With years of historic information, we will observe the patterns from previous bull cycles to turn into more and more able to making predictions about our present cycle. On this evaluation, we take a deep dive into when the subsequent Bitcoin peak might happen and at what worth stage.

The Pi Cycle

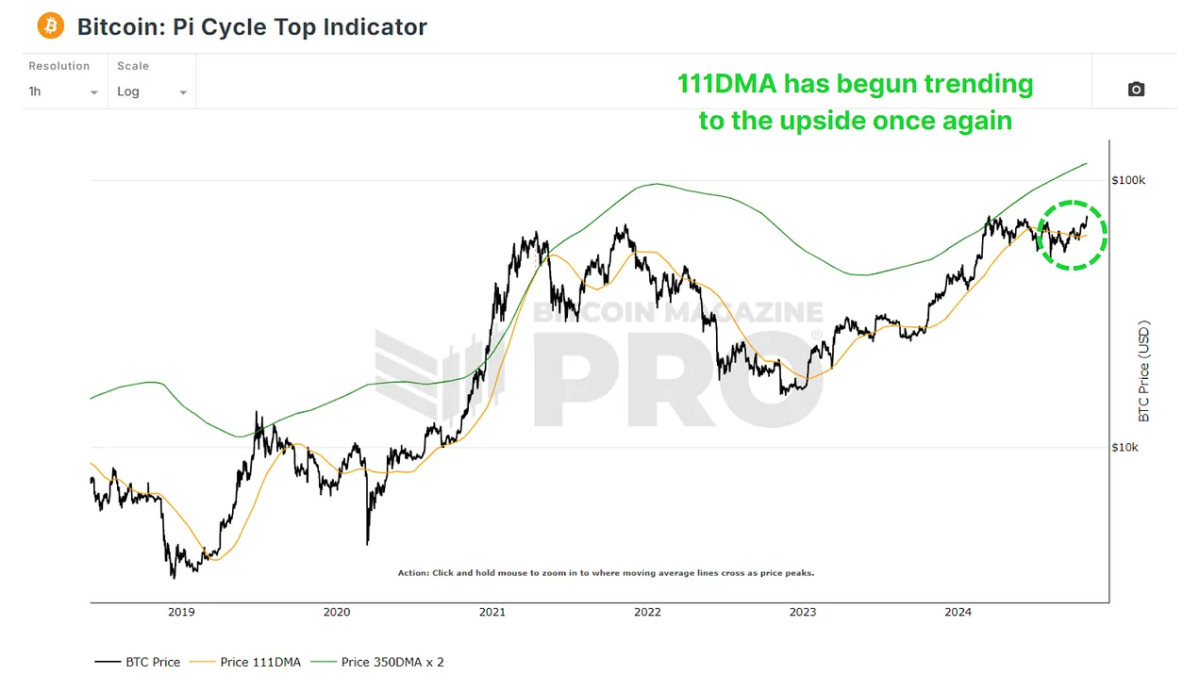

The Pi Cycle Prime Indicator is one among our hottest instruments for analyzing Bitcoin’s cycles. This indicator screens the 111-day and 350-day (multiplied by 2) transferring averages, and when these two strains cross, it has traditionally been a dependable signal of Bitcoin reaching a cycle peak, sometimes inside only a few days. After a number of months of those two ranges drifting aside because of the sideways worth motion, we’ve simply begun to see the 111-day trending again up once more to start closing the hole.

