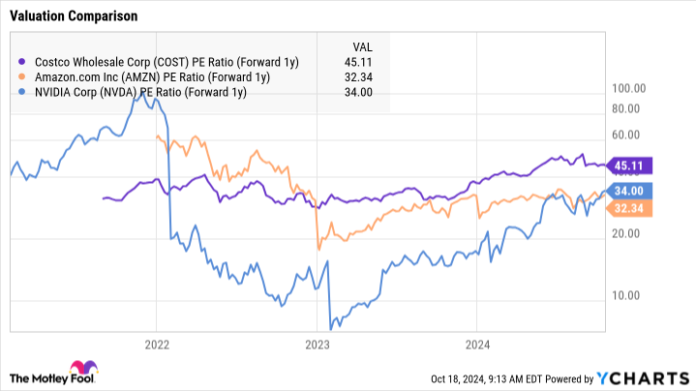

Analysts anticipate Costco to report annualized earnings progress of 9% over the long run, but the inventory trades at a price-to-earnings ratio that’s normally reserved for the perfect progress shares. Costco’s ahead P/E of 45 is much more costly than among the world’s strongest tech corporations, together with high Magnificent Seven shares Amazon (AMZN 0.78%) and Nvidia (NVDA 0.78%), that are anticipated to develop earnings quicker and commerce at decrease valuations.

PE Ratio (Ahead 1y) information by YCharts.

Costco is a retailer buying and selling at a progress tech inventory valuation, and Wall Road has made this error earlier than. Within the late Nineteen Nineties, shares of Coca-Cola and Walmart traded at over 50 instances earnings. The next returns over the following decade had been disappointing, as these stalwarts could not ship sufficient earnings progress to help their excessive valuation.

The important thing to success within the inventory market is to at all times go for robust companies that provide the perfect progress prospects at a comparatively enticing valuation. This framework says to move on Costco proper now, as a result of there are many progress shares providing higher worth. These Magnificent Seven shares are place to begin.

1. Amazon

Amazon is considered one of Costco’s chief rivals in e-commerce. To its credit score, Costco is rising its on-line gross sales quicker than Amazon. Costco’s e-commerce enterprise grew gross sales 19% 12 months over 12 months on an adjusted foundation within the fiscal quarter ending Sept. 1. This beats Amazon’s single-digit progress from on-line shops.

Costco has the good thing about rising from a smaller base of on-line gross sales than Amazon. Amazon managed 37% of the home e-commerce market in 2023, in keeping with Statista, in comparison with 6% for No. 2 Walmart. Costco was in a distant seventh place with 1.5% share.

Nonetheless, contemplating all of Amazon’s income sources — together with promoting, cloud providers, subscription providers, and bodily retail places — it is higher positioned to ship superior returns to buyers. Amazon’s complete income grew 10% 12 months over 12 months within the second quarter. Over the past 10 years, Amazon grew gross sales at a 22% compound annual charge, in comparison with simply 8% for Costco.

Furthermore, Amazon is implementing a number of cost-cutting initiatives to bolster its earnings. Working revenue grew 91% 12 months over 12 months final quarter, as administration continues to shorten transportation distances between success facilities and clients’ doorsteps. In distinction, Costco’s working revenue grew simply 9% 12 months over 12 months final quarter.

Importantly, most of Amazon’s working revenue comes from its cloud providers enterprise. Amazon Net Providers is the highest cloud supplier in a $297 billion market that grew 22% in Q2, in keeping with Synergy Analysis. The profitable income streams Amazon generates from non-retail providers like cloud computing are a significant benefit over conventional retailers. They permit Amazon to be extra aggressive in investing in e-commerce infrastructure to guard its lead.

Analysts anticipate Amazon’s earnings per share to develop 23% on an annualized foundation over the long run. The inventory’s ahead P/E is 39 on 2024 earnings estimates, which is a reduction to Costco shares, and may result in higher returns.

EPS LT Development Estimates information by YCharts.

2. Nvidia

Nvidia shares have delivered unbelievable returns of over 2,700% during the last 5 years. Some buyers would possibly take a look at that tremendous run and assume the inventory is overvalued. However this high semiconductor firm is benefiting from highly effective tendencies in synthetic intelligence (AI) and information middle progress that might gas extra market-beating returns.

Wall Road has underestimated the marketplace for Nvidia’s graphics processing models (GPUs). GPUs had been initially used within the Nineteen Nineties for enjoying video video games and working different graphics-intensive pc software program. However in recent times, Nvidia’s chips have run among the strongest supercomputers on this planet.

The corporate estimates that there’s about $1 trillion price of knowledge middle infrastructure within the means of switching from legacy computing {hardware} to extra highly effective GPUs which can be wanted to speed up pc processing for AI workloads. Consequently, Nvidia’s income has accelerated over the previous few years, as information facilities construct extra optimized infrastructure to prepare AI fashions, which require large quantities of knowledge and computing horsepower.

Knowledge by YCharts.

It is essential to bear in mind that, as a number one firm in a cyclical chip trade, Nvidia’s income progress hasn’t been as constant as Costco’s. However buyers are being nicely compensated for accepting a extra bumpy journey.

Analysts anticipate Nvidia to ship 38% annualized earnings progress over the following a number of years. Nvidia’s earnings jumped 168% 12 months over 12 months in the newest quarter. That is due to a scarcity in AI chips relative to demand, which is permitting Nvidia to cost excessive costs. Over the past 10 years, Nvidia’s earnings grew at a compound charge of 51%. The alternatives forward within the information middle market ought to proceed to drive stronger progress and returns for shareholders than Costco shares.

Nvidia at the moment trades at a ahead P/E of 49. However utilizing subsequent 12 months’s earnings estimate, the inventory trades at a ahead P/E of 34, in comparison with a costlier 45 a number of for Costco.

Do not pay a excessive P/E for below-average progress

There’s a proper time to pay a excessive valuation for a inventory, however there are additionally flawed instances. To justify a excessive P/E, the corporate must ship a number of earnings progress. Amazon and Nvidia are assembly these expectations, however buyers ought to assume twice earlier than paying a excessive P/E for Costco’s single-digit gross sales and earnings progress.

There are many expensive-looking progress shares which have crushed the inventory market’s common return, however Costco cannot be thought of a progress inventory when it isn’t rising earnings greater than the common firm within the S&P 500 index.

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. John Ballard has positions in Nvidia. The Motley Idiot has positions in and recommends Amazon, Costco Wholesale, Nvidia, and Walmart. The Motley Idiot has a disclosure coverage.