Tremendous Micro Pc has some short-term headwinds dragging the inventory down.

Inventory splits are often good indicators of power, since firms usually solely break up their inventory after the value of a person share has gotten costly. Tremendous Micro Pc‘s (SMCI 0.56%) break up is coming quickly — the corporate expects its 10-for-1 break up to take impact on Oct. 1 — nevertheless it hit a tough patch shortly after asserting it.

Since then, the inventory is down round 32%. There are a number of causes for this, however I do not suppose any of them justify avoiding the inventory as a long-term funding — though traders should concentrate on the chance they’re taking up.

Supermicro’s merchandise are in excessive demand

Tremendous Micro Pc manufactures elements for information facilities and builds full servers. This was a great enterprise in recent times, and it has been an exceptional enterprise these days. Due to unprecedented synthetic intelligence (AI) demand, firms are speeding to broaden their computing capability. This has induced companies like Supermicro’s to increase as a result of it’s a key provider on this house.

Whereas it has many opponents, none supply an answer that’s as custom-made as Supermicro’s for a full server. And its liquid-cooled know-how affords purchasers probably the most energy-efficient server out there, which saves on long-term working prices.

These elements have mixed to make Supermicro the best choice for information heart elements and full-server builds, which is why the inventory has completed so effectively this 12 months.

However there’s extra to Supermicro’s funding thesis than its best-in-class merchandise.

Two elements are inflicting the inventory to wrestle within the quick time period

Because the inventory peaked in March this 12 months, it has steadily declined. A part of this decline is warranted for the reason that expectations priced into the inventory at the moment had been unrealistic. Nevertheless, the degrees it has fallen to are too low-cost, creating an thrilling funding alternative.

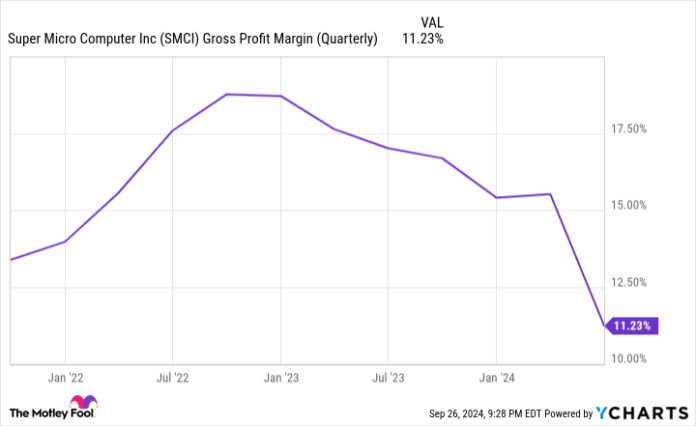

The causes of the newest inventory drop following its earnings report for its fourth quarter (ending June 30) are twofold. First, Supermicro’s gross margins have declined for a lot of quarters.

SMCI gross revenue margin (quarterly); information by YCharts.

This is not an incredible signal — declining gross margins can point out that Supermicro’s merchandise have gotten commoditized and that it is dropping pricing energy. Nevertheless, administration blames the launch of its new liquid cooling know-how and different new merchandise for the decline. It believes these gross margins will recuperate all through fiscal 2025 and return to historic norms over the long run.

Regardless, this can harm earnings within the quick time period, which traders do not wish to see. This induced the preliminary inventory decline following earnings.

The second purpose for the decline includes Hindenburg Analysis, a famed short-selling agency that advantages when inventory costs drop. Hindenburg launched a short-seller report alleging accounting malpractice by Supermicro, one thing that the corporate has already been fined for by the Securities and Alternate Fee (SEC).

To make issues worse, Supermicro has delayed submitting its end-of-year type 10-Ok with the SEC as a result of, administration mentioned, it’s assessing the “design and working effectiveness of its inside controls over monetary reporting.” If you cannot belief the financials an organization is reporting, the inventory turns into unworthy of an funding, which is why many dumped the inventory following the report.

However the firm would not count on any modifications to its monetary outcomes. So this may very well be a wake-up name for administration to get its enterprise so as, and can probably not be a consider the long run, assuming its financials do not change and the Hindenburg report seems inaccurate.

That is not the finish of the Hindenburg saga, nevertheless. Shortly after the Hindenburg report, the U.S. Division of Justice opened at probe into Supermicro. This probe may give you nothing. Nonetheless, there’s a chance that it might result in additional motion, so the chance of investing in Supermicro has elevated. Traders have a very long time to attend till the outcomes of this investigation are recognized.

In the meantime, these two short-term elements driving the inventory down have opened up a long-term funding alternative if it seems that the corporate is not discovered to have engaged in accounting malpractice. This may be seen in its ahead price-to-earnings ratio (P/E), because the inventory trades for a dirt-cheap 12 instances ahead earnings.

SMCI PE ratio (ahead) information by YCharts.

That is low-cost for any inventory, not to mention one set to develop its income between 74% and 101% in fiscal 2025. Couple that with steadily enhancing margins, and you’ve got a recipe for a inventory that might have a powerful 12 months as soon as different questions are sorted out.

I feel Supermicro’s inventory might soar after its break up. A number of short-term elements are dragging it down, however ought to these be resolved favorably, Supermicro is primed to publish wonderful returns due to the large demand for its merchandise.

For now, there’s an elevated threat of investing in Supermicro as a result of an ongoing authorities probe. This should not trigger you to disregard the inventory utterly, assuming you are prepared to take the chance, nevertheless it ought to information your place sizing in case you select to spend money on the inventory someday quickly.