In just some years, Nvidia has change into probably the most useful firm on this planet, and in addition one of the worthwhile.

The S&P 500 and Nasdaq Composite are hovering round all-time highs. A giant a part of the rally is investor pleasure for sustained synthetic intelligence (AI)-driven progress and changes to Federal Reserve coverage that open the door to rate of interest cuts.

Whereas investor sentiment and macroeconomic components undoubtedly affect short-term value motion, the inventory market’s long-term efficiency in the end boils right down to earnings.

Nvidia (NVDA 1.10%) will report its second-quarter fiscal 2026 earnings on Aug. 27 after market shut. This is why expectations are excessive, and why the “Ten Titans” inventory may single-handedly transfer the S&P 500.

Picture supply: Getty Photos.

Nvidia’s profound affect on the S&P 500

The Ten Titans are the biggest progress shares by market cap — making up a staggering 38% of the S&P 500.

Nvidia is the biggest — with a 7.5% weighting within the index.

The opposite Titans are Microsoft, Apple, Amazon, Alphabet, Meta Platforms, Broadcom, Tesla, Oracle, and Netflix.

Apart from its worth, Nvidia can be a serious contributor to S&P 500 earnings progress.

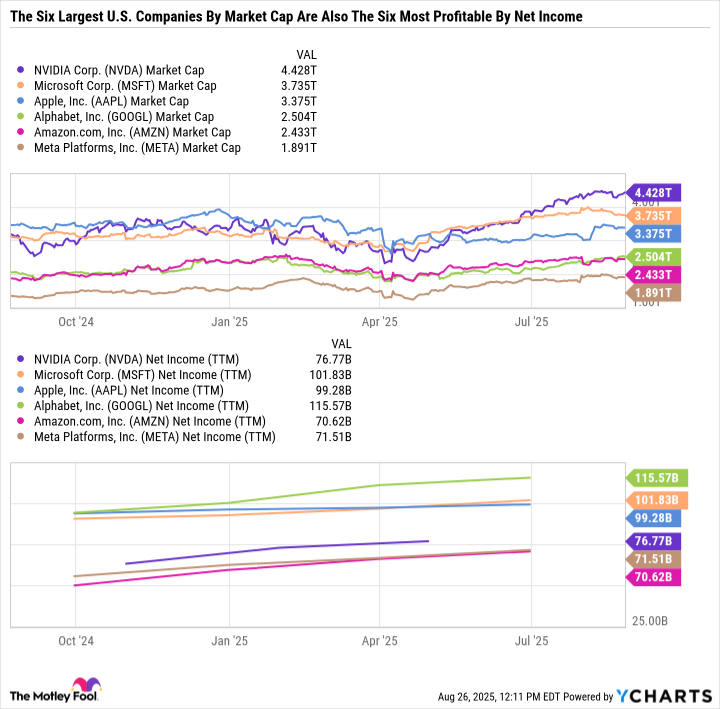

NVDA Market Cap information by YCharts

Megacap tech corporations affect the worth of the S&P 500 and its earnings. And since lots of the high earners are rising shortly, the market arguably deserves to have a premium valuation.

Because the begin of 2023, Nvidia added roughly $4 trillion in market cap to the S&P 500. Nevertheless it additionally added over $70 billion in internet revenue — as its trailing-12-month earnings went from simply $5.96 billion on the finish of 2022 to $76.8 billion at present. That is like creating the mixed earnings contribution of Financial institution of America, Walmart, Coca-Cola, and Costco Wholesale within the span of lower than three years.

Nvidia’s worth creation for its shareholders, and the size of simply how huge the enterprise is from an earnings standpoint, is not like something the market has ever seen. However buyers care extra about the place an organization goes than the place it has been.

Nvidia’s unprecedented revenue progress

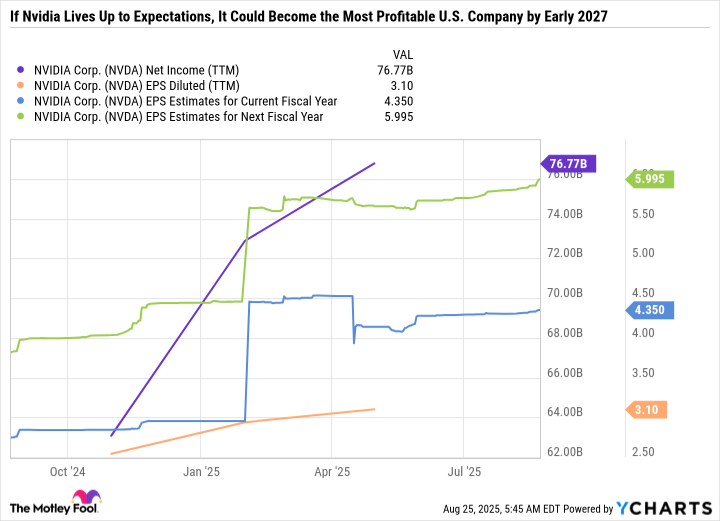

Expectations are excessive for Nvidia to proceed blowing expectations out of the water. Over the past three years, Nvidia’s inventory value rose after its quarterly earnings report 75% of the time. Analysts have spent the previous couple of years flat-footed and scrambling to lift their value targets as Nvidia retains elevating the bar. It seems like they are not making that mistake any longer — as near-term forecasts are extremely formidable.

