The Dow completed October down barely. Do you have to purchase any of those blue chips?

October ended with a thud for buyers as disappointing earnings from Microsoft and Meta Platforms pushed the indexes down on the final day of the month, and an accounting scandal at AI server maker Tremendous Micro Pc weighed on AI shares.

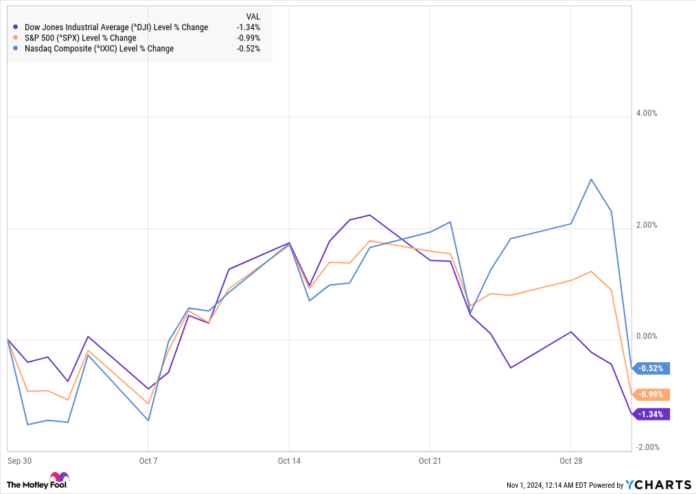

As you may see from the chart beneath, the indexes sank into unfavourable territory on the final day of the month.

Market pullbacks can generally create shopping for alternatives, so let’s check out the three worst-performing shares in October to see if any of those blue chips are value shopping for.

1. Nike (down 12.8%)

Nike‘s (NKE 1.21%) woes continued final month because the sportswear big posted one other quarter of disappointing outcomes. It is dropping market share to upstart rivals and making an attempt to repair the errors that came about beneath former CEO John Donahoe.

Nike axed its CEO in September, bringing in longtime firm veteran Elliott Hill to run the corporate. With income and income falling by double-digits, Nike has plenty of work to stabilize the enterprise and get again to progress. However Hill looks as if a sensible choice for the job as he is run Nike’s product and market division, and will be capable to assist restore a few of its historic strengths.

That features rebuilding its wholesale enterprise, which the corporate deprioritized to deal with its direct-to-consumer enterprise. Ignoring wholesale clients gave a chance to its rivals. Nike may additionally use a product refresh, because it has relied an excessive amount of on basic kinds to drive gross sales.

Total, there’s comeback potential for the inventory, however I might prefer to see proof that it is beginning to acquire traction earlier than calling it a purchase.

Picture supply: Getty Photographs.

2. Merck (down 9.9%)

Pharmaceutical firm Merck (MRK -0.43%) was one other underperformer on the Dow final month. The inventory fell steadily all through October as rising rates of interest pressured dividend shares like Merck, which pays a dividend yield of two.9%.

Merck delivered a strong earnings report on the finish of the month, however the inventory nonetheless fell on the information. Income within the quarter rose 4% to $16.7 billion, which was forward of the consensus at $16.46 billion.

Gross sales have been once more pushed by Keytruda, its drug that helps the immune system struggle most cancers, which was up 17% to $7.4 billion, making up practically half of Merck’s income. On the underside line, the corporate reported adjusted earnings per share of $1.57, which beat estimates at $1.50.

Animal well being gross sales have been up 6%, however Merck’s different drug franchises declined, together with Gardasil, ProQuad, and Januvia, and the corporate’s focus danger is now mounting as Keytruda approaches half of its gross sales.

Contemplating its gradual income progress, Merck’s purchase case does not appear compelling even after final month’s pullback.

3. Dow (down 9.6%)

Chemical maker Dow (DOW -0.83%) is likely one of the smaller corporations on the Dow Jones Industrial Common at a market cap of simply $35 billion. The inventory fell steadily over October, dropping 9.6% to make it the third worst-performing inventory on the blue chip index.

There wasn’t a single cause for Dow’s decline, although rising rates of interest appeared to contribute to the inventory’s slide as Dow is a cyclical inventory that is delicate to financial progress.

The corporate reported simply 1% progress in web gross sales within the quarter to $10.9 billion, on a 1% improve in quantity. Pricing was flat too. On the underside line, adjusted earnings per share fell from $0.48 to $0.47.

Dow has underperformed the Dow Jones Industrial Common and S&P 500 lately, and there is not so much within the report that gives a cause to suppose it could possibly change that streak. Nonetheless, dividend buyers could need to make the most of the 5.7% dividend yield proper now.

The corporate did not give particular steerage, nevertheless it stated the financial cycle was enhancing, and it is aiming for greater than $3 billion in earnings by 2030.

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Jeremy Bowman has positions in Meta Platforms and Nike. The Motley Idiot has positions in and recommends Merck, Meta Platforms, Microsoft, and Nike. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.