It looks as if ages in the past, however many buyers forgot that on the finish of 2023, Rivian Automotive (RIVN -2.20%) arguably had extra momentum than some other younger electric-vehicle (EV) maker. Gross sales had been nonetheless heading larger, and the corporate had acquired quite a few awards for high quality and reception of its R1 automobiles.

Since then, nevertheless, demand has faltered and gross sales and deliveries have declined. Beneath, I will check out the first-quarter decline, what occurred, and the silver lining for buyers.

Demand wanes

It is part of the automotive cycle: As automobiles age, demand wanes. Automakers usually offset this with a mid-cycle refresh, which updates just a few issues and a few design options to clean up the look and stoke demand.

Whereas Rivian did improve to a second era of the R1 automobiles, a lot of the consideration went to {hardware} and price discount. There’s additionally the chance that demand will proceed to wane for its R1 automobiles.

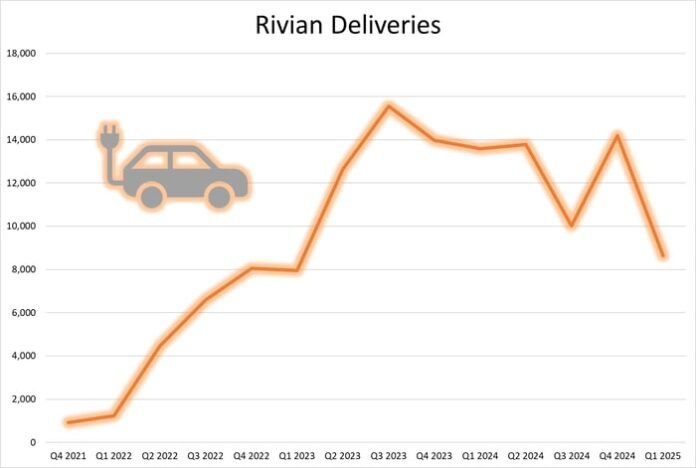

Knowledge supply: Rivian press releases. Picture supply: creator.

The graph above additionally exhibits the corporate exiting 2023 with momentum, earlier than issues started to sluggish. Additional, add in the truth that Rivian had a pull-through impact on its EDVs into the fourth quarter, which led to disappointing first-quarter deliveries. In different phrases, the corporate constructed extra industrial automobiles in the course of the fourth quarter to catch up from a provide scarcity, pulling ahead demand from the primary quarter.

Silver lining

The silver lining with Rivian is evident: Regardless of slowing deliveries, the corporate has managed to take away prices and enhance its gross revenue. The primary quarter marked the second-consecutive report quarter for gross revenue, producing $206 million. That broke all the way down to $92 million from the automotive section and $114 from the software program and companies section.

That is a formidable enchancment, contemplating that lagging deliveries and income dropped from $1.1 billion to $922 million in the course of the first quarter. Which means the development needed to have come from the prices aspect of the equation. Certain sufficient, Rivian managed to cut back the price of good bought by a staggering $22,600 per automobile delivered in the course of the first quarter in comparison with the prior 12 months.

Rivian R1T and R1S. Supply: Rivian.

The following step

Now, all eyes are turning towards the R2 launch in 2026. Not solely will the R2 construct on the {hardware} upgrades to the up to date R1, which can decrease prices, it additionally will open the door to a wider client base with a price ticket beginning at round $45,000.

Presently, Rivian is establishing an growth to its Regular, Illinois, manufacturing facility to allow the preliminary manufacturing of the R2. Development is on schedule, and the corporate has began design validation builds on the prototype line utilizing manufacturing tooling.

What all of it means

Other than the upcoming R2, arguably the most important issue to look at is Rivian’s liquidity, one thing all the time of significance on the subject of such younger corporations. Thankfully, for Rivian’s second-consecutive quarter of gross revenue, the corporate unlocked a $1 billion cost from Volkswagen as part of its three way partnership.

Together with the opposite $7.2 billion in money and money equivalents, the capital ought to present sufficient runway for operations by means of the ramp up of not solely the R2 in Regular, but additionally the R2 and R3 in Georgia. The latter ought to help a pathway to constructive free money circulation and scale.

Rivian is a extremely speculative inventory that ought to occupy solely a small place in any portfolio. Nonetheless, regardless of slowing gross sales, the corporate has managed to take away significant prices and enhance its operations, setting itself up for a significantly better 2026.

Daniel Miller has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.