As talked about, Nvidia’s trailing-12-month internet revenue is $76.8 billion, which interprets to $3.10 in diluted earnings per share (EPS). Consensus analyst estimates have Nvidia bringing in $1 per share in earnings for the quarter it reviews on Wednesday and $4.35 for fiscal 2026. Going out additional, analyst consensus estimates name for 37.8% in earnings progress in fiscal 2027, which might deliver Nvidia’s diluted EPS to $6 per share.

NVDA Internet Earnings (TTM) information by YCharts

Based mostly on Nvidia’s present excellent share depend, that will translate to internet revenue of $107.7 billion in fiscal 2026 and $148.5 billion in fiscal 2027. Until different leaders like Alphabet, Microsoft, or Apple speed up their earnings progress charges, Nvidia may change into probably the most worthwhile U.S. firm by the point it closes out fiscal 2027 in January of calendar yr 2027. These projections strike on the core of why some buyers are prepared to pay a lot for shares within the enterprise at present.

The important thing to Nvidia’s lasting success

Nvidia can single-handedly transfer the inventory market because of its excessive weighting within the S&P 500. Nevertheless, its affect goes past its personal inventory, as sturdy earnings from Nvidia may be a boon for different semiconductor shares, like Broadcom. However the ripple impact is much more impactful.

In Nvidia’s first quarter of fiscal 2026, 4 clients made up 54% of complete income. Though in a roundabout way named by Nvidia, these 4 clients are nearly actually Amazon, Microsoft, Alphabet, and Meta Platforms. So sturdy earnings from Nvidia would mainly imply that these hyperscalers proceed to spend huge on AI — a constructive signal for the general AI funding thesis.

Nevertheless, Nvidia’s long-term progress and the stickiness of its earnings in the end depend upon its clients translating AI capital expenditures (capex) into earnings — which hasn’t actually occurred but.

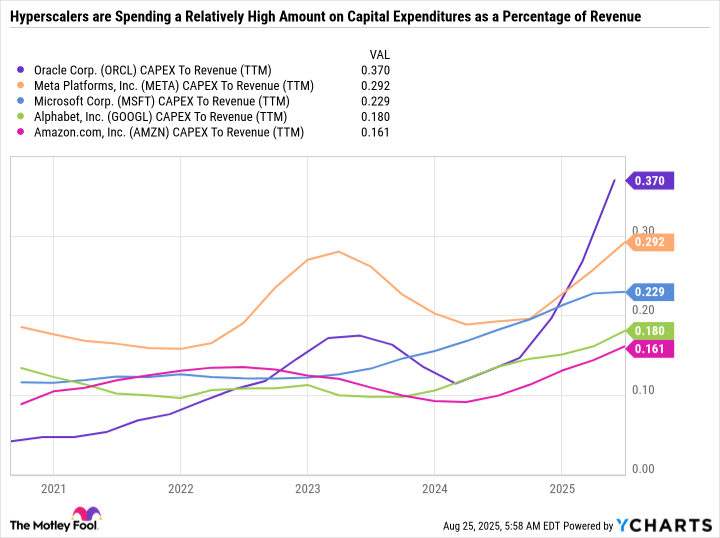

ORCL CAPEX To Income (TTM) information by YCharts

Cloud computing hyperscalers are spending loads on capital expenditures (capex) as a share of income — showcasing accelerated funding in AI. However ultimately, the ratio ought to lower if investments translate to increased income.

Buyers might need to keep watch over the capex-to-revenue metric as a result of it offers a studying on the place we’re within the AI spending cycle. Right this moment, it is all about enlargement. However quickly, the web page will flip, and buyers will strain corporations to show that the outsize spending was value it.

The best option to method Nvidia

Nearly all of Nvidia’s income comes from promoting graphics processing models, software program, and related infrastructure to information facilities. And most of that income comes from only a handful of consumers. It would not take loads to attach the dots and determine simply how dependent Nvidia is on sustained AI funding.

If the investments repay, the Ten Titans may proceed making up a bigger share of the S&P 500, each when it comes to market cap and earnings. But when there is a cooldown in spending, a downturn within the enterprise cycle, or elevated competitors, Nvidia may additionally unload significantly. So it is best solely to method Nvidia with a long-term funding time horizon, so you are not banking on every little thing going proper over the subsequent yr and a half.

All instructed, buyers ought to pay attention to doubtlessly market-moving occasions however not overhaul their portfolio or make emotional selections based mostly on quarterly earnings.

Financial institution of America is an promoting associate of Motley Idiot Cash. Daniel Foelber has positions in Nvidia. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Costco Wholesale, Meta Platforms, Microsoft, Netflix, Nvidia, Oracle, Tesla, and Walmart. The Motley Idiot recommends Broadcom and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.