This world-class enterprise has minted millionaires over time.

Costco Wholesale (COST 1.49%) is known for a number of causes. The massive-box retailer is famend for its low costs, huge product choice, and $1.50 hotdog meal combo, a favourite amongst consumers that has remained the identical value since its introduction in 1984.

The corporate is equally fashionable amongst traders. Late billionaire Charlie Munger, recognized most for his friendship and work alongside Warren Buffett, owned inventory and served on the corporate’s board for years. Costco Wholesale has confirmed to be an incredible funding, producing whole returns exceeding 150,000% from the early Nineteen Eighties.

It is as sturdy a resume as you will discover in a inventory. However can traders rely on Costco Wholesale transferring ahead? In any case, previous returns do not assure future outcomes.

Right here is whether or not traders should purchase Costco Wholesale inventory proper now.

Outlining Costco’s aggressive benefits

The retail area is very aggressive. Nonetheless, Costco Wholesale has carved out its area of interest as a number one big-box warehouse membership retailer the place customers should buy issues in bulk portions however want a membership. It has practically 900 warehouse shops worldwide, together with 617 in the US, and generated $264 billion in income over the previous 4 quarters.

Costco’s enterprise mannequin is easy. It sells merchandise at very skinny margins and makes cash on membership charges. Final quarter, Costco’s membership charges of $1.19 billion represented simply 1.8% of whole income however 51.5% of whole working earnings! Product choice, low costs, fashionable private-label manufacturers, and quirky perks (the $1.50 hotdog) have translated to a sterling repute that pulls consumers.

In 2023, Axios ranked Costco because the second-most trusted U.S. firm amongst customers. Its model energy is so sturdy that Costco would not spend cash on promoting as a result of it would not must, making it a formidable drive within the retail area.

Development will most likely stay regular however may final years

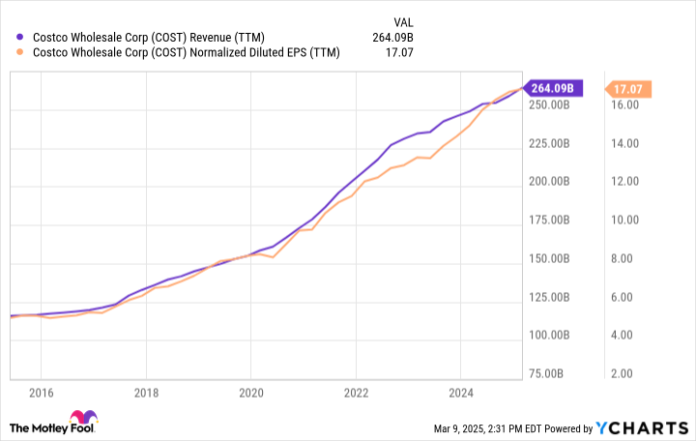

Costco’s prospects are sometimes excessive earners since shopping for in bulk can require spending giant sums of cash upfront. This demographic is profitable as a result of the highest 10% of earners in America account for about half of all client spending. You possibly can see that Costco’s prime and backside strains have grown with out a lot interruption over the previous decade, which works a good distance in explaining the inventory’s stellar returns.

COST Income (TTM) knowledge by YCharts

The cool half about Costco’s success is that it is primarily natural. The corporate is rising as a result of extra individuals are procuring at Costco shops. Lively warehouses have elevated from 540 in 2010 to 897 as we speak. Plus, years of inflation tack development onto the enterprise if you’re a price chief promoting items at razor-thin markups. In different phrases, Costco grows as merchandise turns into costlier over time.

It is a comparable story for Costco’s memberships, the place quantity drives income development greater than value will increase. Paid memberships grew by 6.8% yr over yr final quarter. Costco did elevate its membership charges late final yr, nevertheless it was the primary value hike in seven years. As we speak, a fundamental membership in the US prices $65 (premium is $130) yearly. That also appears cheap and arguably leaves room for future value will increase if wanted.

Analysts estimate Costco will develop earnings by a median of about 9% yearly, which appears real looking primarily based on all these components.

Is Costco Wholesale a purchase in March 2025?

Costco’s previous efficiency, enterprise mannequin, and development alternatives, it is most likely evident that Costco Wholesale stays a top-notch inventory value including to any long-term portfolio.

Nonetheless, valuation is a wildcard that may stunt inventory returns, even for the most effective firms. Sadly, Costco Wholesale is kind of costly as we speak. On the time of this writing, the inventory trades at a price-to-earnings ratio of 56, even after tumbling about 10% from its all-time excessive. I like utilizing the PEG ratio (value/earnings-to-growth) to weigh a inventory’s valuation in opposition to its anticipated development. I will normally purchase a high-quality inventory with a PEG ratio of two.0 to 2.5. The decrease the ratio, the extra worth you are getting. It will get more and more tough to justify shopping for shares as you exceed that threshold.

Costco’s PEG ratio is 6.2, which is effectively past that. The inventory may decline 50% from its present value and nonetheless be costly.

Buyers ought to bounce on an opportunity to purchase inventory in Costco Wholesale, however not at this valuation. Take into account ready for a major value decline or quicker earnings development to justify a better valuation. Barring one thing unexpected, it is unlikely Costco Wholesale is a great purchase this month.

Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Costco Wholesale. The Motley Idiot has a disclosure coverage.