In case you’re keen to look, you will discover progress alternatives which are simply as robust as Amazon, however at a greater worth.

In case you’ve been investing lengthy sufficient, you’ve got nearly actually thought of a stake in Amazon (AMZN -0.15%). It is one in all Wall Avenue’s favourite suggestions, in any case. And to be honest, Amazon inventory has been a strong performer and continues to be a good decide.

From a risk-reward perspective, nevertheless, Amazon is not fairly the chance it was in its early days. Its large measurement makes it tough to proceed rising at a significant tempo. E-commerce opponents are lastly stepping up their video games, too. And shares are arguably close to their full potential valuation. It is perhaps time to place different names forward of Amazon in your watch record.

Listed here are three higher choices to consider shopping for now.

DraftKings

It has been a troublesome few months for shareholders of sports activities betting know-how firm DraftKings (DKNG 0.35%). Principally in response to income shortfalls and a proposed surcharge on its clients’ wagering, the inventory is down greater than 30% from March’s excessive, and nonetheless nearby of the multiweek low hit earlier this month. Buyers are merely responding to headlines.

However these worries obscure the truth that DraftKings continues to be rising in a giant method, and persevering with to make progress towards sustained profitability.

Take its second-quarter numbers for example. Whereas its high line of simply over $1.1 billion fell barely wanting estimates of a bit of greater than $1.11 billion, gross sales had been nonetheless up 26% 12 months over 12 months. Adjusted per-share earnings of $0.22 not solely topped expectations for a lack of $0.01, however almost doubled the Q2 year-earlier comparability of $0.14. The second quarter’s income and earnings additionally prolonged long-established developments which are anticipated to persist properly into the longer term.

And these lofty expectations are hardly out of line. Though the federal ban on sports activities betting was lifted in 2018, states have staggered their legalization of it. As of the newest look solely about two-thirds of U.S. states now allow sports activities betting in any kind. However most of the others are a minimum of contemplating passing laws that will make it authorized, opening the door to DraftKings’ presence in that market. Market analysis outfit Technavio believes the worldwide sports activities betting market is about to develop at an annualized tempo of 12% via 2030, largely led by the U.S.

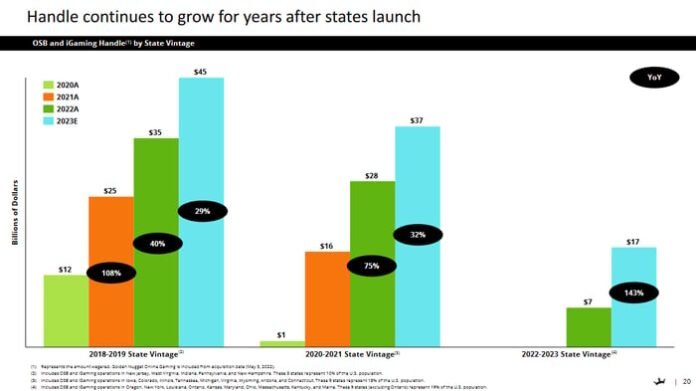

Fueling a minimum of a few of this growth is the way in which the enterprise grows. A paying buyer base swells for a very long time as soon as DraftKings establishes its presence in a selected market, as individuals be taught extra about its choices and eventually reply to advertising efforts. Because the graphic beneath exhibits, betting handles are nonetheless rising even within the fourth 12 months DraftKings is working in any given state. This ongoing progress is prone to present related progress within the years past the fourth one, too, as soon as DraftKings has that knowledge to supply.

Picture supply: DraftKings’ November 2023 investor day presentation.

Translation: There’s room and cause to count on continued progress right here. So why is not the inventory reflecting any of this? As a result of typically shares simply quickly stumble. For excellent corporations like DraftKings although, these short-term stumbles are long-term shopping for alternatives.

Shopify

Very similar to DraftKings, Shopify (SHOP -0.29%) inventory has been a troublesome title to stay with of late. Shares are down almost 20% from their February peak regardless of a strong earnings-prompted bounce this month. Its latest revenue steerage has been lower than the market hoped for. Additionally like DraftKings although, it is debatable that the market is simply been in search of dangerous information from this title, ignoring the larger bullish image.

Shopify helps corporations construct and handle an e-commerce presence. Thousands and thousands of small (and not-so-small) companies depend on this firm’s tech to promote their items and companies. In some ways it may very well be thought of the anti-Amazon in that it empowers a service provider with an choice apart from a large on-line shopping center that pits these sellers towards each other.

Certain, the e-commerce market could also be crowded and mature. That does not imply there’s not plenty of alternative right here, nevertheless. The Census Bureau stories that solely about 16% of the US’ retail gross sales are carried out on-line. Though a few of the different 84% can by no means be carried out on-line, a giant chunk of that enterprise is up for grabs to the e-commerce business.

Mordor Intelligence believes the US’ e-commerce market is about to develop by a mean of 14.7% per 12 months via 2029. An identical dynamic applies abroad, the place this firm is beginning to develop its presence.

And forecasts jibe with this industrywide outlook. Shopify’s 2024 high line is anticipated to enhance on final 12 months’s income by over 23%, with the following a number of years prone to mirror that tempo. Earnings are apt to continue to grow at a good sooner clip.

Sure, the corporate has obtained a revenue margin problem proper now that most likely will persist for a minimum of just a few extra quarters. It isn’t a deadly drawback, although. There’s merely an excessive amount of in direct-to-consumer buying to carry Shopify again.

Microsoft

Lastly, add Microsoft (MSFT 0.14%) to your record of unstoppable shares to purchase as an alternative of Amazon. You, in fact, know the corporate. Microsoft has been on the coronary heart of the non-public laptop enterprise since its fast proliferation within the ’90s though it is turn out to be a lot extra within the meantime. Cloud computing, enterprise companies, synthetic intelligence, and even video gaming are all in its wheelhouse now.

Diversification is not the crux of the rationale you would possibly need to personal a chunk of this software program large, nevertheless. Quite, it is the way in which the enterprise more and more works.

Fewer and fewer persons are outright shopping for software program anymore. They’re renting cloud-based variations of their productiveness platforms like Phrase or Excel, translating into predictable and recurring high-margin income for the supplier. The corporate’s cloud computing choices can be found through the same association. This mannequin permits Microsoft to concentrate on attracting new paying clients.

And it is doing this very, very properly. Final quarter’s income of $64.7 billion was up 16% 12 months over 12 months, extending long-standing progress developments which are anticipated to proceed into the distant future. Ditto for earnings. The world’s just too depending on this firm — and its fashionable Home windows working system particularly — to actually think about various platforms.

This inventory’s persistent positive aspects may very well be intimidating to would-be consumers. Do not sweat it a lot that you find yourself unwilling to make a purchase order although. The forward-looking price-to-earnings ratio of simply over 31 is definitely comparatively low cost given a income progress tempo that is persistently within the mid-teens. Analysts’ present consensus worth goal of almost $500 can also be 19% above the inventory’s current worth.

This would possibly assist: Of the 60 analysts following Microsoft inventory, 49 of them fee it not only a purchase, however a powerful purchase.

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. James Brumley has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Microsoft, and Shopify. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.