Story shares are enjoyable, however on the finish of the day each enterprise ultimately wants to have the ability to produce sustainable revenue development.

There is definitely no scarcity of hype surrounding comparatively new inventory Figma (FIG -4.36%) today. And understandably so. This seemingly easy firm is rising like loopy, just lately reporting a year-over-year quarterly high line of enchancment of 41%, with extra of the identical on the horizon.

Sadly, hype alone would not assure bullishness. This inventory’s down by greater than half of its early August post-IPO surge excessive, actually, with a lot of that setback in response to what appeared like wholesome Q2 numbers posted this previous week.

Nonetheless, many traders insist this weak point is a chance reasonably than an omen, and are utilizing the pullback to step right into a place they count on to in the end soar. Are they proper? Might a $10,000 funding on this younger ticker flip into 1,000,000 {dollars} or extra within the foreseeable future?

First issues first.

What’s Figma anyway?

What’s Figma? The right reply to the query appears too easy to be true. But, it’s. Figma is a web-based collaboration platform that enables a number of members of the identical staff to co-create and edit visible person interfaces for cellular apps and web sites. That is it. That is all it does.

OK, this description arguably understates the facility of the technological software. Figma’s cloud-based software program helps customers construct the look of an interactive app or net web page from the bottom up, change it as usually as wanted, and facilitate communication between a staff’s members as any updates are made. And, although it is meant for non-coders and non-engineers, a function referred to as Dev Mode (“dev” being brief for “developer”) can simply flip a structure into the pc code wanted to make it work in the actual world. Figma additionally presents digital whiteboards and slideshow presentation templates.

By and huge, although, the corporate’s core competency is just serving to organizations simply construct what their clients see when utilizing that group’s app or web site.

The factor is, there is a clear and rising demand for such an answer. Figma’s just lately reported Q2 high line grew 41% 12 months over 12 months to almost $250 million. The corporate’s steerage requires comparable development via the remainder of the 12 months, too, with the majority of its largely recurring income coming from present clients merely including extra options or customers to their subscription. Figma’s additionally reliably worthwhile (albeit solely marginally, for now) regardless of its small dimension and pretty younger age.

And but, Figma’s inventory tumbled once more in response to Wednesday’s second-quarter outcomes. Whereas it was solely a wild guess as to how a lot the corporate ought to have reported in income for the three-month stretch, what was primarily a breakeven clearly wasn’t adequate for many traders.

Or possibly that wasn’t the rationale for the setback in any respect.

Nothing’s ever uncommon within the wake of an IPO

It is a irritating fact — however it takes some time for newly minted shares to shake off all of their post-public-offering volatility. It is also price detailing that even the shares that do find yourself hovering in the long term usually undergo main — and generally extended — sell-offs first.

Living proof: Meta, when it was nonetheless referred to as Fb. It was all the trend earlier than and shortly after its Might 2012 IPO. Three months later, nonetheless, it had almost been halved from the worth of its first commerce as a publicly traded subject. It would not reclaim that value once more till greater than a 12 months later.

Rival social networking outfit Snap (guardian to Snapchat) ran its shareholders via the same wringer that also hasn’t run its full course but. Though this inventory was red-hot following its late-2020 public providing all over October of 2021, shares then started what would flip right into a sell-off of greater than 80% in lower than a 12 months, leaving the inventory properly under its first commerce’s value. It is nonetheless roughly at that depressed value as we speak, actually.

It isn’t all unhealthy information, although. Synthetic intelligence knowledge middle help supplier Coreweave bought a little bit of a wobbly begin following its March public providing, however lastly discovered its footing in April and remains to be a lot increased than it was then, regardless of a newer lull.

However what’s this bought to do with Figma? It is a reminder that the market would not actually know value — and even what to do with — newly created shares. Buyers innately perceive that shares are normally unstable after their preliminary public providing. Buyers additionally know, nonetheless, that in lots of circumstances issues find yourself paying off anyway, even when that ticker’s elementary argument would not maintain a lot water but.

In different phrases, there’s actually no means of telling when, the place, and even if Figma shares will get well. It is bought extra to do with emotions and traders’ perceptions, that are fickle and inconceivable to foretell. It could possibly be months, if not years, earlier than this ticker really displays the underlying firm’s prospects.

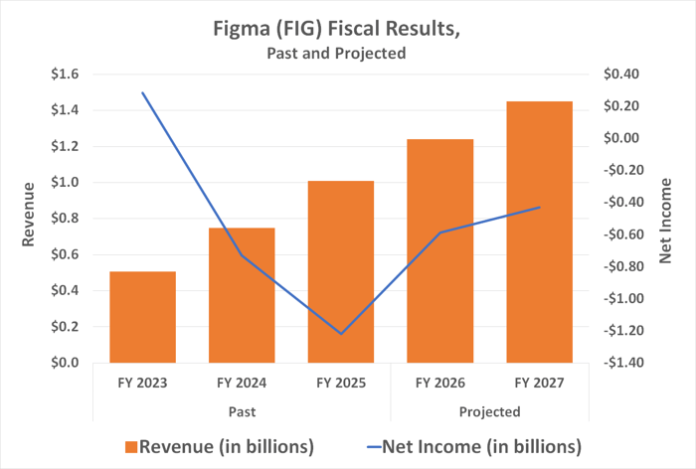

Information supply: SimplyWallSt.com. Chart by writer.

Or the corporate could run right into a headwind earlier than the inventory even will get an opportunity to take action.

One gaping vulnerability too huge to disregard

However the query stays: Might investing $10,000 in Figma as we speak make you a millionaire at any affordable level in your lifetime? In spite of everything, clearly, there is a rising demand for the interface design collaboration software program it gives.

By no means say by no means. However, in all probability not — simply not for the rationale you may assume, just like the inventory’s outrageous valuation of almost 30 instances its gross sales. Not simply earnings, however gross sales, versus the software program’s industrywide common value to gross sales ratio of about 10.

Placing the sheer problem of buying and selling shares with latest IPOs apart for a second, Figma’s bought a a lot greater drawback. That’s, there is not any actual moat to talk of right here. That simply means there’s little to nothing to forestall a much bigger and deeper-pocketed rival from seeing the success that Figma is having fun with with its platform and replicating the concept for itself. There is definitely nothing legally stopping it from taking place, anyway. Whereas processes, equipment designs, or new creations can all be patented, a mere premise or a enterprise thought is not protected on this means.

Picture supply: Getty Photographs.

And do not assume for a minute that would-be rivals aren’t already at the least considering about it, both, significantly now that Figma has confirmed this enterprise is worthwhile, in addition to extremely marketable. Advertising and marketing and graphics software program outfit Adobe already made an acquisition supply to Figma, actually. Whereas it in the end bumped into too many regulatory hurdles to be possible, the truth that Adobe was prepared to pay such a premium for Figma all the best way again in 2023 underscores its confidence within the marketability of Figma’s know-how.

If not Adobe, maybe Microsoft may discover a means of including this type of interface-design platform to its lineup of cloud-based productiveness and team-collaboration instruments. Odds are good that at the least most of Figma’s paying clients are already accustomed to and utilizing one or two Microsoft-made merchandise anyway.

You get the concept. It would not take a lot to launch a viable various to Figma. If one other participant wasn’t earlier than, they’re definitely extra prone to have an interest now within the wake of well-publicized development for its easy enterprise.

Backside line? Purchase it in case you should. Simply know what it’s you are shopping for. You are not investing in a development enterprise with confirmed endurance — at the least not but. You are betting that the market goes to vary its thoughts about this inventory within the very foreseeable future. And that is a reasonably dangerous proposition.