Bitcoin has been in freefall just lately, however this common indicator is but to achieve the identical highs because the final two cycles. Is the actual prime nonetheless forward for the asset?

Bitcoin aSOPR Has Been Consolidating For The Final Two Years

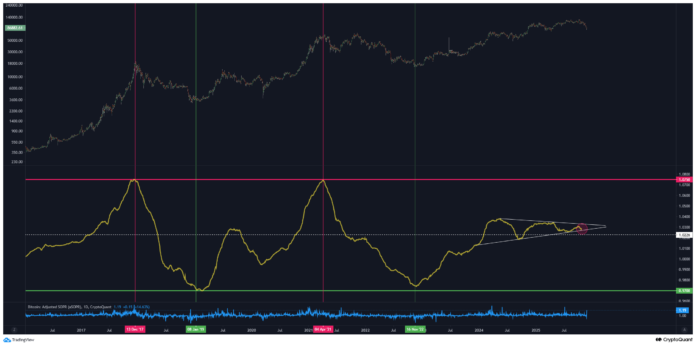

As identified by an analyst in a CryptoQuant Quicktake publish, the Bitcoin aSOPR has been consolidating between converging trendlines for almost two years. The Spent Output Revenue Ratio (SOPR) is an indicator that tells us whether or not the BTC traders are promoting their cash at a revenue or loss.

When the worth of this metric is larger than 1, it means the common holder is transferring their cash at some web revenue on the blockchain. However, the indicator being beneath this threshold implies the dominance of loss taking over the community. Naturally, the SOPR being precisely equal to 1 suggests revenue realization is canceling out loss realization. In different phrases, the traders as an entire are simply breaking even on their gross sales.

Within the context of the present dialogue, the model of the SOPR that’s of curiosity is the Adjusted SOPR (aSOPR). This indicator eliminates from the info gross sales of all cash that moved inside an hour of their final motion. Such strikes are normally relay transactions and carry no penalties for the market.

Now, here’s a chart that reveals the development within the Bitcoin aSOPR over the previous few years:

Because the quant has highlighted within the graph, the 2017 and first-half 2021 bull runs each apparently topped out because the aSOPR rose to the crimson line. This stage corresponds to a notable diploma of revenue realization among the many traders.

Equally, the bear markets of the final two cycles discovered their bottoms at about the identical time because the aSOPR hitting a low on the inexperienced line, far beneath the 1 mark. At this stage, loss-taking is dominant, so weak fingers capitulating and resolute entities accumulating their cash could possibly be behind the underside formation sample.

Within the present cycle to this point, the aSOPR hasn’t touched the crimson line. As an alternative, the indicator has been caught in consolidation inside two converging trendlines in a gentle profit-taking area for nearly the final two years.

Contemplating the sample of the final two cycles, it’s doable that the most recent one hasn’t hit its prime but. One other chance, nonetheless, may very properly be that the aSOPR merely isn’t going to the touch the crimson stage on this cycle in any respect.

The Bitcoin aSOPR is now slowly inching towards the tip of its converging channel, so a breakout come what may may occur quickly. It solely stays to be seen which path the indicator will exit.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $86,300, down 9% over the past week.