It is no secret that the final 12 months has been punishing.

Are Pfizer‘s (PFE -0.04%) greatest days behind it? If the inventory’s critics are to be believed, the reply is an emphatic “sure, clearly,” with points like its current stint of unprofitability and a beaten-down prime line being the first items of supporting proof.

However even the perfect firms can typically have a number of quarters of issue, and buyers ought to hesitate earlier than counting this inventory out. Let’s analyze the arguments on both sides and attain an actionable conclusion.

The argument for it being too late

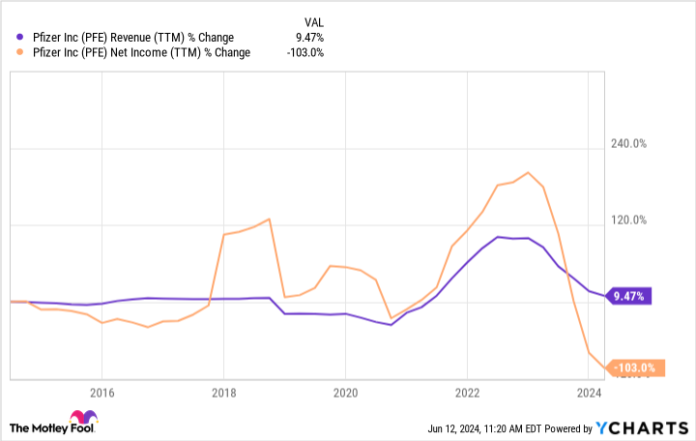

What does it even imply for somebody to say that it is too late to purchase shares of one of many world’s largest and best-known pharmaceutical shares? Maybe Pfizer’s detractors consider that almost all of the expansion alternative is prior to now. One fast have a look at this chart signifies that they may be on to one thing:

PFE income (TTM) information by YCharts; TTM = trailing 12 months.

As you possibly can see, its trailing-12-month income and earnings are at the moment trending downward, with both anemic progress or a decline during the last 10 years. And its web losses over that interval whole $309 million, which additionally means that its dividend might be liable to a lower.

When paired with the corporate’s new plan to chop $4 billion in prices earlier than the tip of this 12 months, it is easy to color an image that exhibits Pfizer as being in a state of decline. To make issues worse, the forces behind this purported decline don’t suggest room for restoration.

As proven on the chart, Pfizer’s efficiency in the course of the early section of the pandemic was very sturdy because of its fast improvement of its Comirnaty vaccine in opposition to COVID, in addition to its antiviral known as Paxlovid. Within the first quarter of 2023, international gross sales of Comirnaty introduced in income of greater than $3 billion. However within the first quarter of 2024, Comirnaty gross sales had been simply $354 million.

That income will not be coming again. And there in all probability will not be any single alternative of the same measurement anytime quickly, if there ever is. Even when analyzing the corporate’s prime line with out the detrimental affect of its collapsing COVID phase, it nonetheless grew by solely 11% within the first quarter — hardly a handy guide a rough sufficient tempo to consider that higher occasions are forward for shareholders.

So, not less than for buyers who’re nonetheless on the lookout for a repeat of the returns supplied by Pfizer inventory early within the pandemic, it seems like it’s certainly too late to purchase its shares.

The critics won’t have the complete image

The above arguments for why it is too late may appear convincing, and so they’re not with out some fairly substantial kernels of reality. However they’re truly misguided for a number of causes.

Before everything, Pfizer has been round for a very long time. Its positive factors and setbacks during the last 4 years or so will quickly sufficient be overshadowed by the drivers of its long-term worth, which is to say its analysis and improvement (R&D) capabilities in addition to its merger and acquisition (M&A) actions. On these fronts, administration has huge plans.

Its R&D expenditures have totaled $10.6 billion during the last 12 months, and its pipeline has 37 applications in late-stage medical trials and one other 28 applications in mid-stage trials. Since not too long ago shopping for Seagen, a most cancers drug developer, and launching its new long-term technique to bolster its oncology pipeline dramatically over the approaching years, it now plans to be treating not less than 4.6 million most cancers sufferers per 12 months by 2030, twice as many because it did in 2023.

By 2030, it additionally expects to have a minimal of eight blockbuster most cancers medicine yielding upward of $1 billion in annual income. A few of these would be the results of extra acquisitions, however many might be produced by its personal R&D efforts. All informed, administration is anticipating roughly a further $45 billion in annual income throughout the subsequent six years. For reference, its trailing-12-month income was $54.8 billion.

Due to this fact, if these plans are delivered to fruition — and thus far, it seems like they’re on monitor — the Pfizer of 2030 can have a prime line of practically $100 billion. Buyers who purchased shares now, when the inventory is out of favor and the strategic plan hasn’t even began to ship its goals, will doubtless see a major run-up in alternate for taking the chance.

Certain, it is doable that one of many world’s most persistently worthwhile pharmaceutical companies may go right into a tailspin and fail at its bold targets. However that will be a stunning consequence. And with that perspective in hand, it is undoubtedly not too late to purchase Pfizer inventory should you’re affected person.

Alex Carchidi has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Pfizer. The Motley Idiot has a disclosure coverage.