Bitcoin market efficiency has been underwhelming since its peak above $73,000 in March 2024. As an alternative of constructing on this rally, the highest crypto has confronted continued consolidation coupled with a sequence of declines, irritating many traders.

Presently, Bitcoin is down 22.7% from its March excessive, elevating issues over whether or not this alerts the beginning of a deeper bear market. The decline has shaken confidence, with market analysts now questioning the near-term outlook for the digital asset.

Associated Studying

Bitcoin Worth Continous To Battle, Why?

Analysts from IntoTheBlock, a market intelligence platform, have not too long ago shared insights on X, reflecting the altering sentiment. In a publish uploaded earlier right now, the analyst famous:

Bitcoin’s worth stays underneath strain, with no important upward momentum. The market, as soon as longing for a rally, now faces rising uncertainty as each retail and institutional curiosity look like dwindling.

The analysts requested, “is that this only a quiet part or the beginning of a chronic bear market?”

To reply this query, IntoTheBlock first assessed Bitcoin worth struggles and the components contributing to the lackluster worth motion.

Mentioning “macro panorama,” the market intelligence platform disclosed that the opportunity of a worldwide recession looms giant, making a cautious outlook for threat property like Bitcoin.

They famous that though many count on fee cuts quickly, these measures might take time to have an effect on Bitcoin and different cryptocurrencies positively. In the meantime, till that occurs, the broader macro setting will seemingly proceed to strain market sentiment and investor confidence.

