The veteran telecom large boasts a big dividend, however an impending acquisition could muddy the waters.

Shares of telecom large Verizon (VZ -0.22%) have been on an upswing. The inventory is up about 14% over the previous 12 months on the time of this writing. Whereas a rising share worth is welcome, maybe the inventory’s most interesting side is as an revenue funding.

Verizon’s dividend serves as a dependable supply of passive revenue, given its 18 straight years of will increase. It additionally sports activities a powerful forward-dividend yield of 6.5% as of Nov. 7.

Given these positives, it looks like Verizon’s inventory is price shopping for for the lengthy haul. However there is a wrinkle to think about. In September, Verizon introduced the approaching acquisition of Frontier Communications Mum or dad. This is a glance into how the Frontier buy could have an effect on whether or not to purchase Verizon inventory.

Verizon’s beneficial properties from a Frontier acquisition

Verizon’s want to accumulate Frontier is a part of its gambit to seize prospects within the increasing fiber-optic web market. Demand for high-speed web is growing as a result of data-intensive on-line actions corresponding to video calls and streaming media.

A key good thing about the deal is that it could develop Verizon’s fiber community. Frontier gives fiber-optic web service throughout 25 states, which might elevate Verizon’s fiber footprint to 31 states.

By way of income, Frontier generated $1.5 billion within the third quarter, up 4% yr over yr due to rising adoption of its fiber providing. In the meantime, Verizon’s Fios-branded fiber product produced $3.2 billion in Q3 gross sales, which was primarily flat from the earlier yr.

As soon as the Frontier acquisition closes, which is predicted to take 18 months, Verizon’s Fios income will likely be boosted by Frontier’s addition. The acquisition is smart when it comes to strengthening Verizon’s broadband enterprise, however downsides exist.

Issues round Verizon’s deal for Frontier

The Frontier buy will likely be an all-cash transaction valued at $20 billion. Based on media reviews, Verizon appears to tackle debt to finance the deal. The telecom already shoulders a hefty $126.4 billion in unsecured debt as of Q3.

Furthermore, Frontier has amassed its personal debt in extra of $11 billion. The corporate has acknowledged, “We have now a major quantity of indebtedness, and we could incur considerably extra debt sooner or later. Such debt and debt service obligations could adversely have an effect on us.”

Including to this, Verizon will incur additional capital expenditures because it continues to develop its fiber community. Frontier alone plans to succeed in 10 million houses by 2026, up from about seven million right this moment.

All of this implies Verizon should rigorously steadiness debt funds, investments in its enterprise, and dividend payouts. In any other case, its streak of dividend will increase may very well be in danger.

The telecom’s free money stream (FCF) is a crucial indicator of its skill to fulfill these obligations. Exiting Q3, Verizon’s year-to-date FCF was $14.5 billion, which is a slight drop from 2023’s $14.6 billion.

On the subject of FCF, the Frontier acquisition will not assist. Frontier ended Q3 with adverse FCF of $81 million. The truth is, Frontier isn’t a worthwhile enterprise. The corporate generated a web lack of $82 million in Q3.

To purchase or to not purchase Verizon shares

Verizon views fiber as an vital progress space for the corporate. If it may well flip Frontier’s operations right into a worthwhile enterprise, the deal may very well be a great transfer over the long term. That is as a result of prospects who undertake each Verizon’s cellular and web providers “present elevated loyalty” and are much less prone to depart the service, based on the corporate.

Definitely, Fios gross sales might use a shot within the arm. Its $3.2 billion is barely a minor portion of Verizon’s $33.3 billion in Q3 income. The majority of the telecom’s earnings comes from its mobile-wireless service. This phase noticed Q3 gross sales enhance 3% yr over yr to $19.8 billion.

If fiber paired with cellular service may also help the latter’s gross sales, that is a constructive for traders. This coupled with Verizon’s 18 years of dividend will increase and reliable FCF era makes it a worthwhile revenue inventory to think about as a long-term funding.

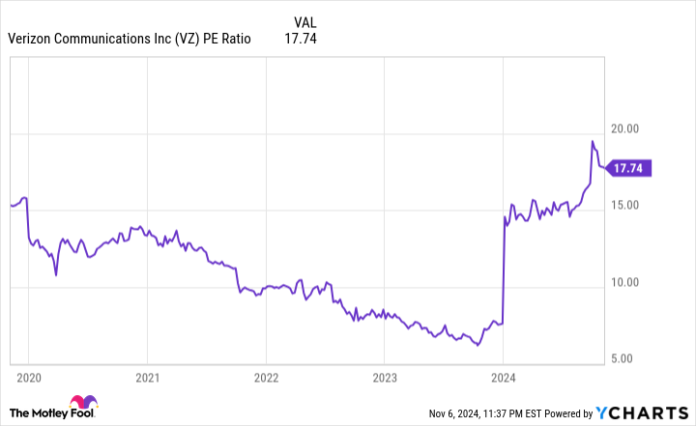

That brings us as to if now’s the time to purchase. One issue to weigh is its price-to-earnings (P/E) ratio, used to evaluate inventory valuation. The P/E ratio tells you ways a lot traders are keen to pay for a greenback’s price of earnings.

Information by YCharts.

The telecom’s P/E a number of is presently greater than it has been in years. So there is not any rush to seize shares proper now. Verizon inventory has pulled again from its 52-week excessive of $45.36 reached in September. Await the inventory to dip additional earlier than deciding to purchase for its strong dividend.