In case you invested $1,000 in shares of athletic attire titan Nike (NKE 2.97%) one yr in the past, I am sorry in your losses. The inventory is down about 34% over the last 12 months, leaving simply $660 in worth for anybody who invested a grand.

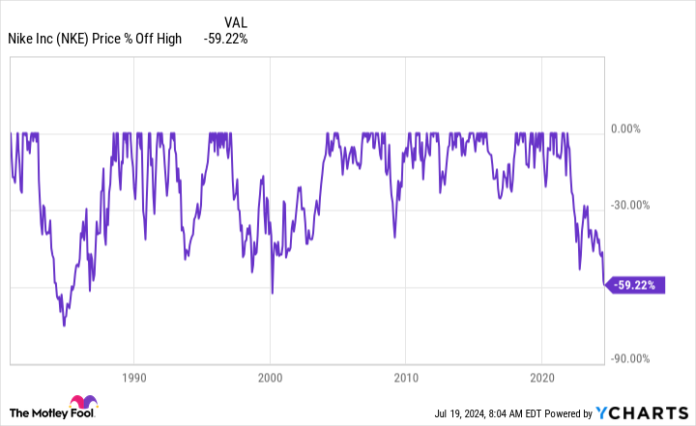

It will get worse: Nike inventory is now down almost 60% from all-time highs reached in 2021. A 60% drawdown is not essentially uncommon on the inventory market, however it’s uncommon for Nike. Since going public in 1980, it is solely dropped 60% or extra two different occasions. And it hadn’t occurred over the last 20 years till now.

Nike inventory is dropping as a result of the enterprise is shedding some floor to opponents. In its fiscal fourth quarter of 2024 (the interval that resulted in Could), CFO Matthew Good friend mentioned that taking a look at the long run, the corporate is “centered on taking again market share,” which suggests it is positively misplaced some.

Wanting past its misplaced market share in its fiscal 2024, Nike’s administration says that its fiscal 2025 can be a “transition yr.” I see this as a pleasant company approach of claiming “disappointing.” Income is predicted to drop for fiscal 2025 as a complete, with a ten% drop coming within the first quarter.

Gross sales are anticipated to drop (and presumably earnings, though exact steering wasn’t supplied) and this has brought on the most important drop in Nike inventory in additional than 20 years, as talked about. However the valuation for the inventory can also be unusually low. As of this writing, it trades at about 19 occasions its trailing earnings. Traders have to return 12 years to search out the final time this valuation was this low.

NKE PE Ratio knowledge by YCharts

Due to this fact, Nike traders are taking a look at a valuation that hasn’t been seen in 12 years and a drop in value that hasn’t been seen in effectively over twenty years. Traders understandably wish to know if it is a shopping for alternative. To reply this, traders ought to do not forget that fiscal 2025 is forecast to be a transition yr. And to offer good returns from right here, it issues what the enterprise is transitioning to.

What is the plan for Nike?

Briefly, Nike wants higher gross sales progress to show its inventory round. And the corporate has a plan that it thinks can accomplish this.

CEO John Donahoe says he believes that “Accelerating our tempo and consistency of innovation will permit us to ship impacted scale season after season.” Administration has additionally talked about investing in its “storytelling.”

What do I feel Nike actually means by innovation and storytelling? By innovation, it merely means a refreshed product lineup — new stock. And by storytelling, it actually simply means a change in its advertising emphasis. In different phrases, evidently most of Nike’s plan is to only make and promote new merchandise.

I am unsure that plan goes to meaningfully speed up Nike’s long-term progress fee. In my opinion, a shoe firm ought to all the time have a brand new lineup of footwear popping out. A discretionary client firm ought to all the time look to enhance its advertising message. These are desk stakes, not one thing that separates a enterprise from its friends.

I consider the most important “drawback” for Nike is that it is already so large and profitable with over $50 billion in annual income. It is simply actually arduous for a enterprise this large to have one thing that meaningfully strikes the needle.

NKE Income (TTM) knowledge by YCharts

That is to not say that Nike cannot have a steady enterprise and even get pleasure from modest progress — I consider it could actually. And given its cheaper valuation, the inventory may get pleasure from some modest long-term upside in that state of affairs.

Nevertheless, I am unsure that traders must pounce shortly on Nike inventory. The market has misplaced curiosity due to its forecast drop in gross sales within the coming yr, which is not a scenario that’s anticipated to out of the blue enhance — enchancment will seemingly be gradual, giving traders time.

Furthermore, it is doable the market additional loses curiosity in Nike inventory over the subsequent yr because it performs out, giving traders extra time to be affected person. Take into account that administration says it plans to spend $1 billion in fiscal 2025 on “consumer-facing actions.” This seems to be one other approach it is merely attempting to freshen its model notion. I am not in opposition to the transfer but it surely is likely to be extra pricey than some traders notice.

In closing, I consider long-term traders ought to keep watch over Nike inventory from the sidelines. I would wish to see it begin taking again some market share for the entire effort it can exert within the coming yr earlier than I would be comfy shopping for — the valuation is comparatively cheaper however not essentially a screaming cut price but. If the corporate had a clearer path to develop the enterprise, I would really feel in another way. However in my opinion, Nike’s administration is utilizing plenty of buzzwords to generate pleasure over an in any other case vanilla outlook.

Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nike. The Motley Idiot recommends the next choices: lengthy January 2025 $47.50 calls on Nike. The Motley Idiot has a disclosure coverage.