Many buyers clearly imagine this development firm can maintain its upward trajectory.

Earlier this month, shares of promoting expertise (adtech) firm The Commerce Desk (TTD 0.30%) hit $100 per share. It wasn’t an all-time excessive — the corporate hit that in late 2021. However it was the best the inventory has been in two years, which is thrilling.

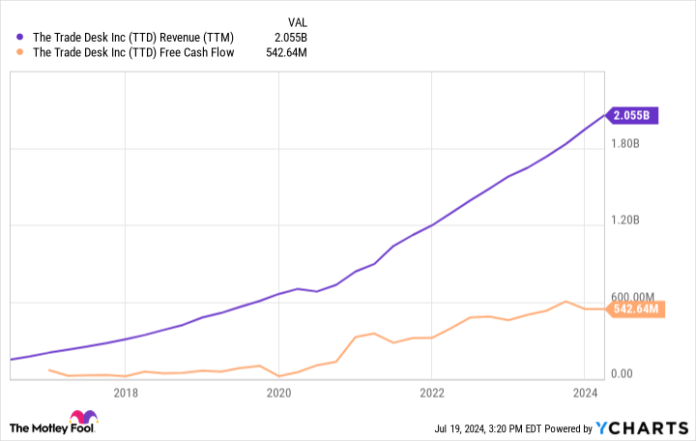

The Commerce Desk inventory is a bit of off its excessive as of this writing. However shares have climbed steadily lately, due to excellent enterprise development. The corporate’s income is roughly 10 occasions larger than it was when it first went public in 2016. And it constantly generates optimistic free money circulation. Each components have helped or not it’s a inventory market winner.

TTD Income (TTM) knowledge by YCharts.

The Commerce Desk appears to be unstoppable. Will that keep the case? To reply that, it is best to check out the trade it is in, the corporate’s enterprise mannequin, and another related numbers.

This is why The Commerce Desk is so profitable

The Commerce Desk is a programmatic adtech software program firm. In line with eMarketer, programmatic promoting is “Any advert that’s transacted or fulfilled by way of automation.” In different phrases, lots of the digital adverts individuals are uncovered to are positioned there robotically, reasonably than being a set advert positioned there by a human decision-maker.

The profit with a system like that is that publishers can show adverts which are focused to a desired viewers. As a result of it is focused, the possibility of getting good outcomes for advertisers is excessive. And since advertisers are competing behind the scenes to get that advert spot in actual time, the charges these publishers can cost are increased, in idea.

With regards to digital promoting, eMarketer is the outfit to speak to. It commonly tracks trade gross sales knowledge and provides forecasts, that are useful. In 2024, it expects practically 16% development for programmatic advert spend, lifting the scale of the market to $157 billion. A lot of this development is coming from linked TV (CTV) — TV programming delivered over an web connection.

The Commerce Desk specializes on this area and has consequently benefited from the trade development — it was in the appropriate place on the proper time. Advertisers use the corporate’s software program to position computerized bids on advert areas. The corporate additionally gives the power to focus on and monitor advert effectiveness, which is one thing in excessive demand.

In line with administration, development in CTV income was the principle development driver for The Commerce Desk within the first quarter of 2024, as has been the pattern. This is smart given the final tailwind for CTV promoting. However the firm advantages from programmatic advert development in different areas as properly.

The Commerce Desk claims to be the biggest adtech firm that does what it does — it is a demand-side platform. However despite the fact that it is the most important, the corporate solely has $2 billion in trailing 12-month income. That is a small sliver of the market and provides it loads of room for ongoing development.

To be clear, it is cheap to anticipate development from right here. Not solely is the trade rising, as eMarketer factors out, however The Commerce Desk has some good issues going. Giant digital promoting firms are phasing out third-party monitoring knowledge, doubtlessly making The Commerce Desk and its first-party knowledge extra related than ever to advertisers. That is the info used to enhance concentrating on and increase effectiveness. Furthermore, administration claims that its synthetic intelligence (AI) software program is bettering its concentrating on capabilities.

What ought to buyers do?

I imagine The Commerce Desk might be an unstoppable enterprise for years to come back. The trade’s development appears to be sustainable in the long run, and the corporate is driving the pattern increased due to its personal deserves. I do not imagine this trajectory shall be stopped.

That stated, The Commerce Desk inventory is richly valued at about 23 occasions its trailing gross sales.

That is known as valuation danger. The Commerce Desk is richly valued due to the standard of its enterprise and its development prospects. But when something have been to ever occur with buyers’ perceptions of the corporate’s high quality or if development unexpectedly slowed, the valuation would possible come down and trigger the inventory to underperform.

Nonetheless, buyers won’t essentially need to wait for reasonable valuation for The Commerce Desk inventory. Because the chart under exhibits, the market has sustained this lofty valuation for a while.

TTD PS Ratio knowledge by YCharts.

For buyers who imagine it is a sturdy development trade and that The Commerce Desk is a prime firm, the higher choice could also be to dollar-cost common when shopping for shares. This technique invests cash progressively over a time period. That means, the cash is unfold out in case a inventory instantly drops decrease.

By dollar-cost averaging, buyers can get The Commerce Desk inventory for a mean value, reasonably than danger investing all the things at an costly peak. This might be a great way to get publicity to this unstoppable development inventory.

Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends The Commerce Desk. The Motley Idiot has a disclosure coverage.