The restaurant big’s enterprise technique is delivering robust income development.

Restaurant chain Chipotle Mexican Grill (CMG 1.90%) capped an incredible run up in its share value this yr with a 50-for-1 inventory break up in June. It was one of many largest inventory splits within the historical past of the New York Inventory Alternate.

Explaining why the corporate did it, CFO Jack Hartung mentioned, “We consider the inventory break up will make our inventory extra accessible to our staff in addition to a broader vary of traders.”

With its historic inventory break up full, is now the time to put money into Chipotle? This is a glance into the corporate to reply that query.

Chipotle’s gross sales success

Chipotle’s share value has already elevated considerably over the previous a number of months, almost doubling from a 52-week low of $35.37 final October to a excessive of $69.26 in June. This can be a testomony to the corporate’s excellent monetary efficiency.

In 2023, Chipotle generated $9.9 billion in income, a 14% bounce from 2022’s $8.6 billion. As well as, its internet earnings elevated a whopping 37% yr over yr to $1.2 billion. These outcomes propelled Chipotle’s 2023 diluted earnings per share (EPS) to $44.34, a 38% enhance from the prior-year’s $32.04.

Final yr’s success continued into 2024. Its first-quarter income reached $2.7 billion, representing 14% year-over-year development, whereas internet earnings rose 23% to $359.3 million from 2023’s $291.6 million. Chipotle’s Q1 EPS rose 24% yr over yr to $13.01.

To place this efficiency into context, competitor Yum! Manufacturers, proprietor of a number of restaurant chains together with Pizza Hut and Taco Bell, posted $1.6 billion in gross sales, $314 million in internet earnings, and an EPS of $1.10 in Q1. Yum! Manufacturers is an fascinating rival to check to as a result of Chipotle’s CEO, Brian Niccol, was as soon as the CEO of Taco Bell.

Chipotle’s gross sales technique

Niccol, who took over the CEO spot in 2018, summarized the technique used to provide Chipotle’s wonderful monetary outcomes when he mentioned, “Our robust gross sales developments have been fueled by our deal with bettering throughput in our eating places.”

This technique helped Chipotle’s Q1 gross sales in its present shops obtain a 7% year-over-year enhance. Progress in same-store gross sales is important to the corporate’s capability to spice up income, therefore the significance in strengthening buyer throughput.

Chipotle makes use of numerous ways to extend the variety of prospects it might probably drive via every location. For instance, the restaurant chain makes it straightforward for purchasers to position orders on-line by way of its web site or cell app. Digital gross sales accounted for 37% of the corporate’s Q1 meals and beverage income.

One other tactic is Chipotle’s coupling of on-line orders with a brand new retailer format referred to as a Chipotlane. A Chipotlane is a drive-through devoted particularly for purchasers to select up on-line orders.

This evolution of the standard drive-through idea makes it fast and simple for purchasers to get their meals, additional growing throughput per location. The Chipotlane was launched in 2018 underneath Niccol’s tenure.

The corporate described the Chipotlane format’s success, stating, “New restaurant openings that function this digital order pick-up lane have demonstrated larger volumes and higher returns than a standard Chipotle restaurant format.” The corporate expects at the least 80% of latest shops in 2024 to incorporate a Chipotlane.

Deciding on Chipotle inventory

New retailer openings is one other think about Chipotle’s income development. In Q1, the corporate opened 47 places and is focusing on a complete of at the least 285 new eating places in 2024. Final yr, it added 271 shops.

Chipotle’s objective is to succeed in 7,000 places in North America. On the finish of Q1, it was about midway to this objective with almost 3,500 eating places.

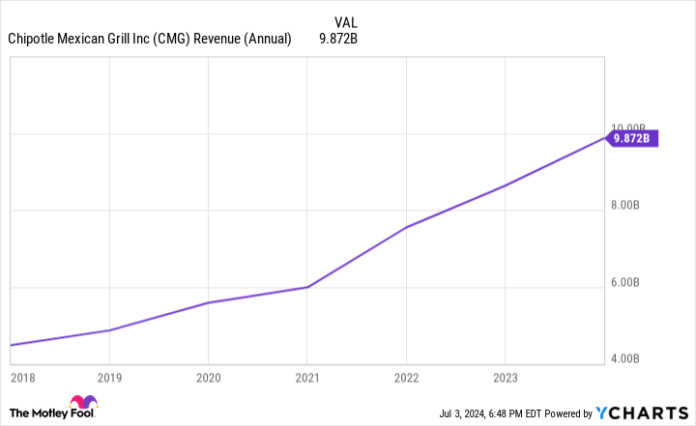

Due to the opening of latest places and rising same-store gross sales, Chipotle’s income has grown considerably with Niccol on the helm, greater than doubling for the reason that begin of his tenure.

Information by YCharts.

Niccol’s management, Chipotle’s success growing buyer throughput, and its store-expansion plans place the corporate for sustained income development, which might increase its inventory’s potential to extend in worth. In actual fact, the present consensus amongst Wall Avenue analysts is an obese score with a median share value of $67.69 for Chipotle inventory.

With shares down from June’s 52-week excessive after the historic inventory break up, now is an efficient time to purchase shares in Chipotle.