Is it time to swap Bitcoin for Solana? Here is what you should find out about these massive crypto names and their long-term prospects.

The S&P 500 (^GSPC 1.09%) market index has seen a complete return of 25% in 2024. That is a unbelievable yr for the inventory market, however it could possibly’t maintain a candle to the crypto market.

In keeping with CoinMarketCap, the market worth of each cryptocurrency added as much as $1.65 trillion on the finish of 2023. The mixed market cap is as much as $3.30 trillion on Dec. 19, which works out to a doubling in lower than 12 months.

Crypto pioneer Bitcoin (BTC 0.87%) gained 138% over the identical interval. Good contracts innovator Solana (SOL -4.75%) confirmed a 101% achieve, simply forward of the crypto sector as an entire.

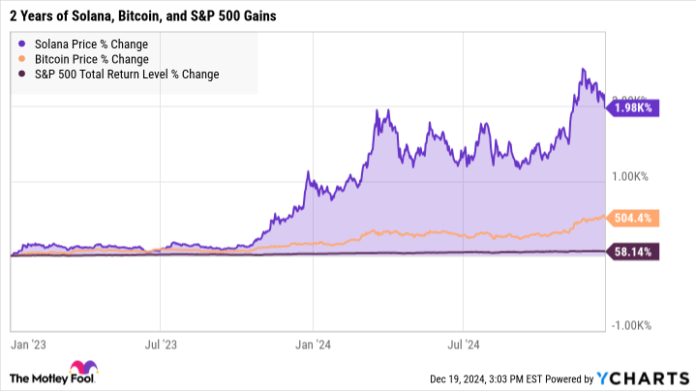

However the image modifications when you zoom out just a little. Ranging from the doldrums of December 2022, Solana stands head and shoulders above Bitcoin and the inventory market with a 2,000% worth achieve:

Solana Value information by YCharts

So Solana has a latest historical past of outperforming Bitcoin, regardless that the bigger cryptocurrency loved a fairly unbelievable return in the identical time span. It could be fairly superior if that two-year development may proceed in 2025 and past.

Is that this time to rebalance your crypto holdings, backing out of Bitcoin to purchase extra Solana as a substitute?

Solana’s surge: A rebound from FTX fallout

First, let me level out that Solana’s latest worth surge began from a really low level.

Caught up within the monetary meltdown of Sam Bankman-Fried’s FTX crypto trade, Solana had not too long ago plunged from $259 to $10 per token in a couple of yr.

It isn’t straightforward to recuperate from a drop of that magnitude, however nonetheless a less complicated process than skyrocketing from the next start line. Bitcoin additionally suffered from the FTX debacle, however its worth drop was a lot smaller than Solana’s. In different phrases, Solana’s stellar positive aspects from the summer time of 2022 have been assisted by an artificially low beginning worth.

Solana’s real-world functions

On the upside, Solana is poised to carry out. The cryptocurrency continues to be a high performer relating to executing good contracts in a rush, which is sweet for automating monetary transactions and different asset-based modifications.

Particularly, Solana’s high-speed contracts come in useful while you’re managing a big quantity of those decentralized packages on the similar time in a time-pressure state of affairs. Cellular video games spring to thoughts, alongside blockchain-based buying and selling platforms and non-fungible token (NFT) gross sales. Sometime, perhaps you will even purchase chewing gum and fuel with a fast Solana transaction. That is the type of stuff a cryptocurrency with good contracts and speedy transaction settlement can do.

Subsequently, Solana’s return to the top-10 record of enormous and widespread cryptocurrencies is smart. Proudly owning some Solana might be a good suggestion in 2024, because the token appears more likely to turn out to be broadly utilized in real-world functions over the subsequent couple of years.

Bitcoin’s high development catalysts

However can Solana outperform Bitcoin at this juncture? Maybe, however I am not so certain. Bitcoin has too many development catalysts happening:

- Bitcoin not too long ago up to date its financial perform for the fourth time, halving the quantity of cash which are issued when a brand new block of Bitcoin transaction information is processed. These halvings have traditionally led to spectacular worth positive aspects a couple of yr later, and there isn’t any purpose to consider that this cycle shall be any completely different.

- Change-traded funds (ETFs) based mostly on up-to-the-minute Bitcoin costs are a couple of yr previous. Their introduction was anticipated to convey numerous new capital into the crypto market, utilizing instruments already acquainted to any inventory investor. About 5.2% of all Bitcoins have discovered their manner into the spot Bitcoin ETFs up to now, led by the large iShares Bitcoin Belief (IBIT 0.16%). The capital influx picked up the tempo in November, although this week’s disappointing financial stories led to the most important single-day outflow up to now. Even Bitcoin and its ETFs are nonetheless fairly risky.

- November’s Bitcoin enthusiasm referenced the election outcomes. The incoming Trump administration brings a extra crypto-friendly angle to the Capitol and White Home, and the president-elect included cryptocurrency help in his marketing campaign. Amongst different issues, this regime change may result in the creation of a nationwide Bitcoin reserve, which might increase the cryptocurrency’s worth by making it much more scarce on the open market.

I may go on, boring you to tears with technical information and promising market tendencies, however you get the thought: Bitcoin is not standing nonetheless. Solana might want to work arduous to beat this behemoth in the long term.

I want to personal extra Bitcoin than Solana

It could sound humorous, given Bitcoin’s lengthy historical past of untamed worth swings and continued volatility, however the digital gold is evolving right into a strong value-holding asset. There are not any “protected bets” within the crypto market, however Bitcoin will get fairly shut. A pointy flip of occasions may flip Solana right into a footnote in crypto historical past, however it takes a large sea change to make Bitcoin out of date.

As a long-term investor, I’d relatively have a big Bitcoin holding and a smaller, speculative Solana funding than the opposite manner round. To be clear, I personal a little bit of each. Nonetheless, Bitcoin’s future worth tendencies will make a a lot greater distinction to my nest egg than Solana’s ever may.

And that is the best way I prefer it. Your mileage could fluctuate, however Bitcoin seems just like the stronger funding concept to me.

Anders Bylund has positions in Bitcoin and Solana. The Motley Idiot has positions in and recommends Bitcoin and Solana. The Motley Idiot has a disclosure coverage.