This in style retailer has returned over 250% over the previous 5 years, greater than double the S&P 500.

Huge-box retailer Costco Wholesale (COST 0.08%) has dazzled Wall Avenue with a wide ranging 250% whole return over the previous 5 years, simply trouncing the S&P 500. The corporate’s famously low costs, vast product choice, and in style meal offers (like its $1.50 hotdog) have created a sticky buyer base.

It is a easy method that has constructed Costco’s model and aggressive benefits right into a juggernaut. I count on it to proceed creating enterprise worth for shareholders for the foreseeable future.

Nevertheless, an organization’s enterprise and its shares are two various things. The inventory’s immense success lately raises truthful questions on whether or not traders ought to proceed to count on extra of the identical. Is Costco Wholesale a purchase, promote, or maintain heading into subsequent 12 months?

A latest membership price hike ought to give Costco a lift

Most individuals notice that Costco is among the world’s largest retail firms, with greater than $250 billion in annual income. However do you know that promoting items is not how Costco makes most of its cash? The corporate works on solely a 12.6% gross revenue margin, utilizing the slimmest markups attainable to supply shoppers the bottom costs.

Costco’s secret sauce is charging membership charges to anybody who outlets at its shops. These high-margin charges account for over 70% of the corporate’s income. The corporate would not increase its charges usually, but it surely did problem a rise earlier this 12 months (roughly 8%) for all new memberships and renewals, beginning Sept. 1. The rise will enhance membership charges all through fiscal 2025 (starting with the upcoming quarter).

Costco’s whole membership price income was $4.8 billion in fiscal 2024, so an 8% worth enhance would translate to roughly $5.2 billion in 2025 with out factoring in new memberships. That ought to all trickle all the way down to Costco’s earnings, which analysts estimate will develop by 10.2% in fiscal 2025 to roughly $17.75 per share.

The inventory’s valuation displays excessive expectations

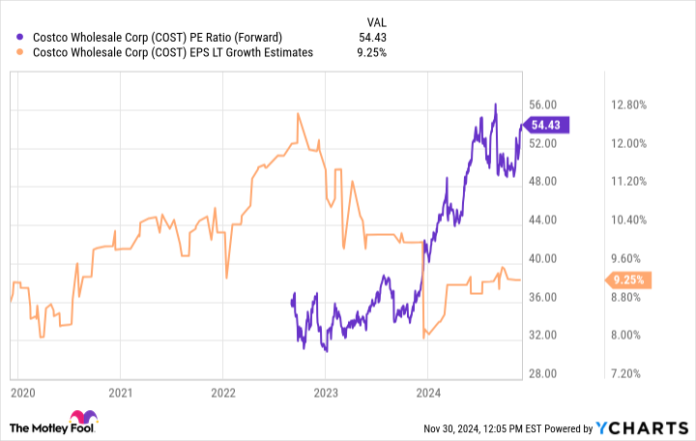

As nice as Costco is, the corporate’s earnings have not saved up with the inventory’s 250% features over the previous 5 years. In consequence, the inventory’s valuation has risen by fairly a bit:

COST PE Ratio (Ahead) knowledge by YCharts

Right now, the inventory trades at a ahead P/E ratio of 54, a hefty premium to the broader market. The S&P 500 at present trades at 23 occasions its earnings estimates. It isn’t essentially an issue that Costco trades at the next valuation than the broader market. I agree that Costco is an distinctive enterprise, and its model energy, observe document, and sturdiness can affect what traders would possibly pay for a inventory.

Nevertheless, the hole between Costco and the market is so huge that sustaining such a excessive valuation would probably require speedy progress. Analysts at present estimate Costco will develop earnings by a mean of 9.25% yearly over the long run. That is most likely not adequate.

Traders can use the PEG ratio to weigh a inventory’s valuation towards its anticipated progress charge. Costco’s present PEG ratio is a whopping 5.9. I really feel comfy shopping for shares with PEG ratios as much as about 2.5 in the event that they’re distinctive firms. As you possibly can see, Costco is nicely past that valuation. Translation: The inventory most likely cannot justify its present worth.

Is the inventory a purchase, promote, or maintain?

So, what’s prone to occur?

No person can predict short-term inventory costs, however this out-of-line valuation will most likely work its approach again to Earth in some unspecified time in the future. The inventory would possibly crash and proper shortly. Or the inventory worth might merely stagnate whereas Costco’s underlying earnings catch up and treatment the valuation. Both approach, it is laborious to see Costco inventory persevering with to outperform the broader market from its present worth.

Does that imply traders ought to promote their inventory? Not essentially. It finally relies upon by yourself investing beliefs and circumstances. Somebody sitting on large features from Costco inventory has a logical argument for promoting and realizing these returns. Some traders might not consider in promoting a high-quality inventory for valuation causes alone, and that is additionally effective.

People can resolve whether or not Costco is a inventory to promote or maintain as an alternative. Both approach, Costco’s extreme valuation makes it laborious to contemplate it a purchase heading into 2025.

Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Costco Wholesale. The Motley Idiot has a disclosure coverage.