UPS offers a service that may at all times be wanted, however be ready as a result of there’s extra transition forward for this high-yield inventory.

United Parcel Service (UPS -1.01%) is finest recognized for the brown vans that sprint about most inhabitants facilities in america. The vans are so frequent that they’re a reasonably ubiquitous a part of life, displaying the significance of what UPS, as it’s extra generally referred to as, does as a enterprise. In some methods the corporate’s inventory may set you up for all times, however there are dangers to contemplate before you purchase it.

What does UPS do?

For most individuals, the short abstract of UPS’ enterprise would begin and cease with the phrases “bundle supply.” Nevertheless, the background behind these two phrases is essential. What this industrial large actually excels at is logistics, a truth helped alongside by UPS’ huge scale as a enterprise.

Picture supply: Getty Photos.

Primarily, UPS permits clients to simply transfer a bundle from one place to a different. That effort contains bundle pickup, bundle routing, and bundle supply. Every step is a large effort in its personal proper. Pickup, for instance, can occur at a buyer’s enterprise (as different packages are being delivered), in a neighborhood drop-off field, or in one of many firm’s many shops. Routing is the magic second, as UPS makes use of its vans, airplanes, and sorting amenities to ensure every merchandise will get to the place it must go shortly, effectively, and cheaply. And supply, the half that most individuals are seeing after they watch these brown vans round city, is the top of the method (and typically the beginning of a brand new course of, if packages are being picked up).

UPS’ enterprise is straightforward in some regards, however massively advanced in others. In truth, it might be arduous to duplicate what UPS does. Even Amazon (AMZN 0.23%), after years of capital investments in its personal bundle supply service, nonetheless makes use of UPS. That exhibits the worth of the community that UPS has developed over the a long time. And you will need to needless to say packages will should be delivered for so long as folks stay in numerous areas. This isn’t a fly-by-night enterprise, which suggests that purchasing it may assist set you up for all times as an investor.

What’s incorrect with UPS?

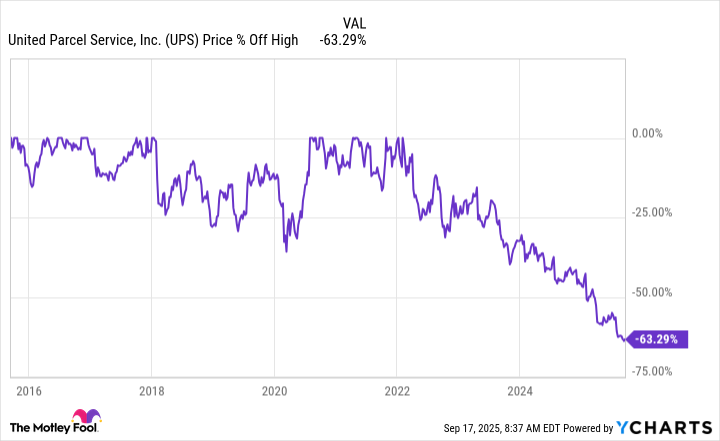

That stated, UPS’ inventory has fallen 60% from the highs it reached in 2022. The value is now under the place it was previous to the coronavirus pandemic. These are each necessary details to contemplate earlier than shopping for UPS.

The steep drop is partly associated to an enormous value spike through the pandemic. Wall Avenue extrapolated the short-term demand increase for bundle supply through the pandemic far into the long run. When the world discovered to stay with COVID and bundle supply demand cooled, so did UPS’ inventory value.

The corporate is not sitting round and hoping for the perfect, nevertheless, it’s actively working to improve its enterprise. That features spending on know-how, closing older distribution facilities, and shifting its buyer focus to its most worthwhile enterprise. For instance, it lately introduced that it might be materially decreasing its relationship with e-commerce large Amazon as a result of the deliveries it makes for the corporate are low-margin.

The outcomes of the corporate’s efforts to improve its enterprise have included decrease income and rising prices. It was unavoidable and monetary outcomes obtained hit not simply by the receding of the pandemic, but additionally by administration’s strategic plans for the long run. Traders are nervous despite the fact that the corporate’s makes an attempt to improve its operations seem applicable from a enterprise perspective. When you assume in a long time, the downbeat view of UPS’ shares at the moment may very well be a shopping for alternative.

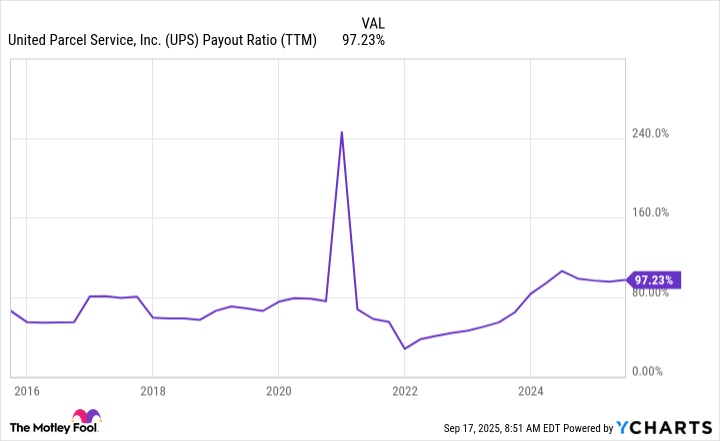

The issue is available in when you think about the dividend, noting that the dividend yield is a really attractive 7.7%. That is excessive sufficient that it suggests dividend buyers are nervous a few dividend reduce. That is not an unfounded concern, even supposing UPS has elevated its dividend yearly for 16 years.

UPS Payout Ratio (TTM) knowledge by YCharts

The dividend payout ratio is at the moment closing in on 100%. To be truthful, it has lengthy been within the 70% to 80% vary, so the payout ratio was by no means low. However given the overhaul of the enterprise, there’s a very actual chance that the dividend additionally will get a reset. Nevertheless, even when the dividend have been reduce by 50%, the yield would nonetheless be pretty engaging relative to the tiny 1.2% yield of the S&P 500 index (^GSPC 0.49%).

Might UPS set you up for all times?

In case you are in search of a dependable enterprise that’s more likely to be a long-term survivor, UPS is a stable choice. And as soon as it really works via its present modernization effort the enterprise is more likely to be a extra worthwhile operation. However in case you are in search of a protected dividend you would possibly need to tread with warning. The overhaul that’s within the works has pushed the payout ratio to a worrying degree and a dividend reset may very well be within the playing cards. If that does not trouble you, noting that it appears unlikely that the dividend can be eradicated, UPS may very well be a pretty turnaround story so as to add to your portfolio.