The corporate’s latest earnings have been much more spectacular than its 9% income development implies.

Semiconductor firm Superior Micro Gadgets (AMD -0.03%) not too long ago reported second-quarter earnings. Whereas archrival Nvidia posted triple-digit income development on AI tailwinds in latest quarters, some laggards in AMD’s enterprise have muffled its top-line efficiency.

Nevertheless, there are indicators that AMD is changing into more and more aggressive in AI, which may speed up the corporate’s complete development.

With shares down over 30% from their excessive, this might be a superb alternative to purchase a inventory with a number of development alternatives forward.

Gaming and embedded weighing down AMD’s development

AMD’s AI enterprise had a unbelievable quarter. But complete income grew by simply 9% yr over yr in Q2.

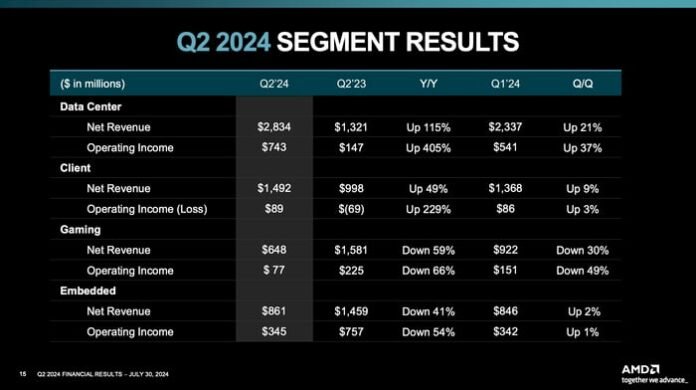

Sharp declines in AMD’s gaming and embedded segments offset stellar AI uptick within the information middle and shopper segments:

Picture supply: Superior Micro Gadgets (AMD) presentation.

The gaming phase, which is cyclical, is enduring a downturn between gaming console generations. In the meantime, prospects within the embedded phase are working by excessive stock ranges which have cooled gross sales. Embedded income did develop 2% over Q1, which administration famous as a backside, so it ought to proceed rising from right here.

However each greenback of income counts the identical. AMD’s underperforming gaming and embedded segments, which represented $1.5 billion of AMD’s complete $5.8 billion Q2 gross sales, introduced complete year-over-year income development all the way down to 9%. The excellent news is that complete development is poised to speed up as the info middle, shopper, and embedded segments develop, and gaming represents a smaller portion of complete gross sales.

Inspecting AMD’s AI development potential

It is no secret that Nvidia is the market chief in AI chips. Nevertheless, a robust runner-up can nonetheless make a lot of cash. AMD has the chance to develop by taking market share from Nvidia and using the tide as AI chip demand grows. CEO Lisa Su believes the AI chip market will attain $400 billion by 2027. AMD is on tempo to seize only a fraction of that determine — round $12 billion in information middle gross sales this yr.

AMD’s information middle phase income rose 115% yr over yr in Q2, quicker than Q1’s 80% development price. Microsoft talked about in its latest fiscal yr This fall earnings name that it had added new chips from AMD, Nvidia, and its in-house improvement. Understandably, some corporations might need to diversify their chip suppliers to keep away from placing all their AI eggs within the Nvidia basket.

The shopper phase, which notched income development of 49% yr over yr in Q2, is one other development alternative. Private computer systems with AI-capable chips are poised to blow up over the approaching years. Analysis agency Canalys estimates that AI PC shipments may enhance at a 44% annualized price from 2024 by 2028, which might translate to 600 million PCs cumulatively over the subsequent 4 years.

Traders may see AMD’s income development speed up as these burgeoning segments contribute extra to AMD’s complete income.

Is the inventory a purchase immediately?

A stabilization in AMD’s embedded phase is sweet information, however the primary story right here is AI. AMD’s Q2 earnings present that enterprise is booming, which instills confidence within the firm’s development outlook. Analysts at the moment count on AMD earnings to develop by a mean of 33% yearly over the subsequent three to 5 years. Utilizing estimated 2024 earnings, AMD trades at a ahead P/E ratio of 40.

The inventory presents strong worth immediately if AMD delivers development on par with estimates. Annualized 33% development is a excessive bar to clear. Nonetheless, one may argue that AMD’s alternative to extend its market share from its small footprint is a bonus over Nvidia, which should defend towards competitors from a number of instructions. In fact, that may rely on AMD’s skill to execute and promote its product available in the market.

Up to now, accelerating information middle development is a promising signal.

AMD has a number of alternatives proper in entrance of it. After the latest 30% drop, those that consider within the firm’s skill to translate potential into outcomes have an opportunity to purchase shares cheaply.

Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.