Investing $500 in these corporations and holding them for the long term might transform a wise transfer.

Shopping for and holding high shares for a protracted, very long time is likely one of the finest methods to generate income within the inventory market, as a result of this technique permits buyers to capitalize on secular progress tendencies and in addition helps them profit from the ability of compounding.

For example, a $500 funding made within the Nasdaq-100 Know-how Sector index a decade in the past is now price $2,300, translating into annual progress of 16% throughout this era. So, in case you have $500 to spare proper now after paying off your payments, clearing costly loans, and saving sufficient for tough occasions, it might be a good suggestion to place that cash into shares of corporations which might be benefiting big-time from the rising adoption of synthetic intelligence (AI).

That is as a result of the worldwide AI market is forecast to develop at an annual price of 28% by 2030, producing virtually $827 billion in annual income on the finish of the last decade. The adoption of this know-how is ready to influence a number of industries, starting from cloud computing to digital promoting.

On this article, I’ll look at the prospects of two corporations which might be working in these niches and are already benefiting from the quickly rising adoption of AI to see why it might make sense to take a position $500 in them (both individually or mixed).

1. The Commerce Desk

The Commerce Desk (TTD 0.08%) operates a programmatic, cloud-based promoting platform that helps advertisers buy advert stock and handle and optimize their campaigns throughout varied channels equivalent to video, cellular, e-commerce, related tv, and others. The Commerce Desk’s automated platform makes use of real-time knowledge to assist drive stronger returns on investments for advertisers in order that they will buy and show the proper adverts to the proper viewers on the right time.

It’s price noting that the corporate operates in a fast-growing area of interest because the programmatic promoting market is anticipated to generate incremental income of $725 billion between 2023 and 2028 at a compound annual progress price of 39%, as per TechNavio. The Commerce Desk has been counting on AI to seize this huge end-market alternative.

The corporate launched its AI-enabled programmatic advert platform Kokai in June 2023. Kokai analyzes 13 million advert impressions each second in order that it will possibly “assist advertisers purchase the proper advert impressions, on the proper value, to achieve the audience at the very best time.” The nice half is that The Commerce Desk’s prospects are already witnessing an enchancment of their returns on advert {dollars} spent due to Kokai.

On its August earnings convention name, The Commerce Desk administration identified:

For these campaigns which have moved from Solimar to Kokai in combination, incremental attain is up greater than 70%.

Price per acquisition has improved by about 27% as knowledge parts per impression have gone up by about 30%. As well as, efficiency metrics have improved by about 25%, serving to to unlock efficiency budgets on our platform for years to come back.

Solimar is The Commerce Desk’s programmatic advert platform that was launched in 2021. So, it will not be shocking to see extra of the corporate’s prospects shifting to the AI-enabled Kokai given the numerous enchancment in advert efficiency that it’s delivering. Extra importantly, The Commerce Desk’s concentrate on integrating AI has allowed it to speed up its progress as nicely.

The corporate’s income within the second quarter of 2024 elevated 26% 12 months over 12 months to $585 million as in comparison with the 23% progress it recorded in the identical quarter final 12 months. Its adjusted earnings elevated at a sooner tempo of 39% from the identical quarter final 12 months to $0.39 per share. The corporate’s income forecast of $618 million for Q3 would translate into 27% progress from the identical quarter final 12 months, suggesting that its top-line progress is on observe to speed up within the present quarter.

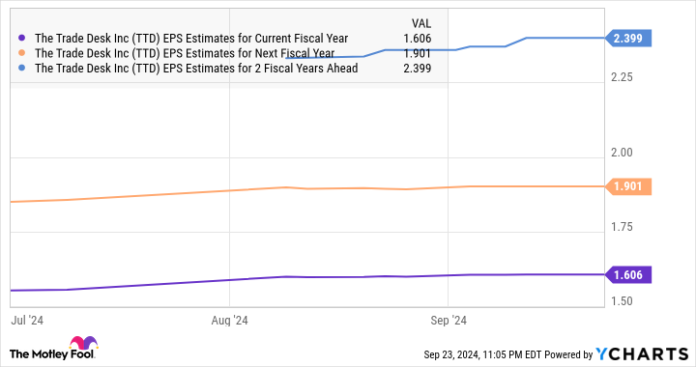

The nice half is that analysts predict The Commerce Desk’s earnings progress price to choose up sooner or later.

TTD EPS Estimates for Present Fiscal Yr knowledge by YCharts

The corporate is anticipated to clock an annual earnings progress price of 26% for the subsequent 5 years, however latest tendencies and the large addressable alternative within the programmatic promoting market (which The Commerce Desk administration pegs at $1 trillion) counsel that it might outperform consensus estimates.

The market has rewarded The Commerce Desk inventory with 50% positive aspects in 2024 to date due to its enhancing progress profile, and its shiny prospects counsel that it might hold flying greater. That is why investing $500 in The Commerce Desk might transform a wise long-term transfer proper now contemplating that it has a value/earnings-to-growth ratio (PEG ratio) of 0.6, which signifies that it’s undervalued with respect to the expansion that it’s forecasted to ship.

2. Oracle

The cloud computing market has been a giant beneficiary of the rising AI adoption within the preliminary days, Grand View Analysis estimates that the cloud AI market might develop at an annual price of 40% by 2030 to generate income of $647 billion on the finish of the forecast interval. Oracle (ORCL 0.38%) is getting a giant enhance due to the fast progress of the cloud AI market, as evident from the corporate’s latest outcomes.

Oracle’s cloud income within the first quarter of fiscal 2025 (which ended on Aug. 31) elevated 21% 12 months over 12 months to $5.6 billion, outpacing the corporate’s complete income progress of 8% to $13.3 billion. Extra particularly, the Oracle Cloud Infrastructure (OCI) enterprise recorded terrific year-over-year progress of 45% to $2.2 billion.

OCI is the corporate’s infrastructure-as-a-service (IaaS) enterprise by which it rents out its cloud infrastructure to prospects trying to prepare AI fashions. Administration factors out that this enterprise now has an annual income run price of $8.6 billion and demand for OCI is exceeding provide. The demand for Oracle’s cloud infrastructure providing is so sturdy that its remaining efficiency obligations (RPO) shot up a terrific 52% 12 months over 12 months within the earlier quarter to $99 billion.

RPO is the whole worth of an organization’s future contracts which might be but to be fulfilled, and it’s price noting that AI is taking part in a central position in driving this metric greater. Oracle factors out that its “cloud RPO grew greater than 80% and now represents almost three-fourths of complete RPO.”

Contemplating the large alternative that is current within the cloud AI market, it will not be shocking to see demand for Oracle’s cloud infrastructure improve at a strong tempo for a very long time to come back. That is additionally the explanation why consensus estimates are projecting Oracle’s income to extend by double digits over the subsequent three fiscal years following a top-line leap of simply 6% in fiscal 2024 to $53 billion.

ORCL Income Estimates for Present Fiscal Yr knowledge by YCharts

Oracle is up 57% to date in 2024. Traders would do nicely to behave rapidly so as to add this cloud inventory to their portfolios as it’s nonetheless buying and selling at a sexy 27 occasions ahead earnings, a small low cost to the Nasdaq-100 index’s ahead earnings a number of of 29. Its big addressable market and the immense measurement of its backlog that is rising on account of the fast adoption of cloud AI providers is prone to result in extra inventory value upside sooner or later.