The technology-heavy Nasdaq Composite index at the moment finds itself in correction territory. A inventory market correction happens when the market falls 10% or extra from its all-time highs.

Ought to traders purchase the dip? There’s a likelihood the current pullback will flip into one thing worse, reminiscent of a chronic bear market. Nonetheless, most 10% corrections resolve themselves comparatively rapidly, making them nice instances to choose up high-quality firms for the lengthy haul.

Meaning for these wanting so as to add to their long-term portfolios, high-quality shares within the “Magnificent Seven” group, which has pulled again together with the market, could be nice pickups immediately. Of those seven all-star firms, one ultra-safe identify seems to be like the perfect of the bunch at this opportune second.

Picture supply: Getty Pictures.

Be grasping when others are fearful

Over the previous 10 years, the Nasdaq has corrected six instances, good for about as soon as each 1.67 years. So, the excellent news is {that a} correction is an everyday, possibly even wholesome, a part of markets.

However, typically corrections flip right into a full-fledged bear market, which is a correction of greater than 20% and often lasts for much longer than mere corrections.

It stays to be seen whether or not the present pullback is a prelude to one thing worse. Buyers will probably not know till April 2, when the Trump administration’s reciprocal tariffs on Mexico and Canada are supposed to enter full impact. Even when they do, nonetheless, it stays to be seen whether or not they may trigger a full-blown bear market.

Given the extremely unsure impression of tariffs, traders wanting so as to add to their inventory portfolios at this second ought to stick to high-quality, comparatively “secure” shares which have, nonetheless, skilled pullbacks however may additionally climate a full-blown recession if it involves cross. That is why the next Magnificent Seven inventory seems to be so engaging proper now.

Is Microsoft able to “awaken?”

Microsoft (MSFT 1.07%) is the second-largest firm on this planet immediately and a staple of many expertise portfolios, however that does not imply the corporate cannot outperform going ahead.

Microsoft is one in every of only a few firms vying for synthetic intelligence (AI) supremacy. Given the large funding required to compete within the race for synthetic basic intelligence (AGI), it is not out of the query to suppose the very largest firms may change into much more highly effective 10 years from now. In any case, individuals have been questioning whether or not the regulation of enormous numbers would meet up with the Magazine-7 shares for some time. But, these extremely revolutionary firms have defied skeptics and managed to innovate their technique to outsized revenue development over the previous decade.

Furthermore, if the financial system had been to fall off the bed, Microsoft has $71.6 billion in money on its stability sheet in opposition to simply $45 billion in debt. Furthermore, in simply the primary half of its fiscal 12 months (led to December), Microsoft generated $26 billion in free money movement, underpinned by a set of high-margin, largely recession-resistant subscription companies.

In truth, Microsoft is one in every of solely two firms with a AAA credit standing — a ranking that exceeds even that of the U.S. authorities!

Catalyst No. 1: A efficiency reversion to the imply?

Microsoft has outperformed the market by a major margin since Satya Nadella took over as CEO in 2014, however its efficiency over the previous couple of years has truly lagged a few of its friends. In truth, the inventory is definitely down 8.2% over the previous 12 months — the one detrimental performer of all of the Magazine-7 names.

MSFT 1 12 months Whole Returns (Each day) information by YCharts.

However that underperformance does not look like because of something improper with Microsoft’s enterprise. Final quarter, Microsoft grew income a strong 12%, and working revenue grew 17% as margins expanded.

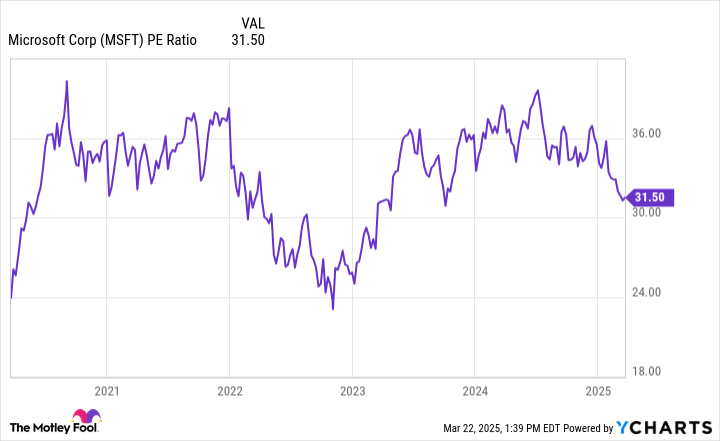

So, the current underperformance could merely be because of irregular bursts of positive factors and consolidation intervals with any inventory. Microsoft inventory now trades at 31.5 instances trailing earnings, towards the decrease finish of its vary over the previous 5 years:

MSFT PE Ratio information by YCharts. PE Ratio = price-to-earnings ratio.

