In investing, there is no must put money into particular person shares to realize sturdy returns over time. Do not get me improper. I personal about 40 totally different particular person shares and utterly consider it is doable to beat the market over time. However even in the event you merely match the market’s efficiency by means of the magic of index fund investing, you could be shocked on the outcomes.

With that in thoughts, listed here are 5 easy index funds that might assist set you on the trail to a million-dollar retirement portfolio, and with minimal ongoing effort in your half. We’ll additionally take a look at how you need to use these to develop your portfolio to a seven-figure sum earlier than you retire.

5 easy index funds to purchase and maintain for many years

To be honest, there are a whole bunch of strong index funds that might make glorious retirement investments for you. But when I have been to begin a portfolio from scratch immediately and will solely select 5 index funds, this is what they’d be:

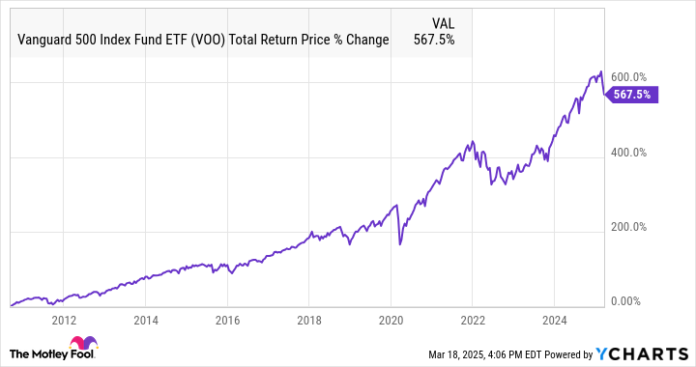

- Vanguard S&P 500 ETF (VOO -1.08%): There is a strong case to be made that in the event you have been solely going to purchase one index fund, it ought to be this. The Vanguard S&P 500 ETF will observe the efficiency of the benchmark S&P 500 index over time, which has traditionally averaged annual returns of about 10%. And with a rock-bottom 0.03% expense ratio, you will get to maintain a lot of the index’s positive aspects.

- Vanguard Actual Property ETF (VNQ -0.57%): Actual property funding trusts, or REITs, are sometimes regarded as boring investments. Nevertheless, many individuals do not understand that not solely have REITs barely outpaced the S&P 500 over the long term, however they’ve completed so with considerably much less volatility.

- iShares iBoxx Funding Grade Company Bond ETF (LQD 0.25%): Whilst you’re younger, it is best to have most of your cash in shares, nevertheless it’s nonetheless a good suggestion to place a few of your cash into fixed-income investments and to regularly shift your allocation towards them as you become old. This index fund invests in company bonds and at present has a 4.4% yield with comparatively low draw back danger.

- Vanguard Russell 2000 ETF (VTWO -0.80%): In full disclosure, that is the index fund I have been shopping for not too long ago. It invests in a broad basket of small-cap shares, and whereas small caps have underperformed their large-cap counterparts, they have an inclination to provide comparable and even higher returns over lengthy intervals of time.

- Vanguard Worldwide Excessive Dividend ETF (VYMI 0.10%): It may be a wise thought to diversify a few of your portfolio into shares based mostly exterior of the USA. Since dividend shares are usually comparatively mature with secure money flows, I like to make use of this ETF to get worldwide publicity (and a 4.3% dividend yield).

VOO Whole Return Value knowledge by YCharts.

How are you going to flip these right into a million-dollar retirement portfolio?

Let’s assume for a second that you’re going to common 10% returns yearly with these index funds. This is how a lot you would want to speculate monthly (whole, not in every fund) to succeed in a $1 million nest egg, relying on how lengthy you will have till your retirement:

|

Years Till Retirement |

Month-to-month Funding to Attain $1 Million |

|---|---|

|

20 years |

$1,455 |

|

25 years |

$847 |

|

30 years |

$507 |

|

40 years |

$188 |

Information supply: Writer’s personal calculations. Quantities rounded to the closest greenback.

One extraordinarily vital takeaway from this chart is the sooner you get began, the better it is going to be to succeed in your objectives. Somebody who begins shopping for index funds once they’re 40 years from retirement has to avoid wasting lower than one-fourth as a lot monthly as somebody who waits till 25 years from retirement.

It is also price noting that many individuals need to retire with considerably greater than $1 million, so this chart may be adjusted to provide you an thought of how a lot to speculate. For instance, if you wish to retire with a $3 million nest egg, merely multiply the suitable month-to-month funding within the chart by three.

After all, there is no approach to know precisely how these index funds will carry out over the following few a long time. We additionally do not know what the market shall be doing once you retire. In case you anticipate retirement in 2050, for instance, there is no approach to know if we’ll be in the course of a deep recession or a interval of maximum financial prosperity.

Having mentioned that, a basket of those 5 index funds, mixed with the tax-advantaged compounding of retirement accounts and regular investments over time, can put you on the trail to a financially safe retirement no matter what the economic system does within the meantime.

Matt Frankel has positions in Vanguard Worldwide Excessive Dividend Yield ETF, Vanguard Actual Property ETF, Vanguard Russell 2000 ETF, and Vanguard S&P 500 ETF. The Motley Idiot has positions in and recommends Vanguard Actual Property ETF and Vanguard S&P 500 ETF. The Motley Idiot has a disclosure coverage.