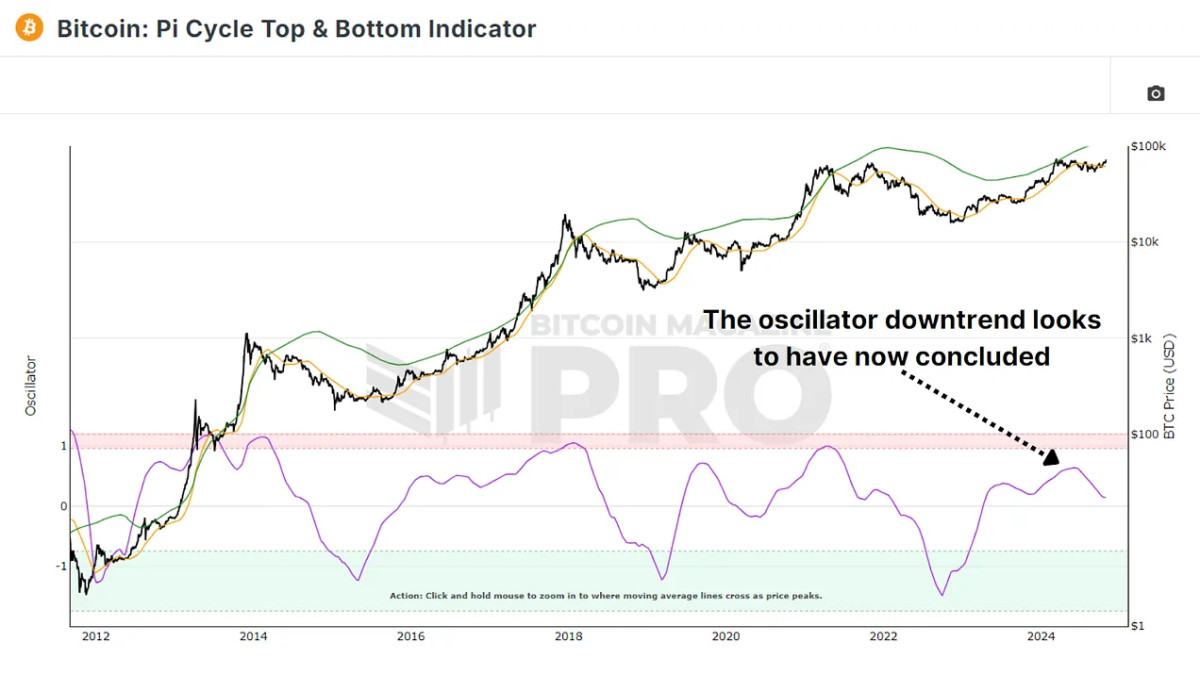

We will measure the distinction between the 2 averages to higher outline Bitcoin’s place inside bull and bear cycles with the Pi Cycle Prime & Backside Indicator. This oscillator trending up once more hints that Bitcoin’s subsequent bull run could also be simply across the nook, with parallels to earlier cycles seen in 2016 and 2020.

Earlier Bitcoin Cycles

Traditionally, Bitcoin’s bull cycles exhibit related phases: preliminary fast progress, a cooling-off interval, a second peak, and eventually, a big retracement adopted by a brand new surge.

2016 Cycle: This cycle noticed a primary peak, a dip, a second peak, after which a full-blown bull market. It is similar to the pattern we’re at present seeing. Bitcoin’s worth reached new highs after these two retracements.

2020-2021 Cycle: The sample was barely much less pronounced, however an identical trajectory was noticed. Bitcoin’s worth peaked twice, as soon as throughout the preliminary surge and once more on the peak of the bull run as BTC was reaching an all-time.