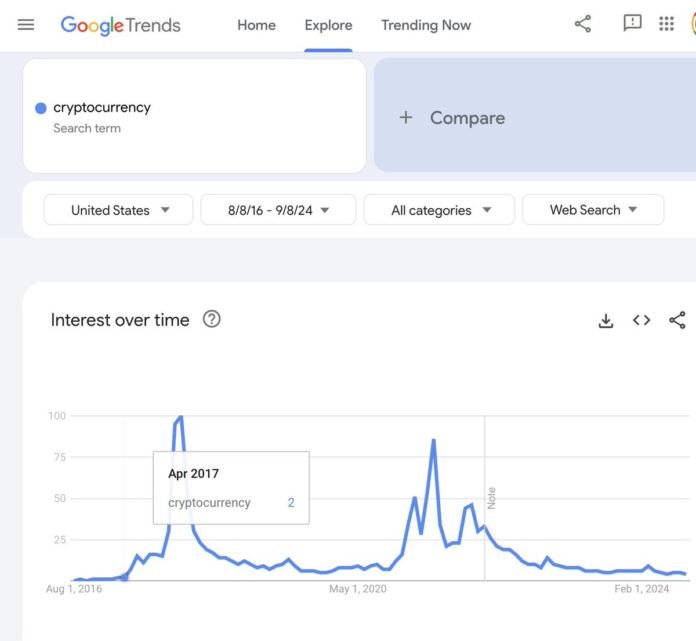

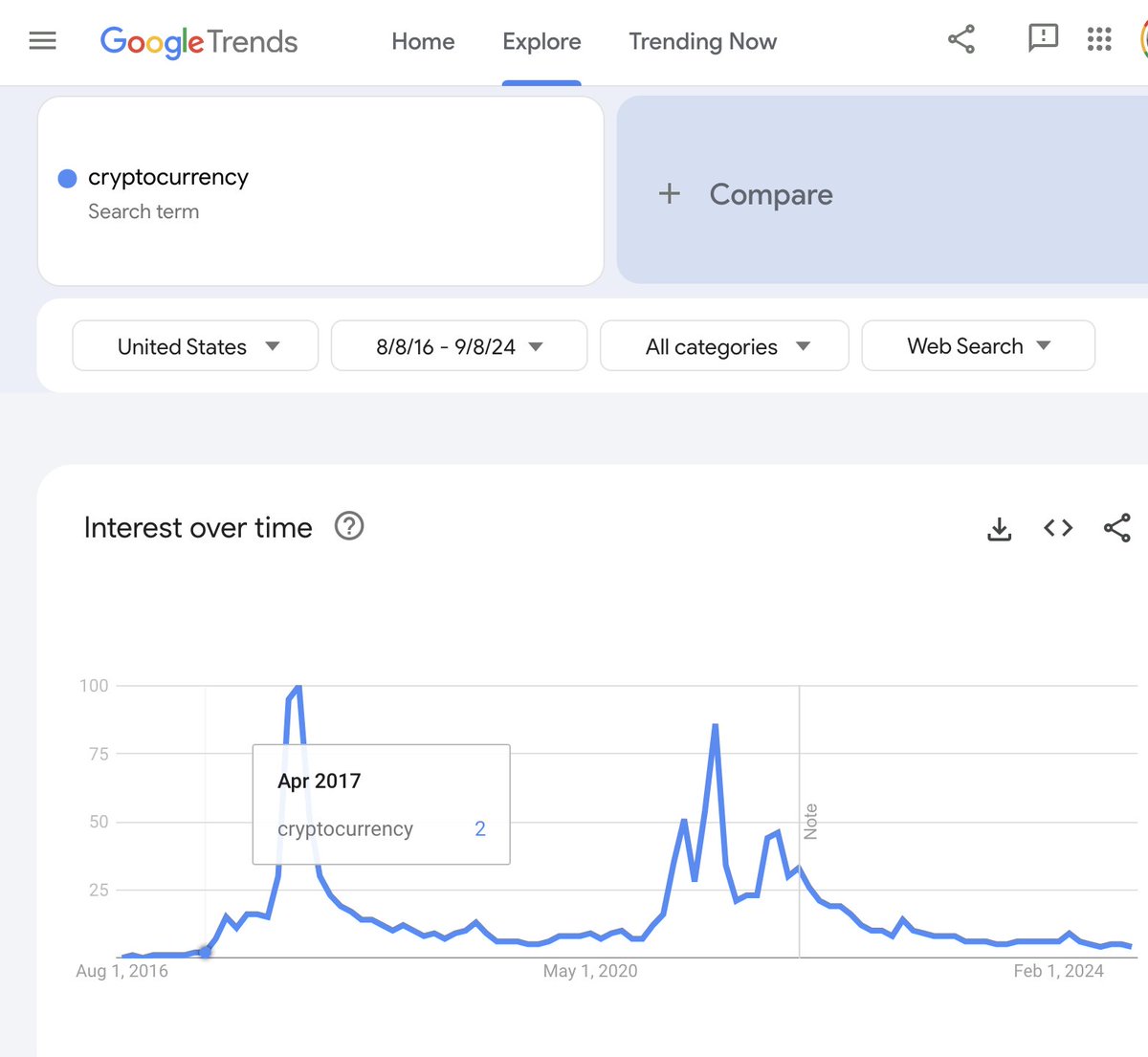

Moreover, IntoTheBlock touched on the curiosity in cryptocurrencies, which has additionally been declining sharply in latest months.

In keeping with the market intelligence platform, search traits associated to Bitcoin and different digital property have considerably decreased, reflecting a drop in public curiosity.

Even app rankings for main crypto exchanges like Coinbase have fallen, suggesting fewer customers have interaction with the market. This pattern has prolonged to on-chain metrics, the place the variety of new Bitcoin addresses stays low, indicating a slowdown in market participation.

Ought to You Panic?

Whereas the present downturn has raised issues, analysts from IntoTheBlock see potential parallels to Bitcoin’s worth motion in 2019. They famous:

Historic Bitcoin halving cycles recommend it could possibly be a post-halving dip, one thing we’ve seen earlier than. Parallels to 2019: Curiously, many analysts level out the present part mirrors 2019, the place the market additionally slowed down after a (native) excessive. Again then, the market skilled a chronic consolidation earlier than turning bullish once more. May we be on the identical path?

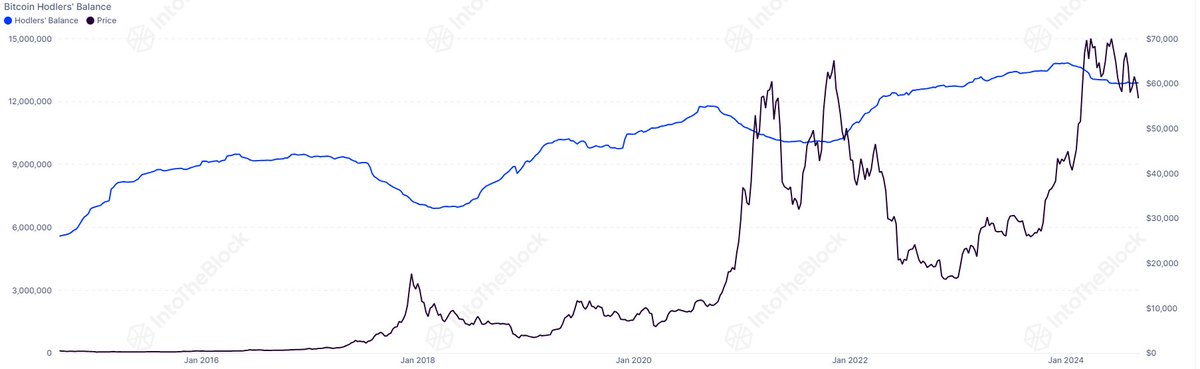

IntoTheBlock additional highlighted that “different cycle knowledge tells a distinct story.” The market intelligence platform famous that in latest weeks, the balances of long-term Bitcoin holders have hit new lows, echoing post-peak traits from earlier market cycles.

In keeping with IntoTheBlock, this might sign a “extended cooldown” part for Bitcoin, doubtlessly delaying any important worth restoration.

Associated Studying

The analysts famous that whereas the market faces uncertainties, there are not any definitive solutions. They concluded:

There are not any clear-cut solutions, however by contemplating previous cycles and present knowledge, we will keep open to potentialities Hold observe of each on-chain knowledge and macro components—they are going to be vital in figuring out what comes subsequent

Featured picture created with DALL-E, Chart from TradingView