When doubtful, go together with the one with fewer apparent dangers.

Within the tech and enterprise world, no matter has been tougher to keep away from than synthetic intelligence (AI). Over the previous couple of years, it has been the matter. With this surge in curiosity has come an increase within the valuations of many tech shares as buyers rush to capitalize on new development alternatives.

No two firms have benefited extra from the AI hype than Nvidia (NVDA -3.38%) and Palantir (PLTR -0.92%). It has propelled Nvidia to the world’s most useful public firm and pushed Palantir’s inventory value up over 810% because the starting of 2024.

Each firms have produced generational returns, however when you had to decide on one of many development shares to put money into, which is the higher selection?

Picture supply: Getty Pictures.

What Nvidia has going for it

Nvidia is undoubtedly one of the vital essential firms within the AI world. It produces graphics processing items (GPUs) that energy information facilities, making it attainable to coach, deploy, and scale AI as we all know it at present. In its newest quarter, Nvidia’s information middle income elevated 56% from a 12 months in the past to $41.1 billion (88% of its complete income).

Nvidia makes GPUs for gaming consoles, automotive functions, and networking, however information facilities are its bread and butter. The corporate plans to go all in on changing into an AI infrastructure firm.

This pivot has labored out in Nvidia’s favor and is anticipated to proceed doing so, as the corporate anticipates AI infrastructure spending to extend between $3 trillion and $4 trillion over the subsequent 5 years from a few of AI’s largest spenders, together with the “Magnificent Seven” shares. Nvidia expects it may well seize as much as 70% of this spending.

What Palantir has going for it

Palantir is a software program firm that makes use of AI to show huge quantities of information into actionable insights. It isn’t as essential to the AI ecosystem as Nvidia, however its use instances are constantly rising, which has fueled its development over the previous couple of years. Palantir’s preliminary focus was on authorities entities, such because the Division of Protection, CIA, and FBI, however it has expanded and proven it may be profitable within the business sector, too.

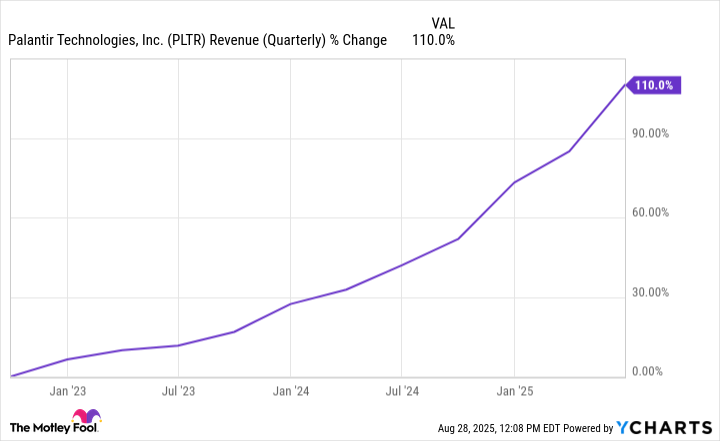

Its U.S. authorities section continues to be the majority of its income (42% of complete income), however its U.S. business section is its fastest-growing section. Within the second quarter, U.S. business income grew 93% 12 months over 12 months to $306 million. The expansion of each segments helped Palantir obtain its first billion-dollar quarter, greater than doubling its income from simply three years in the past.

PLTR Income (Quarterly) information by YCharts

Palantir’s AI Platform (AIP) is accountable for its current business success. Because it continues to realize adoption throughout numerous industries, Palantir ought to see its income base diversify, enhancing its long-term enchantment.

What downsides does every firm have?

Nvidia’s largest “roadblock” is that it is in the midst of a unstable relationship between the U.S. and China. The Trump administration imposed a ban on gross sales of the H20 chip (Nvidia’s China-compliant AI chip) to China in April, however reversed the choice in July after Nvidia agreed to pay the federal government a 15% tax on AI chip income generated in China (the deal is in place, however has not but been finalized). It is value keeping track of how this performs out.

Palantir’s draw back is its reliance on U.S. authorities contracts. These contracts can present profitable alternatives, however they can be topic to altering authorities budgets and political priorities. As unstable as the present political setting is, it would not be far-fetched for a few of these contracts to be restructured or canceled fully. Palantir’s business enterprise is rising, however it nonetheless depends on U.S. authorities contracts to maintain the lights on.

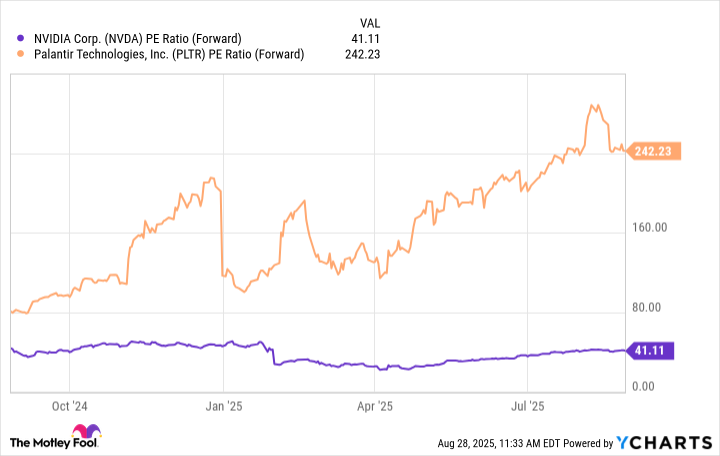

You may’t ignore how every firm is valued

Though each firms have nice development prospects, you’ll be able to’t determine on which is the higher one to personal with out their valuations. As of Aug. 28, Nvidia is buying and selling at 41 instances its ahead earnings, whereas Palantir is buying and selling at 242 instances its ahead earnings.

NVDA PE Ratio (Ahead) information by YCharts

Nvidia’s 41 ahead P/E ratio is dear by most requirements, however Palantir’s valuation is among the highest in historical past. It has gotten to the purpose the place an Economist article talked about that Palantir “could be probably the most overvalued agency of all time.”

Once I consider which is the higher inventory to personal, I take into consideration which one has extra margin for error as a result of development shares are recognized for being unstable — particularly ones propped up by AI hype. Nvidia has little room for error with its valuation, however Palantir has just about no room for error at its present valuation.

In my view, that makes Nvidia the higher selection between the 2.

Stefon Walters has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia and Palantir Applied sciences. The Motley Idiot has a disclosure coverage.