Tokyo-headquartered Metaplanet, additionally the fourth-largest public company Bitcoin holder on the planet, reported a $619 million loss for the fiscal yr.

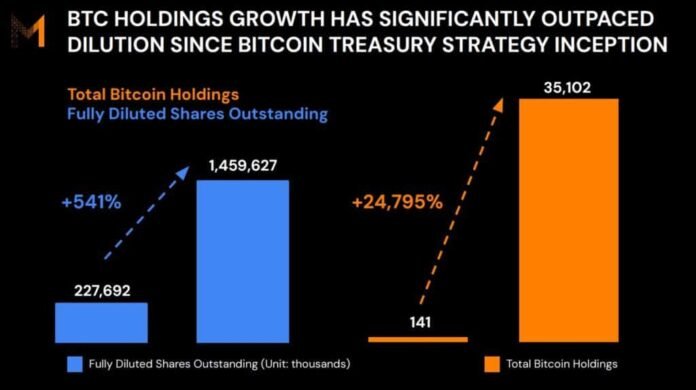

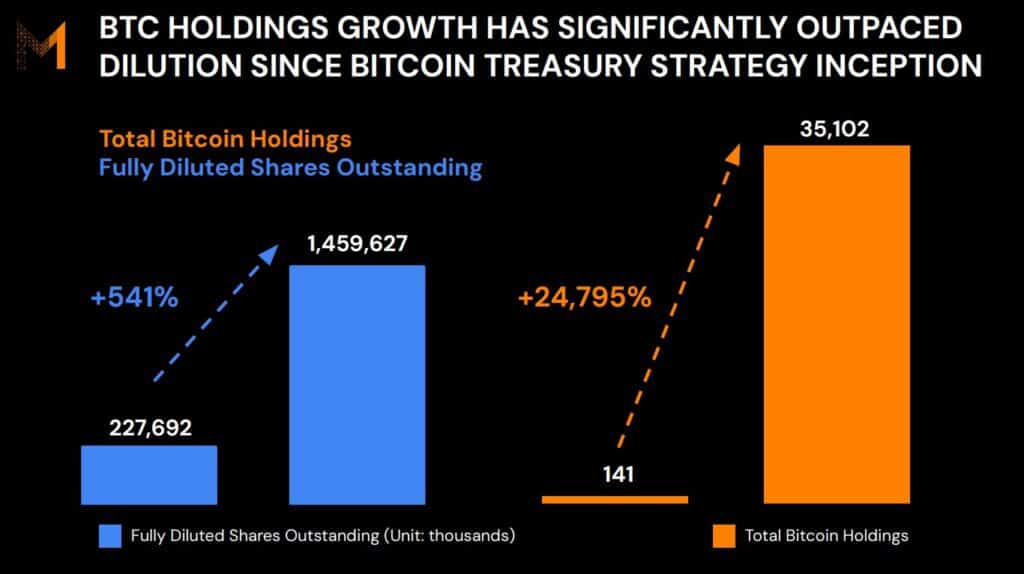

However right here is the twist! They aren’t promoting. As an alternative of folding, the corporate has aggressively grown its Bitcoin stash to 35,102 BTC. Moreover, Metaplanet has reaffirmed a long-term goal of proudly owning 1% of the overall Bitcoin provide, or 210,000 BTC.

On 16 February 2026, Metaplanet CEO Simon Gerovich took to X to disclose the FY2026 forecasts, which embody a +80% YoY income and a +81% YoY working revenue.

Metaplanet reported a internet lack of 102.2 billion yen ($665.8 million), primarily as a result of a decline within the worth of its Bitcoin holdings. Whereas paper losses dominated the steadiness sheet, Metaplanet’s core operations thrived. Income jumped 738% to eight.91 billion yen ($58 million) from 1.06 billion yen the earlier yr.

“We launched the Bitcoin Earnings enterprise in This autumn 2024. Since then, this technique has change into our major income supply and is anticipated to stay a core driver of revenue development,” the corporate mentioned.

Supply: Metaplanet

DISCOVER: 16+ New and Upcoming Binance Listings in 2026

Metaplanet Continues To Purchase The Dip

Identical to when MicroStrategy’s inventory faces stress throughout market downturns, Asia’s MicroStrategy a.ok.a. Metaplanet is seeing purple ink as a result of the present worth of Bitcoin is decrease than their common buy worth of roughly $107,000.

At present, Bitcoin is struggling to carry $68k.

However don’t let the headlines idiot you—whereas the valuation is down, they’re sticking to the plan.

Metaplanet Reported a $664M Unrealized Loss on Bitcoin for FY2025.

However Look Nearer:

➤ $BTC holdings jumped from 1,762 → 35,102 BTC (now 4th largest public holder)

➤ Income up 738% YoY

➤ Revenue up 1,694% YoYThe Development Engine? Bitcoin Choices Buying and selling, not worth good points.… pic.twitter.com/ksW1uZPruh

— Crypto Patel (@CryptoPatel) February 17, 2026

Regardless of the paper losses, they’re shopping for the dip. They ended the yr with 35,102 BTC, an 1,892% enhance from the earlier yr. This mirrors how Technique reported earnings throughout related crashes: ignore the paper valuation and hold stacking sats.

Metaplanet continues to eye 210,000 BTC by 2027 by way of its “555 Million Plan.”

The corporate even famous that its steadiness sheet is “strong” sufficient to outlive even when Bitcoin drops one other 86%, proving they’re ready for excessive volatility.

DISCOVER: High 20 Crypto to Purchase in 2026

Key Takeaways

-

Asia’s MicroStrategy a.ok.a. Metaplanet is seeing purple ink as a result of the present worth of Bitcoin is decrease than their common buy worth of roughly $107,000.

-

Metaplanet eyes 210,000 BTC by 2027 by way of its “555 Million Plan,” betting on Japan’s $7 trillion idle financial savings for gasoline.

The submit Metaplanet Continues To Purchase The Dip Regardless of $619M Internet Loss Pushed By Bitcoin Write-Downs appeared first on 99Bitcoins.