Shares of the air taxi firm are up by 248% since final 12 months, however down by about 17% from their latest highs.

Archer Aviation‘s (ACHR 10.33%) proposed air taxi not too long ago set some new flight data in testing — and its inventory has been climbing ever since.

On the finish of September, the corporate caught the general public’s eye once more when its Midnight plane reached altitudes of seven,000 ft and 10,000 ft throughout check flights, its highest altitudes up to now. Shortly earlier than that, a pilot took one on its longest flight up to now: about 55 miles in 31 minutes.

Each data add to the rising physique of proof that Archer has what it takes to show its imaginative and prescient of flying taxis right into a actuality — and comparatively quickly.

With Archer getting near commercialization and its shares nonetheless buying and selling for underneath $12, is now the time to purchase this transportation inventory?

How Archer might revolutionize city transportation

Archer is engineering small electrical vertical takeoff and touchdown (eVTOL) craft supposed for short-hop flights. Its flagship craft, Midnight, is designed to hold 4 passengers plus a pilot, shuttling them on point-to-point journeys of about 15 miles to twenty miles.

Though the marketplace for eVTOLs would not exist but, demand for them might unfold quickly as soon as they grow to be obtainable. That is as a result of they can assist tackle considered one of city life’s thorniest issues: visitors.

Picture supply: Getty Photographs.

Taxis, ride-hailing platforms, and concrete transit have all alleviated gridlock to some extent. Even so, congested metropolis streets at rush hour can nonetheless flip short-distance drives into grueling hour-long journeys.

Site visitors is much more irritating whenever you’re making an attempt to get to locations like airports or hospitals, the place time is of the essence. Certainly, it is no marvel that Archer has a partnership with United Airways. Quick-hop journeys to airports might grow to be a significant development vector for the corporate sooner or later.

Flying towards key regulatory milestones

The following occasion that would ship Archer inventory hovering could be the Midnight receiving its sort certification from the Federal Aviation Administration (FAA), which might permit it to fly paying passengers commercially.

The corporate’s making progress in pursuit of that aim. It has Half 141 for pilot coaching and Half 135 to start business operations. And it is now actively pursuing sort certification.

In the meantime, the White Home has been selling eVTOL improvement. Within the wake of a flurry of government orders issued by President Donald Trump, Archer is collaborating in an eVTOL pilot program that would see trial operations of Midnight craft within the U.S. in 2026.

Across the identical time, Archer was named the official air taxi supplier of the 2028 Los Angeles Olympics. That sprawling metropolis experiences among the worst visitors congestion within the U.S., and assuming that Archer is ready to meet its targets, the Olympics would supply it a prime-time alternative to showcase the potential of its eVTOLs to the world.

The darkish facet of the dream

Archer’s imaginative and prescient is a moonshot, an formidable try to start disrupting a transportation trade that hasn’t skilled an enormous shift in fairly some time. And, just like the moon itself, this imaginative and prescient has a darkish facet — not less than whereas it stays only a imaginative and prescient.

That darkish facet is the staggering quantity of labor that also must be completed to make eVTOLs an on a regular basis presence. It is one factor for the corporate to get regulatory approval to fly its air taxis. It is fairly one other to place the infrastructure in place to completely help these craft, after which develop a system that permits them to fly and switch a revenue.

Archer might want to construct a number of plane, which is not going to be low cost. It would additionally have to construct or lease quite a few vertiports for landings and takeoffs. It’s going to additionally want batteries, charging stations, and pilots. As you possibly can most likely guess, in one of the best case, its capital expenditures within the close to time period can be giant.

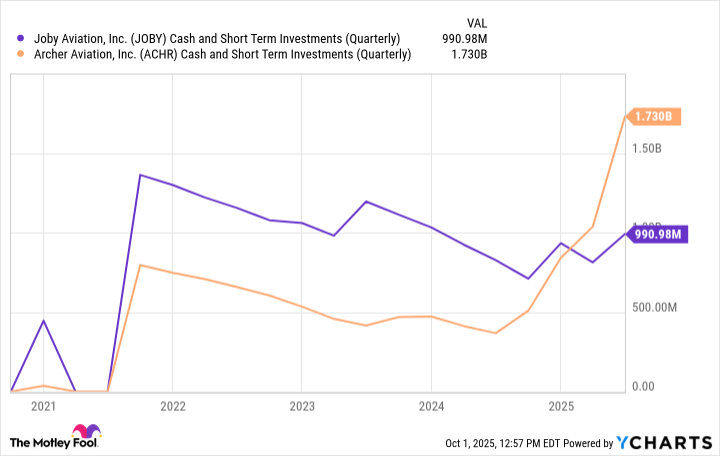

On the identical time, Archer claims to have a $6 billion order guide, which is nearly as a lot as its current market valuation of about $7.2 billion. It additionally had a hefty money place of about $1.7 billion as of the tip of June — over $700 million greater than its chief rival, Joby Aviation.

JOBY Money and Quick Time period Investments (Quarterly) information by YCharts.

Must you purchase Archer whereas it is underneath $12?

If Archer executes on its imaginative and prescient and will get regulatory approval for its Midnight craft, at present’s share value might look like peanuts on reflection.

On the identical time, it is not acceptable for each portfolio. Conservative buyers, for example, will possible wish to keep away. Archer is pre-revenue, it has not but developed the infrastructure that it’s going to require to roll out its eVTOLs broadly as air taxis, and it’ll incur important losses within the technique of constructing out its future. Any setbacks, delays, or unfavourable information might ship the inventory reeling.

As such, I’d view this inventory as a possible speculative play, however I would not make it a core holding.

For development buyers who know what they’re shopping for, including a slice of Archer might expose you to an eVTOL market that Morgan Stanley forecasts could possibly be price about $9 trillion 25 years from now. Those that have a low danger tolerance, nevertheless, may wish to anticipate Archer to hit one other key milestone — like FAA approval — earlier than contemplating the inventory.