Tobacco large Altria Group (MO 1.41%) has been one of many extra outstanding dividend shares over the previous few many years. Regardless of tons of of billions of {dollars} in authorized settlements, its merchandise’ addictive qualities have allowed it to supply beneficiant payouts to attract traders to the inventory.

Nonetheless, the recognition of its chief product — cigarettes — has been declining for many years, so traders ought to look intently at its total enterprise earlier than making an attempt to revenue from these payouts.

Altria’s dividend

Altria pays $3.92 per share in annual dividends. At its present worth, that provides it a dividend yield of 8.75%, which means traders must make investments $11,430 to obtain $1,000 per yr.

That yield is almost 7 instances the S&P 500‘s common of 1.3%. Additionally, administration has elevated the payout yearly since 2009, and the earlier two “dividend cuts” concerned spinoffs that netted traders extra inventory. Therefore, it has served as a wonderful supply of earnings.

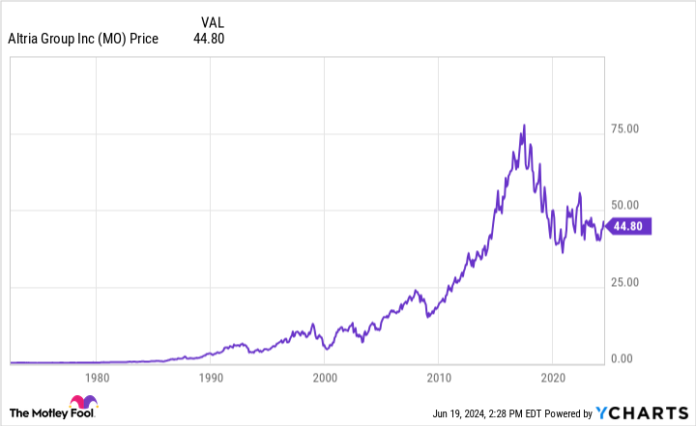

The expansion is very spectacular contemplating that the surgeon common’s report on the hazards of smoking got here out 60 years in the past. Regardless of a long-term decline in smoking charges and heavy authorized prices, Altria inventory and its dividend have elevated massively since then.

Nonetheless, its income fell in 2023 and is on monitor to take action once more in 2024. Altria’s failed funding in vaping firm Juul and its steep losses on its hashish funding in Cronos Group bode poorly for the corporate.

Altria has since invested $2.75 billion in vaping firm NJOY. Nonetheless, if it fails to return to income progress, the dividend might finally be in peril.

Do you have to purchase Altria for the dividend?

Regardless of its excessive yield, traders ought to assume twice about shopping for Altria for the payout. Admittedly, each the tobacco inventory and its dividend have overwhelmed the percentages and risen in previous many years.

Nonetheless, income is declining, and administration has not established a transparent path to get again to progress. Till progress resumes, traders ought to most likely look elsewhere for dividends, even when it means one should make investments extra to realize a $1,000 payout.

Will Healy has no place in any of the shares talked about. The Motley Idiot recommends Cronos Group. The Motley Idiot has a disclosure coverage.