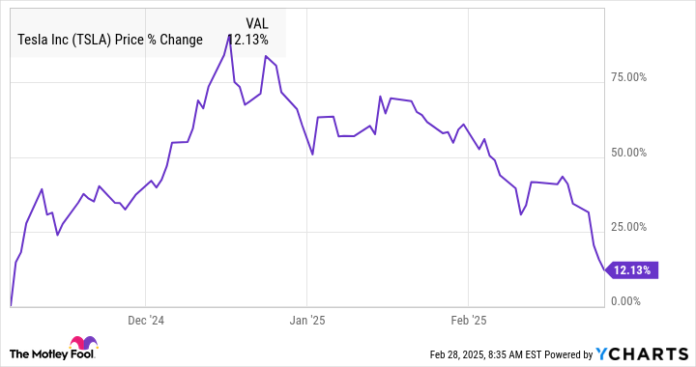

Tesla (TSLA -4.43%) has been a wild trip over the previous couple of months.

Shares of the electrical car (EV) maker soared following the election of President Donald Trump in November as CEO Elon Musk carefully aligned himself with Trump in the course of the marketing campaign. Traders appeared to consider that having a pleasant ear from the president would translate right into a win for the corporate.

Nevertheless, for the reason that inauguration, Musk has confirmed himself to be a lightning rod for controversy, because of the layoffs and price cuts that the Division of Authorities Effectivity (DOGE) is issuing and his different political statements. Now, there’s proof that could possibly be affecting Tesla’s enterprise. January registrations, a proxy for gross sales, for Tesla in Europe dropped 45% whilst general EV gross sales had been up 37%.

As you’ll be able to see from the chart beneath, the inventory almost doubled within the weeks after the election, although it has since given up almost all of these positive factors.

For traders on the lookout for synthetic intelligence (AI) shares, higher choices can be found. Hold studying to see two of them.

Picture supply: Getty Photographs.

1. The Commerce Desk

The Commerce Desk (TTD 0.64%) has been a high adtech firm for over a decade. It is the main impartial demand-side platform (DSP), that means it helps advert businesses and types optimize their advert campaigns, and the corporate is more and more leaning on AI to innovate and enhance its platform.

The Commerce Desk’s new AI platform, Kokai, makes use of deep studying algorithms distributed throughout the shopping for course of, and makes use of knowledge from greater than 13 million promoting impressions each second.

The Commerce Desk acknowledged some missteps with its rollout of Kokai in its latest earnings report, because the inventory plunged after the corporate missed its personal income steerage. The rollout has been slower than anticipated, however it expects to transform all its clients from Solimar, its earlier platform, to Kokai this yr.

In the meantime, the sell-off in The Commerce Desk inventory units up shopping for alternative as shares are actually down almost 50% from their peak within the fall. Whereas the fourth-quarter outcomes had been disappointing, the corporate remains to be rising quickly with income up 22% to $741 million and adjusted earnings per share up 44% to $0.59. With that sort of development and new AI improvements strengthening its aggressive benefits, the inventory ought to be capable of rebound over the remainder of 2025.

2. Microsoft

One other rock-solid AI inventory buying and selling at a reduction is Microsoft (MSFT 0.03%). The tech big was thought to be an early winner in AI resulting from its partnership with OpenAI, however after an preliminary surge, the inventory has lagged the broader market. In truth, the inventory is down over the previous yr as Microsoft has confronted skepticism over its rising capital expenditures, and its valuation had been wanting stretched.

Nevertheless, with the inventory now down almost 20% from its peak and the corporate persevering with to ship stable development quarter in and quarter out, the inventory now seems extra moderately priced at a price-to-earnings ratio of 31.5, simply modestly costlier than the S&P 500.

In the meantime, Microsoft continues to ship regular development and its aggressive benefits are self-evident. It is extra diversified than some other massive tech firm, with companies like Home windows, the Workplace productiveness software program suite, and a variety of software program packages like Groups and Dynamics, video games with Xbox, its LinkedIn social media enterprise, and GitHub coding repository. To not point out the Azure cloud infrastructure enterprise, which anchors its Clever Cloud phase, which grew 19% in the latest quarter and is Microsoft’s fastest-growing phase.

Microsoft’s general income rose 12% and working earnings rose 17%, which ought to quell considerations a few lack of development. In the meantime, Microsoft appears poised to capitalize on development in AI it doesn’t matter what course it goes because it has a number of completely different companies that may profit from it. It is a shut accomplice of OpenAI and has launched a number of of its personal AI instruments together with Copilot, and it is a accomplice within the new Stargate Mission, which proposes to spend as much as $500 billion on AI infrastructure.

If the AI revolution lives as much as investor hopes, Microsoft will virtually definitely be a winner.

Jeremy Bowman has positions in The Commerce Desk. The Motley Idiot has positions in and recommends Microsoft, Tesla, and The Commerce Desk. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.