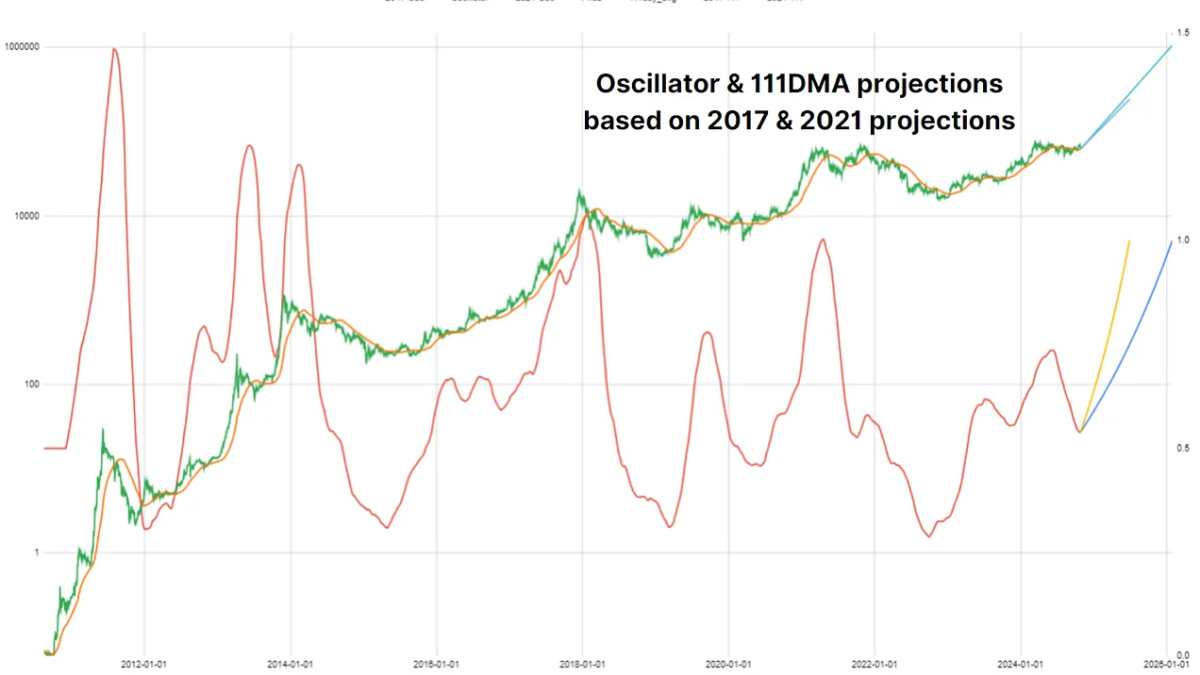

Utilizing the Bitcoin Journal Professional API, we will simulate completely different progress eventualities based mostly on previous cycles. For the reason that Pi Cycle Prime and Backside oscillator not too long ago turned upward we will overlay the speed of change within the oscillator from the earlier cycles to see potential route this cycle.

If the 2021 cycle repeats, the 111-day and 350-day transferring averages might cross round June 29, 2025, signaling a possible Bitcoin peak. If the 2017 cycle is mirrored, the transferring averages won’t cross till January 28, 2026, suggesting a later peak.

Worth Projections

Utilizing these dates, we will additionally try to estimate potential worth ranges. Traditionally, Bitcoin’s worth exceeded the transferring averages considerably at its peak. Throughout the 2017 bull run, Bitcoin’s worth was 3 times the worth of those transferring averages on the peak. Nonetheless, because the market matures, we’ve seen diminishing returns in every cycle, that means Bitcoin’s worth won’t improve as dramatically in comparison with its transferring averages because it has traditionally.

If Bitcoin follows a sample much like the 2021 cycle, with a rise of about 40% above its transferring averages, this could place Bitcoin’s peak at roughly $339,000. Assuming diminishing returns, Bitcoin’s worth would possibly solely rise about 20% above the transferring averages. On this case, the height worth can be nearer to $200,000 by mid-2025.

Equally, if the 2017 prolonged cycle repeats with diminishing returns, Bitcoin may peak at $466,000 in early 2026, whereas a extra reasonable improve would possibly lead to a peak worth of round $388,000. Though it’s unlikely Bitcoin will hit a million {dollars} on this cycle, these extra tempered projections may nonetheless signify substantial positive factors.

Conclusion

Whereas these projections use well-established information, they’re not ensures. Each cycle has its distinctive dynamics influenced by financial situations, investor sentiment, and regulatory modifications. Diminishing returns and doubtlessly even lengthening cycles are seemingly, reflecting the maturation of Bitcoin’s market.

As Bitcoin’s bull cycle continues to develop, these predictive instruments may present more and more correct insights, significantly as the information evolves. Nonetheless, evaluation corresponding to this supplies potential outcomes to help in your danger administration and put together for each final result.

For a extra in-depth look into this matter, try a current YouTube video right here: Mathematically Predicting The Subsequent Bitcoin All Time Excessive