Are traders overreacting to the information of the CEO’s departure, or was a correction within the inventory value warranted given its excessive valuation?

Chipotle Mexican Grill (CMG 0.81%) has been a high development inventory within the restaurant business for years. Its fast development has made it a high funding to personal, with shares rising by 300% over the course of the previous decade.

Lately, nonetheless, the corporate misplaced its CEO, Brian Niccol, to Starbucks. Even the thrill surrounding Chipotle’s 50-for-1 inventory cut up hasn’t been sufficient to forestall shares from falling of late. Prior to now three months, the inventory is down 13%.

Is Chipotle’s inventory in bother, or may this latest decline be an important shopping for alternative for traders?

The corporate’s development prospects stay spectacular

Whereas many eating places have struggled to develop their high strains with out relying closely on value will increase, Chipotle has confirmed to be the exception. When the corporate final reported earnings in July, its quarterly income for the interval ending June 30 rose 18% to $3 billion. And its same-store gross sales development was a powerful 11%, with increased transactions representing the majority of the expansion (almost 9%) and better costs boosting the numbers by a further 2%.

For a lot of eating places, attaining even single-digit comparable gross sales numbers is spectacular, not to mention double-digit will increase, as is the case for Chipotle. And to have that being primarily pushed by means of elevated visitors is outstanding. Identical-store numbers solely examine eating places which were open for greater than a yr, and thus, the metric offers traders a greater perception into the corporate’s true natural development, because it excludes the impression of extra retailer openings.

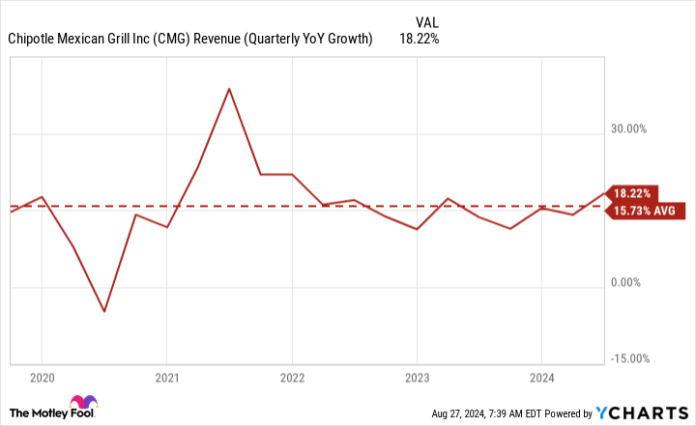

Chipotle has averaged an general development charge of round 16% over the previous 5 years, and its latest numbers have are available in even higher.

CMG Income (Quarterly YoY Development) information by YCharts

A change in CEO does not essentially put the corporate in a foul place

Buyers have been bearish on Chipotle’s inventory after studying that its CEO was leaving the corporate, however that does not essentially imply the enterprise is in bother. With Starbucks providing Niccol a sexy compensation bundle to lure him away from the fast-growing restaurant chain, it might have merely been a suggestion that was too good for the chief to refuse.

Given its robust development numbers and plans for continuous growth, there is not any motive to fret that Chipotle will in some way go on the mistaken path from right here. The corporate’s interim CEO, Scott Boatwright, has been with the corporate since 2017 and has most not too long ago been its chief working officer. Chipotle is not changing Niccol with somebody exterior the enterprise and who could also be unfamiliar with it.

With Boatwright, the corporate has a CEO who has been integral in Chipotle’s development in recent times, and who could also be more likely to proceed with the present path and development technique. Whereas there might be adjustments, there is not any motive as of now to count on any drastic ones.

Must you purchase Chipotle inventory?

Chipotle traders might not wish to see that their CEO has opted to depart, however that does not imply the corporate is in some way in a worse place. If, nonetheless, it ends in an additional decline in value, this might certainly create a shopping for alternative for traders to purchase shares of an distinctive restaurant chain.

Buying and selling at 50 instances its estimated future earnings (in line with analyst expectations), Chipotle’s valuation stays excessive, and which may be the most important motive to carry off on shopping for the restaurant inventory proper now — not a change in CEO. I would argue {that a} correction within the inventory value was overdue as a result of the inventory was buying and selling at such a excessive premium.

Chipotle inventory can nonetheless be purchase for those who’re planning to hold on to it for the long run (e.g., a number of years), however I might wait to see if there’s extra bearishness from traders that sends its value even decrease. At a decrease earnings a number of, there can be at the very least some potential margin of security and never as a lot future development priced into the inventory’s valuation, making it extra possible that traders can earn a excessive return.

David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Chipotle Mexican Grill and Starbucks. The Motley Idiot recommends the next choices: brief September 2024 $52 places on Chipotle Mexican Grill. The Motley Idiot has a disclosure coverage.