Ought to buyers contemplate shopping for this high-flying server producer following its newest surge?

Shares of Tremendous Micro Laptop (SMCI 5.08%) have gone on a curler coaster journey thus far this 12 months. The AI server producer’s inventory racked up features of greater than 300% in lower than three months firstly of 2024, however it’s down 29% since hitting an all-time excessive within the first half of March.

However now, Supermicro inventory appears to be gaining momentum as soon as once more because it rose greater than 12% on June 13. This surge was pushed by the newest earnings stories from main synthetic intelligence (AI) gamers corresponding to Broadcom and Oracle. Whereas Broadcom raised its forecast for AI chip gross sales for the present fiscal 12 months, Oracle identified that it’s constructing extra cloud computing capability to cater to the large demand it is seeing.

These developments bode nicely for Supermicro, whose AI servers are used for mounting chips used for coaching and deploying AI fashions in knowledge facilities. Nonetheless, the inventory’s newest surge means it has almost tripled in 2024 already. So is it too late for buyers to purchase Supermicro inventory? Let’s discover out.

Supermicro is not costly regardless of its spectacular surge

Supermicro inventory is presently buying and selling at 4.3 instances gross sales. That is decrease than the U.S. know-how sector’s common of seven.8, suggesting the inventory is undervalued. A giant cause Supermicro’s price-to-sales ratio is engaging proper now could be the actual fact its share value features have been backed by excellent development on the corporate’s high line.

Extra particularly, Supermicro’s fiscal 2024 Q3 income tripled 12 months over 12 months to $3.85 billion. Moreover, the corporate has elevated its fiscal 2024 income steering to $14.9 billion from the sooner expectation of $14.5 billion (each figures on the midpoint of their respective ranges). The up to date steering means Supermicro’s high line is on monitor to greater than double from the earlier fiscal 12 months.

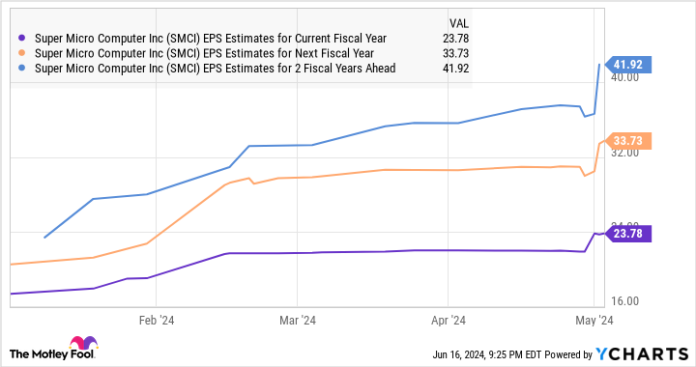

Furthermore, the corporate’s strong gross sales development can also be translating right into a wholesome enchancment in its earnings. Its backside line grew fourfold within the earlier quarter to $6.65 per share. The corporate presently sports activities an earnings a number of of 43, a small low cost to the U.S. tech sector’s common price-to-earnings (P/E) ratio of 45. Nonetheless, its ahead earnings a number of of 21 signifies its bottom-line development is ready to take off.

One other a number of that tells us that Supermicro is attractively valued is its value/earnings-to-growth ratio. The PEG ratio takes into consideration an organization’s potential earnings development. As a rule of thumb, a PEG ratio of lower than 1 means a inventory is undervalued primarily based on the potential development it’s anticipated to ship, and that is exactly the case for Supermicro:

Knowledge by YCharts.

That is not stunning as Supermicro’s earnings are anticipated to develop at an annual price of 62% over the subsequent 5 years, powered by enormous spending on AI servers.

Larger spending on AI infrastructure goes to be an enormous catalyst

The newest earnings stories from Oracle and Broadcom inform us that AI infrastructure spending is rising at a formidable tempo. Oracle, as an illustration, is “working as shortly as we are able to to get cloud capability constructed out given the enormity of our backlog and pipeline.” Broadcom, then again, identified that hyperscale cloud computing suppliers are “accelerating their investments” to enhance the efficiency of their knowledge facilities.

That is the rationale the AI server market is forecast to develop from a measurement of $31 billion in 2023 to a whopping $430 billion by 2033. That is a compound annual development price (CAGR) of 30%. Supermicro is rising at a sooner tempo than the AI server market total, suggesting it’s the firm of selection for knowledge heart operators to deploy AI servers.

Supermicro’s technique of shortly churning out cost-efficient server options for well-liked AI chips from main chipmakers appears to be taking part in a key position in serving to it acquire a much bigger share of the AI server market. Furthermore, the corporate’s deal with shortly including extra manufacturing capability can also be permitting it to make a much bigger dent on this area.

All this means shares of Supermicro might proceed heading increased in the long term. The AI inventory carries a median 12-month value goal of $1,030 per share amongst 20 analysts protecting it, which represents a 22% acquire from present ranges.

Buyers who have not purchased this high-flying inventory but ought to nonetheless contemplate doing so — it is not too late.

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Oracle. The Motley Idiot recommends Broadcom. The Motley Idiot has a disclosure coverage.