Tariffs often goal bodily items, not merchandise like software program. This makes software program corporations like Palantir Applied sciences (PLTR 1.64%) a possible secure haven for buyers. Nonetheless, if company income fall at different corporations, they could be much less prone to spend on enterprise software program, which may hurt Palantir’s demand.

However contemplating how fashionable its software program has turn into amongst corporations trying to deploy an AI-driven information analytics platform, the corporate should still see sturdy demand. So, is it the final word inventory to keep away from tariff fears?

Palantir will possible really feel nearly no disruption in its enterprise

For the reason that market sell-off started in mid-February, the inventory has declined round 40% from its all-time excessive, however presently solely sits a bit greater than 10% down from that prime. That is a fairly clear indication from the broader market that Palantir could possibly be a superb funding as issues about how tariffs will have an effect on the financial system ramp up.

One other issue encouraging buyers in regards to the firm’s outcomes is that governments worldwide are heavy customers of its software program. In fourth quarter, $455 million of its $828 million in income was from authorities sources, which is a wholesome cut up between industrial and authorities companies.

Having the federal government as a shopper is vital within the face of an financial downturn, as a result of it would not have a tendency to chop spending like industrial shoppers may. Nonetheless, some buyers might fear in regards to the impact of the federal authorities effectivity initiative on any potential spending.

This initiative will possible not have an effect on Palantir’s authorities enterprise as a result of the corporate’s main objective is to make use of AI to make data-driven choices. This platform is not prone to see cuts, because it encourages the very factor this initiative was set as much as do: Make the federal government extra environment friendly.

With all that in thoughts, it could possibly be the final word inventory to personal in an surroundings like this, particularly contemplating that Wall Road analysts anticipate the corporate to develop its income by 31% this yr.

However there’s only one downside.

It is nearly unimaginable to justify Palantir’s valuation

There isn’t any manner round it: The inventory is unbelievably costly.

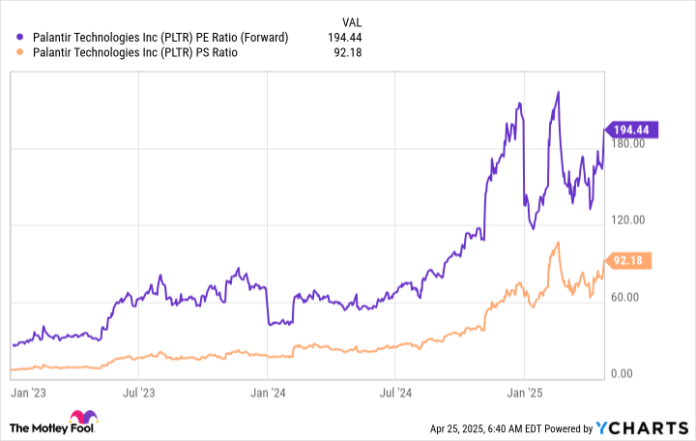

PLTR PE Ratio (Ahead) information by YCharts; PE = worth to earnings, PS = worth to gross sales.

At 194 occasions ahead earnings and 92 occasions gross sales, these are valuation ranges that few corporations ever attain, for good motive: It is practically unimaginable to reside as much as the expectations that these valuations convey.

Usually, these valuations are reserved for the uncommon firm that is doubling or tripling its income yr over yr, however Palantir’s development is barely within the mid-30% vary. For reference, an organization like Nvidia, whose finest year-over-year income development was 265% in 2024, by no means traded for greater than 46 occasions gross sales or 50 occasions ahead earnings.

That is an absurd worth to pay for the inventory, and it clearly signifies that it’s considerably overvalued. It is nearly unimaginable to justify this price ticket.

As an alternative of the 32% that Wall Road thinks it may possibly develop income by for 2025, let’s enhance that fee to 35%. And as an alternative of only one yr, let’s stretch that development fee out for seven years. We’ll additionally ignore the consequences of stock-based compensation (a foul thought for Palantir) and provides the corporate an industry-leading revenue margin of 30%.

If all three of these projections come true, the inventory would commerce at 11 occasions gross sales and 36 occasions earnings, a extra typical valuation for an organization like Palantir when it is totally mature. That is seven years of development already baked into the inventory worth, and that is even with a bullish outlook.

There may be far an excessive amount of success priced into the inventory proper now, and it is going to be unimaginable to reside as much as the expectations that the market has for it. Consequently, Palantir Applied sciences would not seem like as a lot of a secure haven anymore, and buyers ought to discover different locations to place their cash.

Keithen Drury has positions in Nvidia. The Motley Idiot has positions in and recommends Nvidia and Palantir Applied sciences. The Motley Idiot has a disclosure coverage.