With a valuation having reset decrease, the inventory may quickly enter a brand new interval of outperformance.

Catalyst No. 2: Microsoft simply raised costs

Some have puzzled concerning the monetary payoff from the current AI buildout. On that word, Microsoft’s income and earnings appear set to get a lift this 12 months because of a current worth improve — a giant one, in actual fact. In January, Microsoft introduced a large 43% worth hike to its Microsoft 365 client subscription, which is able to now price $9.99 per 30 days or $99.99 yearly, up from $6.99 and $69.99 yearly.

That worth improve is to pay for all of the AI-powered CoPilot options Microsoft has infused into its 365 software program (previously known as Workplace) lately. Whereas the worth hike could appear extreme, it is truly the primary worth improve on the 365 client product in 12 years.

Now, traders ought to mood their enthusiasm over this one improve a bit, as 365 client accounted for under about 3% of Microsoft’s income. So, the bump in income and earnings could also be considerably incremental from this alone.

Nonetheless, business Microsoft 365 merchandise account for a a lot bigger 31% of complete income. And whereas Microsoft has elevated costs for the business product extra just lately, its final worth hike was solely 10% to twenty% throughout the vary of economic 365 merchandise again in 2022.

ChatGPT did not come out till the final month of 2022, so Microsoft hasn’t actually elevated business 365 product costs within the AI period but. Due to this fact, if the smaller take a look at of worth will increase on the patron 365 product goes properly, extra worth will increase for business 365 subscriptions could possibly be on the best way. That may make a giant distinction in Microsoft’s outcomes.

Catalyst No. 3: A possibility to chop prices on AI

Lastly, beginning this 12 months, Microsoft could mitigate a key concern traders have concerning the escalating prices of AI. Thus far, Microsoft has been a very large spender on AI chips relative to its rivals. Final 12 months, expertise consulting agency Omdia estimated that Microsoft purchased 485,000 Nvidia (NVDA -0.75%) Hopper GPUs in 2024 — far and away the biggest buy of some other Nvidia buyer.

That is greater than double the second-largest purchaser, Meta Platforms, which purchased 224,000 Hopper chips, and a couple of.5 instances the variety of GPUs purchased by Amazon (AMZN 0.63%) — though Amazon has a good bigger cloud computing enterprise than Microsoft.

Not solely did Microsoft purchase extra GPUs than anybody else, but it surely’s additionally an enormous renter of GPUs from newer “neoclouds,” reminiscent of CoreWeave, which is about to go public in an preliminary public providing (IPO). In accordance with CoreWeave’s S-1 submitting, Microsoft accounted for 62% of CoreWeave’s $1.92 billion in income final 12 months.

The explanation for Microsoft’s outsized spend is that it has not but scaled up its customized AI chip (XPU) enterprise, whereas its large cloud rivals have invested in customized XPU applications for years now. Nvidia GPUs promote for big margins, as evidenced by the corporate’s skyrocketing gross and working margins for the reason that AI revolution took off two years in the past.

Thus, Amazon and others with strong customized chip applications are routing as many workloads to customized chips as attainable and away from Nvidia GPUs. That is why Amazon’s purchases of Nvidia GPUs had been a lot decrease than Microsoft’s.

However that simply means Microsoft has that rather more alternative to save lots of on AI infrastructure when it scales up its personal XPU enterprise. And that ought to occur quickly. Microsoft simply launched its Maia AI chips in late 2023 and has nonetheless solely deployed its first-generation Maia XPUs to date. So, Microsoft’s in-house chip program hasn’t had a lot time to mature and ramp to large enough volumes to compete with Amazon and others simply but.

Nonetheless, CEO Satya Nadella stated in an interview in late 2024 that Microsoft will not be “chip constrained” by the center of this 12 months prefer it was final 12 months. That would imply Microsoft will ramp up its next-gen in-house XPU program someday in mid-2025, enabling probably large price financial savings and an extra enhance to margins.

All of it provides up

Current underperformance, a comparatively decrease valuation, upcoming worth will increase, and potential AI price financial savings ought to all mix to allow Microsoft to thrive in 2025. Whereas the broader macroeconomic image is unsure immediately, the AAA-rated Microsoft stays a prime identify to choose up proper now for traders with a long-term investing mindset.