For this reason billionaires are piling into PayPal.

Billionaire hedge fund pioneer Paul Tudor Jones of Tudor Funding diminished his stake in chip large Nvidia within the first quarter, undoubtedly making a tidy revenue on the sale. He then funneled that cash into a brand new funding in embattled fintech firm PayPal (PYPL 0.45%).

Jones wasn’t the one investor making this transfer, as Philippe Laffont of Coatue Administration made an analogous transfer, trimming his stake in Nvidia whereas including to his PayPal place. The investor, value an estimated $6 billion, piled into PayPal shares, taking his holdings from 27,200 shares on the finish of 2023 to over 8 million shares on the finish of March.

Let’s take a look at what could have attracted these billionaires to PayPal and if traders ought to observe their lead and scoop up the inventory.

A reasonable inventory

One of many first issues that seemingly drew Tutor Funding and Coatue Administration to PayPal’s inventory is its valuation. The inventory has had a tough go the previous few years, down over 40% the final 5 years.

Throughout that point, PayPal has nonetheless solidly grown its income; nevertheless, it has seen some gross margin strain the previous two years. Nonetheless, that has left the inventory buying and selling at a really enticing valuation.

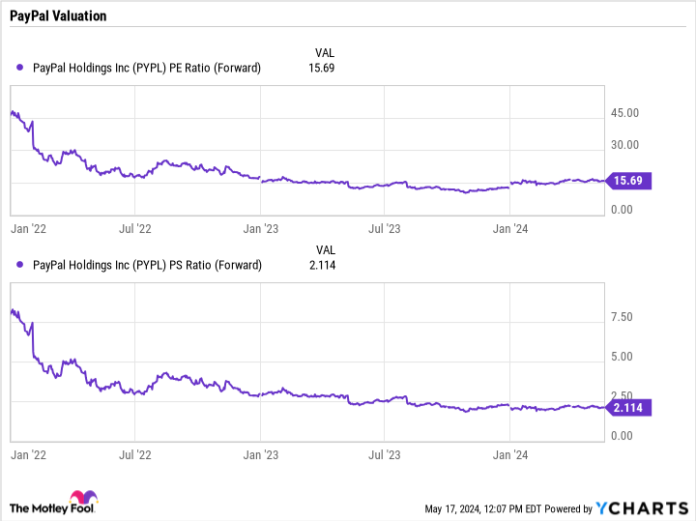

PYPL PE Ratio (Ahead) knowledge by YCharts

The corporate solely trades at a ahead price-to-earnings (P/E) ratio of simply over 15.5 occasions and ahead price-to-sales (P/S) ratio close to 2 occasions. That doesn’t inform the entire story, as the corporate additionally has $8 billion in web money and investments, of which about $1.8 billon was in fairness investments. Excluding that, its ahead P/E drops nearer to 13.5 occasions.

That is an affordable valuation, however an inexpensive inventory alone just isn’t cause sufficient to put money into PayPal.

A turnaround alternative

The opposite massive issue that seemingly attracted these billionaire traders to PayPal is CEO James Chriss and his plans to show the corporate round and place it for the longer term. Chriss took the reins as chief govt of PayPal final September, coming over from Intuit the place he ran the corporate’s Small Enterprise and Self-Employed Group.

He shortly established himself a robust chief pushing PayPal to innovate. Since Chriss has taken over, the corporate has give you a lot of synthetic intelligence (AI) pushed advances. Maybe probably the most thrilling is its Fastlane product. This new checkout resolution allows a product owner’s prospects to take a look at with a single faucet with out having to arrange an account and supply bank card info throughout numerous retailers. On-line retailers lose various potential enterprise when shoppers fail to finish their purchases.

In early exams, the PayPal retailers testing Fastlane have seen an 80% improve in conversion charges. This can be a massive win for retailers and makes a product like Fastlane extremely fascinating. The corporate will begin rolling the product out domestically within the second half of the 12 months.

PayPal has launched a lot of different value-added options as nicely. It introduced a few marketing-oriented merchandise, equivalent to Sensible Receipts and Superior Provide Platforms, that can permit retailers to craft personalised suggestions and customise presents utilizing knowledge based mostly on what prospects have purchased previously, both at their very own web sites or throughout the web. It has launched a fraud administration resolution as nicely.

With innovation, the corporate can be trying to change how its options are priced. One in all PayPal’s points over the previous couple of years has been a deterioration in gross margins, as firms have moved extra towards its lower-margin unbranded resolution BrainTree. Chriss believes the worth of PayPal’s options far exceeds that of aggressive presents, and thus he plans to begin pricing based mostly on worth. On PayPal’s Q1 earnings name, Chriss mentioned that whereas this course of will take time, the corporate is already having conversations with its prime prospects about pricing and specializing in business outcomes.

Picture supply: Getty Pictures.

Time to purchase the inventory?

PayPal is an affordable inventory with a robust stability sheet that has continued to solidly develop its income. Gross margins have been a problem, however the firm clearly has a plan in place to handle this challenge by innovation and pricing based mostly on worth.

That is a beautiful mixture and why the inventory has been beginning to acquire the eye of well-regarded billionaire traders. Whereas there’s all the time the chance that PayPal’s new merchandise do not acquire traction or that its pricing energy is proscribed, given its valuation, this appears to be like a very good alternative to put money into the inventory forward of a possible turnaround. As such, now continues to be a good time to purchase the fintech inventory.

Geoffrey Seiler has positions in PayPal. The Motley Idiot has positions in and recommends Intuit, Nvidia, and PayPal. The Motley Idiot recommends the next choices: brief June 2024 $67.50 calls on PayPal. The Motley Idiot has a disclosure coverage.